The Swiss National Bank finds itself having to deal with an uncertain growth and inflation outlook as well as persistent external risks, but it is unlikely to pre-empt the ECB on interest rates.At its meeting on 13 June, the Swiss National Bank (SNB) will face an uncertain growth and inflation outlook. Economic data have been mixed and, more importantly, external risks (intensification of trade disputes, Brexit, Italian budget disagreements…) have increased. Since the last SNB meeting in March, the CHF has appreciated by 1.5% against the EUR and by 1.3% against the USD.In this context, we believe the bank’s policy statement will remain broadly unchanged. The interest on sight deposits at the SNB will remain at 0.75% and the central bank will reiterate its willingness to intervene in the

Topics:

Nadia Gharbi considers the following as important: Macroview, SNB outlook, SNB policy meeting, SNB rates, Swiss National Bank

This could be interesting, too:

Dirk Niepelt writes “Report by the Parliamentary Investigation Committee on the Conduct of the Authorities in the Context of the Emergency Takeover of Credit Suisse”

Marc Chandler writes US Dollar is Offered and China’s Politburo Promises more Monetary and Fiscal Support

Marc Chandler writes China’s Politburo Validates and Extends Pivot while the US Dollar Sees Yesterday’s Gains Pared

Marc Chandler writes Run on the Dollar Stalls after the Market Boosted Odds of another 50 bp Fed Cut

The Swiss National Bank finds itself having to deal with an uncertain growth and inflation outlook as well as persistent external risks, but it is unlikely to pre-empt the ECB on interest rates.

At its meeting on 13 June, the Swiss National Bank (SNB) will face an uncertain growth and inflation outlook. Economic data have been mixed and, more importantly, external risks (intensification of trade disputes, Brexit, Italian budget disagreements…) have increased. Since the last SNB meeting in March, the CHF has appreciated by 1.5% against the EUR and by 1.3% against the USD.

In this context, we believe the bank’s policy statement will remain broadly unchanged. The interest on sight deposits at the SNB will remain at 0.75% and the central bank will reiterate its willingness to intervene in the FX market if needed. Furthermore, the central bank’s currency assessment is likely to remain unchanged, with the Swiss franc still considered “highly valued” and the situation on the foreign exchange markets “fragile”.

The SNB’s annual GDP growth forecast of “around 1.5%” in 2019 is likely to remain unchanged. But its forecast for inflation will be key to watch. An upward revision in its 2019 conditional forecast is possible (to 0.4% from 0.3%) given the better-than-expected Q2 inflation prints (April-May). But there is a risk that forecasts for 2020 and 2021 are reduced partly due to markets’ reduced expectations for the Fed and ECB policy normalisation.

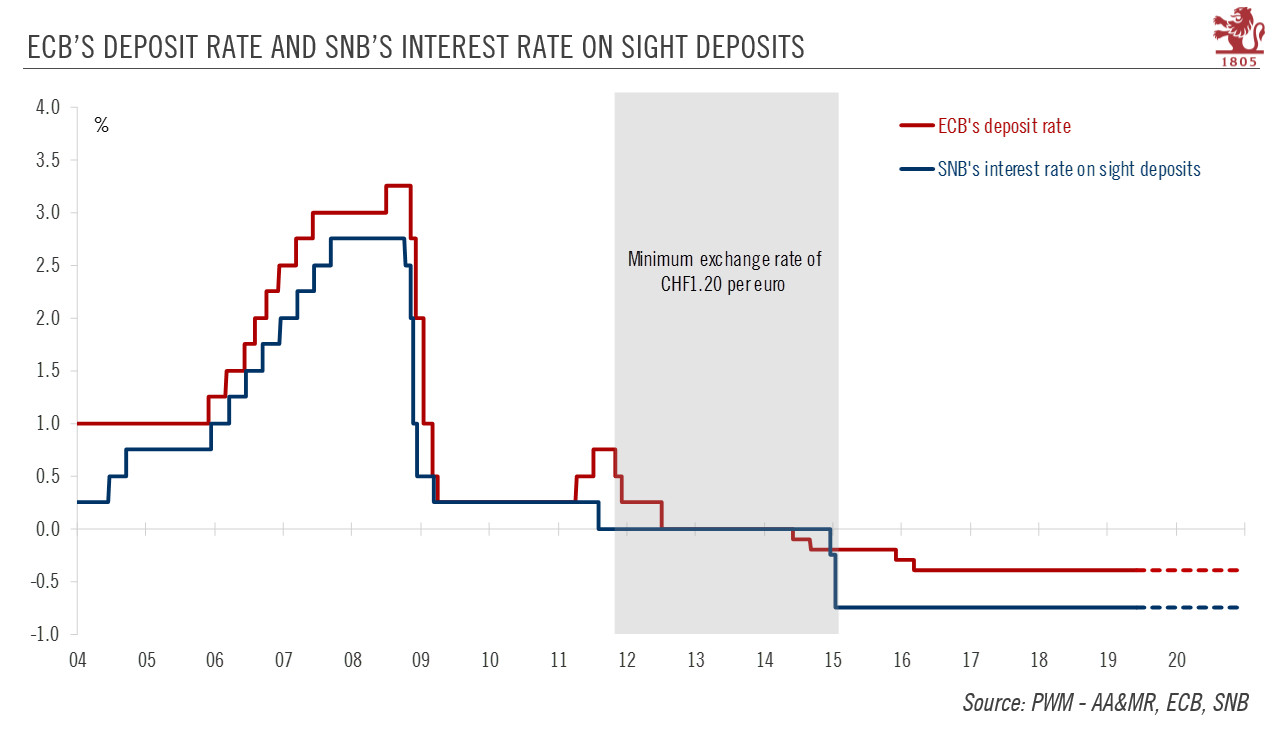

We believe it is unlikely that the SNB will hike rates before the ECB. Members of the SNB’s governing board have many times referred to the importance of the interest rate differential for the exchange rate. A policy rate increase before the ECB would likely lead to an appreciation of the franc, which would weigh on the inflation outlook. The only way we see the SNB hiking rates before the ECB is if there is a surge in Swiss inflation, which we believe is improbable at this stage. As a result, given our view on ECB’s next policy moves, we expect the SNB to stay on hold until the end of 2020 (see chart).

How would the SNB react if other central banks actually ease policy? For the SNB, the first line of defence against any unwarranted appreciation of the CHF will be FX market intervention. Should the SNB need to loosen monetary policy further, it could increase the exemption threshold from the negative interest applied to sight deposits in order to lower the burden on banks. However, this would not solve the side effects linked to negative interest rates on the mortgage sector.