Next week, we expect the ECB to highlight that downside risks to the euro area outlook have diminished further, warranting upward revisions to staff forecasts and a more neutral monetary stance.The latest economic developments are consistent with the ECB turning somewhat more hawkish – or, more accurately, less dovish. Business surveys have improved, pointing to annualised GDP growth of around 2% in Q1. Headline inflation returned to the ECB’s 2% target in February, for the first time in four years. The euro area composite PMI and its price components are now at levels which, in the past, were consistent with ECB rate hikes.But the ECB’s mission is not complete, as inflation is not yet on a sustainable path. We estimate that without the effect of QE, medium-term projections for inflation would not exceed 1.5%.Next week will see the release of ECB staff projections for GDP and inflation. We suspect that the whole inflation profile will be revised up: to 1.7% HICP in 2017 (up from 1.3%); 1.6% in 2018 (up from 1.5%); 1.8% in 2019 (up from 1.7%). The latter would thus come closer to the ECB’s definition of price stability, at least when the anticipated effects of QE are taken into account.

Topics:

Frederik Ducrozet considers the following as important: ECB inflation target, ECB preview, ECB staff forecasts, ECB tapering, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Next week, we expect the ECB to highlight that downside risks to the euro area outlook have diminished further, warranting upward revisions to staff forecasts and a more neutral monetary stance.

The latest economic developments are consistent with the ECB turning somewhat more hawkish – or, more accurately, less dovish. Business surveys have improved, pointing to annualised GDP growth of around 2% in Q1. Headline inflation returned to the ECB’s 2% target in February, for the first time in four years. The euro area composite PMI and its price components are now at levels which, in the past, were consistent with ECB rate hikes.

But the ECB’s mission is not complete, as inflation is not yet on a sustainable path. We estimate that without the effect of QE, medium-term projections for inflation would not exceed 1.5%.

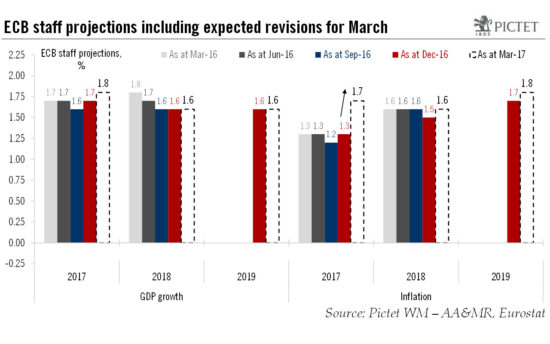

Next week will see the release of ECB staff projections for GDP and inflation. We suspect that the whole inflation profile will be revised up: to 1.7% HICP in 2017 (up from 1.3%); 1.6% in 2018 (up from 1.5%); 1.8% in 2019 (up from 1.7%). The latter would thus come closer to the ECB’s definition of price stability, at least when the anticipated effects of QE are taken into account. As regards GDP forecasts, stronger soft data would warrant some upward revisions as well, but hard data have been more mixed since the turn of the year and staff projections were arguably on the optimistic side in December. In the end, we expect the ECB staff to revise their real GDP projections only marginally higher, to 1.8% in 2017 (up from 1.7%), while leaving the medium-term profile unchanged at 1.6% in 2018 and 2019. As a reminder, the ECB expects potential growth to remain well below those levels, closer to 1%.

Although it is still too early to debate a possible exit strategy from QE, in our view, the ECB is likely to shift to a more neutral stance, starting with an upgrade of its macro outlook next week, including its assessment of the balance of risks. The next step may consist in a change in forward guidance on policy rates, before QE tapering is announced in September and implemented from Q1 2018 on. The ECB could remove the reference to rate cuts from the statement in order to boost demand for the final TLTRO operation on 23 March.