All eyes will be on the Fed policy meeting this week. We believe thoughts of immediate action are premature, but the Fed will push through ‘insurance’ rate cuts in the coming months.The Fed should remain on hold on 19 June, but Chairman Powell is likely to mention the possibility of cutting rates in the coming months, especially if trade tensions continue. Potential monetary easing would be framed as ‘insurance’ rate cuts, similar to those pushed through in 1995 and 1998, mostly to backstop confidence in an uncertain (trade) policy environment. But we think the Fed still wants to see more data and wait for the pivotal G20 summit in Osaka at the end of this month before being more precise in its rate-cutting signals. In short, we expect no pre-commitment to easing on 19 June. Our central

Topics:

Thomas Costerg considers the following as important: Fed dot plot, Macroview, Monetary policy forecast, US Fed preview, US interest rates

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

All eyes will be on the Fed policy meeting this week. We believe thoughts of immediate action are premature, but the Fed will push through ‘insurance’ rate cuts in the coming months.

The Fed should remain on hold on 19 June, but Chairman Powell is likely to mention the possibility of cutting rates in the coming months, especially if trade tensions continue. Potential monetary easing would be framed as ‘insurance’ rate cuts, similar to those pushed through in 1995 and 1998, mostly to backstop confidence in an uncertain (trade) policy environment.

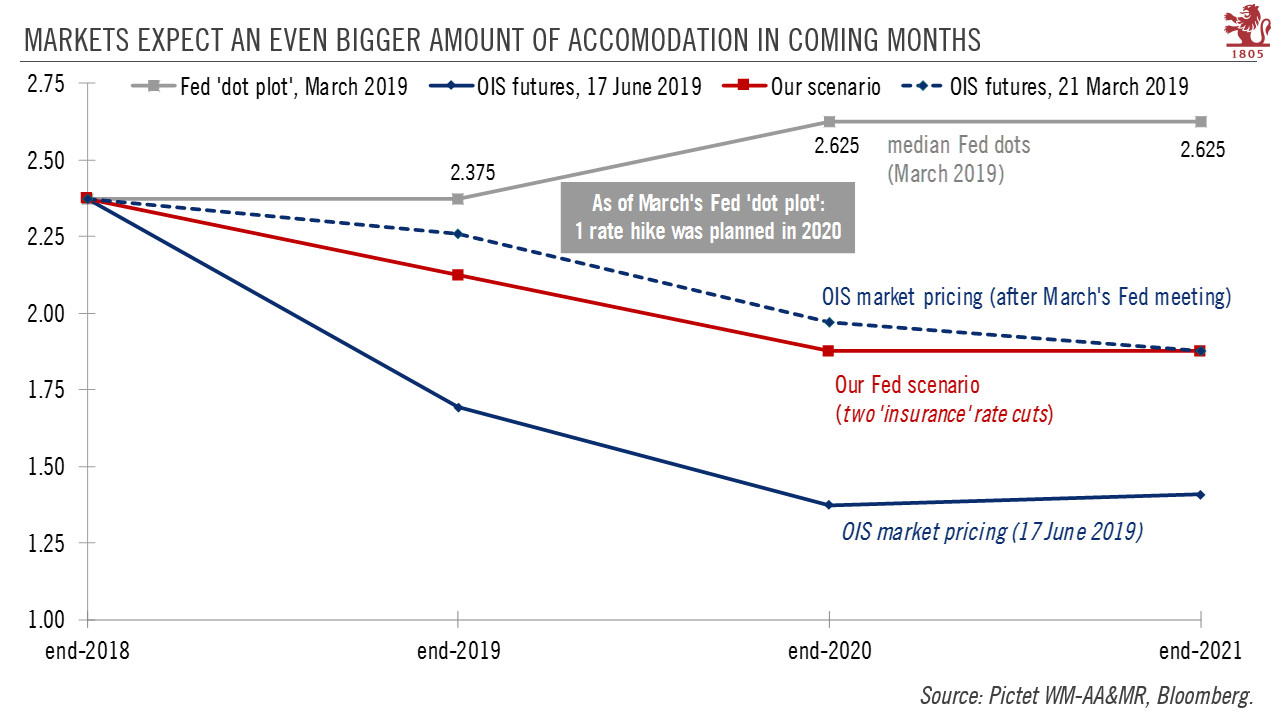

But we think the Fed still wants to see more data and wait for the pivotal G20 summit in Osaka at the end of this month before being more precise in its rate-cutting signals. In short, we expect no pre-commitment to easing on 19 June. Our central scenario still sees a first ‘insurance’ rate cut in December, with another quarter-point cut possible next March to bring the Fed funds rate back up to 2.0%. However, there is a rising possibility it comes in September, mostly because of recent low inflation prints and falling market-based inflation expectations, one of the Fed’s key worries of late.

An earlier rate cut (part of our negative scenario), potentially as soon as July, would probably be on the table if trade tensions escalated sharply—say if Trump placed new tariffs on Chinese imports just after the G20 summit.

The tone of Powell’s comments after Wednesday’s meeting will be important as will Federal Open Market Committee members’ new ‘dot plot’ chart. While the dot plot chart in March showed rates remaining on hold this year, we expect the next one will show one rate cut before the end of this year (as per the ‘median’ forecast).