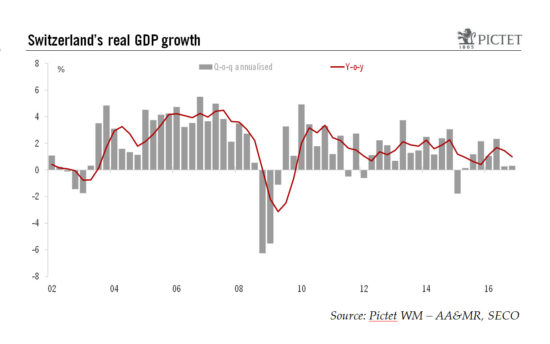

GDP growth picked up in 2016, with the export-orientated manufacturing sector contributing positively in spite of the strong franc. We expect the Swiss growth rate to be broadly similar this year.The Swiss statistical agency (SECO)’s quarterly estimates show a provisional GDP growth rate of 1.3% in 2016 compared with 0.8% in 2015.Two aspects of today’s report are worth mentioning. First, on the expenditure side, both domestic demand components and foreign trade helped to boost Swiss growth in 2016. It was a much better year for exports than 2015, even though the good performance hid significant divergence across sectors. Second, on the production side, the largely export-oriented manufacturing sector, hit hard by the sharp appreciation of the Swiss franc the previous year (the so-called “Frankenshock”), was the main driver of GDP growth in 2016.Switzerland still lags the US and the euro area in terms of GDP growth, but today’s data confirm that the Swiss economy is continuing its modest recovery in spite of the Frankenshock. For 2017, we expect real GDP growth of 1.4%, broadly the same as in 2016. Domestic demand is likely to remain an important economic driver. Private consumption is expected to continue to grow, but with no significant acceleration given the fading effect from lower energy prices and residual challenges in the labour market. Investment prospects are mixed.

Topics:

Nadia Gharbi considers the following as important: Macroview, Swiss economy, Swiss GDP, Swiss GDP forecast, Switzerland growth

This could be interesting, too:

Investec writes Swiss economy stalls in second quarter of 2023

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

GDP growth picked up in 2016, with the export-orientated manufacturing sector contributing positively in spite of the strong franc. We expect the Swiss growth rate to be broadly similar this year.

The Swiss statistical agency (SECO)’s quarterly estimates show a provisional GDP growth rate of 1.3% in 2016 compared with 0.8% in 2015.

Two aspects of today’s report are worth mentioning. First, on the expenditure side, both domestic demand components and foreign trade helped to boost Swiss growth in 2016. It was a much better year for exports than 2015, even though the good performance hid significant divergence across sectors. Second, on the production side, the largely export-oriented manufacturing sector, hit hard by the sharp appreciation of the Swiss franc the previous year (the so-called “Frankenshock”), was the main driver of GDP growth in 2016.

Switzerland still lags the US and the euro area in terms of GDP growth, but today’s data confirm that the Swiss economy is continuing its modest recovery in spite of the Frankenshock. For 2017, we expect real GDP growth of 1.4%, broadly the same as in 2016. Domestic demand is likely to remain an important economic driver. Private consumption is expected to continue to grow, but with no significant acceleration given the fading effect from lower energy prices and residual challenges in the labour market. Investment prospects are mixed.

In view of the still-subdued economic outlook, there is little hope for a significant acceleration in the pace of expansion in investment. The strength of the Swiss franc is likely to continue to weigh on exports, even though its effect might be partly compensated by higher global demand.