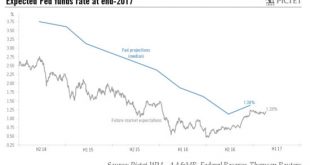

Hawkish comments from several Fed officials mean we now expect three quarter-point rate hikes from the Fed this year, with the first coming this month.As we don’t expect any big negative surprise in the February employment report (to be released on Friday), the probability of a hike next week has risen sharply. We are therefore changing our forecasts for Fed rates this year. Our main scenario is now that the Fed will first hike in March, instead of June. Moreover, to be more consistent with...

Read More »Upbeat Chinese PMI point to strong momentum

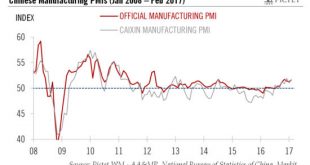

Solid PMI figures indicate stable growth for the Chinese economy in Q1 2017, but we maintain our below-consensus forecast for GDP growth this year.China’s official manufacturing purchasing managers’ index (PMI) in February came in at 51.6, compared with 51.3 in January, while the Caixin (Markit) manufacturing PMI rose by 0.7 from the previous month to 51.7. The official non-manufacturing PMI in February remained an elevated 54.2, only slightly below the reading of 54.6 in January.In summary,...

Read More »Switzerland: modest recovery remains on track

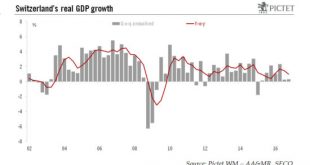

GDP growth picked up in 2016, with the export-orientated manufacturing sector contributing positively in spite of the strong franc. We expect the Swiss growth rate to be broadly similar this year.The Swiss statistical agency (SECO)’s quarterly estimates show a provisional GDP growth rate of 1.3% in 2016 compared with 0.8% in 2015.Two aspects of today’s report are worth mentioning. First, on the expenditure side, both domestic demand components and foreign trade helped to boost Swiss growth...

Read More »ECB preview: less reason to be dovish, but inflation battle not yet over

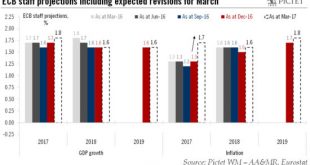

Next week, we expect the ECB to highlight that downside risks to the euro area outlook have diminished further, warranting upward revisions to staff forecasts and a more neutral monetary stance.The latest economic developments are consistent with the ECB turning somewhat more hawkish – or, more accurately, less dovish. Business surveys have improved, pointing to annualised GDP growth of around 2% in Q1. Headline inflation returned to the ECB’s 2% target in February, for the first time in...

Read More »Trump’s fiscal stimulus package may well be delayed

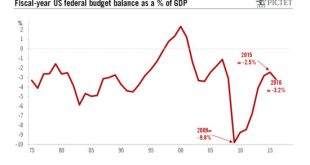

Trump’s speech to Congress proved short on detail when it came to his main economic policy proposals. However, we believe a potentially significant fiscal package will eventually be approved.In his first speech to Congress yesterday, President Trump sounded more presidential but was short of specifics on many of his main policy proposals. He once again complained that US companies are facing higher barriers than their foreign counterparts, but didn’t elaborate on how specifically he intended...

Read More »Euro area fiscal stimulus prospects

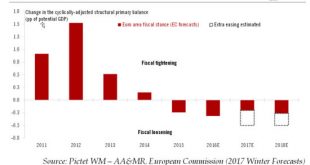

As the emphasis moves away from monetary initiatives, euro area GDP should benefit from a shift in fiscal policy going back to before the US elections.There has been growing evidence of a shift in the policy mix of various developed economies, from monetary to fiscal. In the euro area, we have likely entered a new cycle where the combination of austerity fatigue and greater flexibility on spending rules leads to more sustained fiscal support, however sub-optimal and uneven across countriesIn...

Read More »Oil currencies offer limited potential

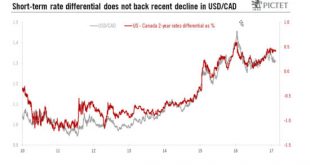

After a period of currency strength linked to the revival in oil prices last year, the Norwegian krone and Canadian dollar may find it harder to make further advances in 2017.In 2016, the sharp rebound in oil prices and the November OPEC deal to cut oil production have been supportive of oil-producer currencies like the Norwegian krone and Canadian dollar. However, we believe the oil price is likely to stabilise at around USD55 in 2017, close to where it already is. In an environment where...

Read More »PMI survey signals sustained euro area expansion in Q1

Although business surveys outpaced expectations and there are signs of rising price pressures, we continue to believe the ECB will not shift its monetary stance in the near term.The euro area composite flash PMI surged to 56.0 in February, the highest reading since April 2011. The main boost came from a surge in the services index due to strong data in Germany and France.The euro area average composite PMI is now consistent with a GDP growth rate of about 0.6% q-o-q in Q1, above our...

Read More »Monthly Investment Strategy Highlights, February 2017

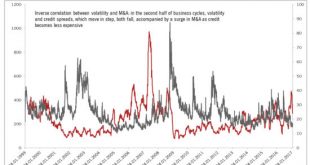

Pictet Wealth Management’s positioning in fast-evolving markets.Asset allocationImproved earnings growth should support attractive returns on developed-market equities.We still expect Treasury yields to rise this year. The 35-year fall in long-term interest rates, during which government bonds provided both strong returns and protection, has probably ended. The protection that government bonds provide for portfolios is therefore set to come at a cost again.Volatility on equity markets is...

Read More »Solid U.S. retail sales follow Fed’s upbeat economic assessment

Amid signs of robust consumer spending, we still expect two rate hikes from the Fed this year.Core retail sales in the US rose by a solid 0.4% m-o-m in January, above consensus expectations. Moreover, December’s figure was revised up. The result was that between Q4 and January, core retail sales grew by a robust 4.2% annualised. We forecast that consumer spending will grow by around 2.2% q-o-q annualised in Q1, after 2.5% in Q4 2016.All in all, we remain optimistic about consumer spending...

Read More » Perspectives Pictet

Perspectives Pictet