After a period of currency strength linked to the revival in oil prices last year, the Norwegian krone and Canadian dollar may find it harder to make further advances in 2017.In 2016, the sharp rebound in oil prices and the November OPEC deal to cut oil production have been supportive of oil-producer currencies like the Norwegian krone and Canadian dollar. However, we believe the oil price is likely to stabilise at around USD55 in 2017, close to where it already is. In an environment where new oil investment is still in a trough, there could therefore be fewer tailwinds for the Norwegian krone (NOK) and Canadian dollar (CAD). Rate differentials (and therefore monetary policy) also remain a key factor even for these commodity currencies. On this score too, there are few reasons for believing these currencies can go much further. Rate differentials suggest that oil currencies are relatively expensive, and so have only limited upside potential in a stable oil price environment.For example, the Bank of Canada (BoC) adopted a more dovish stance during its January monetary policy meeting, highlighting the strength of the Canadian dollar as a source of concern for exports. This, together with excess capacity does not argue for a hawkish monetary stance.In Norway, the fall in oil tax revenue is putting fiscal spending under pressure.

Topics:

Luc Luyet considers the following as important: commodity currencies, Currency forecast, Macroview, Oil currencies

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

After a period of currency strength linked to the revival in oil prices last year, the Norwegian krone and Canadian dollar may find it harder to make further advances in 2017.

In 2016, the sharp rebound in oil prices and the November OPEC deal to cut oil production have been supportive of oil-producer currencies like the Norwegian krone and Canadian dollar. However, we believe the oil price is likely to stabilise at around USD55 in 2017, close to where it already is. In an environment where new oil investment is still in a trough, there could therefore be fewer tailwinds for the Norwegian krone (NOK) and Canadian dollar (CAD).

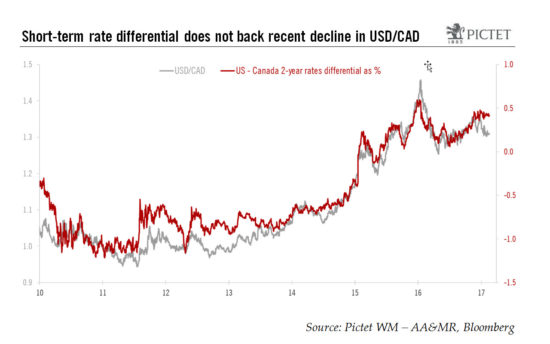

Rate differentials (and therefore monetary policy) also remain a key factor even for these commodity currencies. On this score too, there are few reasons for believing these currencies can go much further. Rate differentials suggest that oil currencies are relatively expensive, and so have only limited upside potential in a stable oil price environment.

For example, the Bank of Canada (BoC) adopted a more dovish stance during its January monetary policy meeting, highlighting the strength of the Canadian dollar as a source of concern for exports. This, together with excess capacity does not argue for a hawkish monetary stance.

In Norway, the fall in oil tax revenue is putting fiscal spending under pressure. With fiscal policy less accommodative, monetary policy may well have to be more dovish, especially given significant appreciation of the Norwegian krone in 2016.

Part of the attractiveness of commodity currencies is that they offer a higher yield than other major currencies. However, both the BoC and the Norges Bank should remain accommodative whereas the Fed should raise rates twice in 2017. In particular, short-term rate differentials do not back up the recent decline in the USD/CAD rate. Likewise the sharp appreciation of the krone against the euro since the start of the year and fact that rate differentials do not support the recent decline in the EUR/NOK rate suggest only limited further upside potential for the Norwegian currency against the euro in 2017.