Nonetheless, the acceleration in headline figures in December masks subdued core inflation. We believe weak core prices will mean the rise in headline inflation will soon stall.Euro area flash HICP inflation rose from 0.6% in November to 1.1% year on year (y-o-y) in December, while core inflation increased slightly to 0.9%, both above consensus expectations. The breakdown by components showed that the main driver of the increase was energy prices.In the next few months, euro area inflation...

Read More »Artificial intelligence in wealth and asset management

Published: Tuesday January 03 2017Edgar van Tuyll van Serooskerken, head of Quantitative Strategies at Pictet Wealth Management, explains how Pictet uses machine learning for two purposes: first, to hunt for profitable investment opportunities; and second, to search for patterns in big data that are similar to those of past periods.For the first use, machine learning can sift through the mass of data we now have on the past prices of assets in various classes, on company performance and on...

Read More »Antonio Bicchi

Published: Saturday December 31 2016Robots used to be separated from people because of safety concerns, but Professor Antonio Bicchi of the Italian Institute of Technology and Pisa University believes that a new generation of lightweight, soft robots will safely interact with humans in everyday life.The robots that play an essential role in many industries today are rigid and heavy, their mechanical and electronic components programmed by humans to be very accurate in what they do. But as...

Read More »Andrew McAfee

Published: Thursday December 29 2016The MIT scientist, co-author of the bestselling book on The Second Machine Age, discusses the impact of digital technologies on work, the economy and society, and how human beings should adapt as the pace of change accelerates.What led you to set up the Initiative on the Digital Economy at MIT’s business school?My colleague Erik Brynjolfsson and I co-founded the Initiative because we felt that there was a need to study how technological progress was...

Read More »The age of intelligent machines

Published: 28th December 2016Download issue:Humankind is moving from an information age to the age of intelligent machines, with consequences for the world of work, the economy and society. The transition is driven by the explosion in the amount of digital data that is now available, artificial intelligence (AI) programmes that can analyse the data for the benefit of humanity, and intelligent robots that are able to work independently.The Winter 2016 edition of Pictet Report includes a talk...

Read More »Equity total returns could reach double digits in 2017

According to our risk factor-based analysis, equities are likely to provide a total return of around 10% on average next year.Major equity markets are likely to deliver a total return of around 10% in 2017 according to our risk factor-based analysis framework. This projection is contingent on two market risk factors, i.e. equity and interest rates.We use four building blocks in our calculation of projected equity returns: dividend yield, buyback yield, valuation and earnings growth.The...

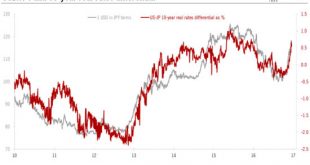

Read More »Limited short-term potential for dollar, yen will continue to weaken

Recent policy meetings at important central banks chime with our currency outlook for major currencies in the coming months.US dollar/euro. The recent break to a fresh 14-year price low after 21 months of consolidation opens the way for a move towards parity in the EUR/USD rate in the next few months. Still, growth in the US is likely to be hurt in the coming months by the ongoing tightening in monetary conditions brought about by the stronger USD and the rise in interest rates before the...

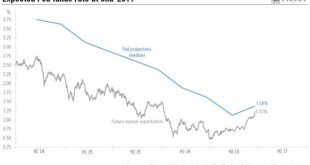

Read More »Fed revises rate projections higher: ours remain unchanged

Given the ongoing tightening in monetary conditions, we are leaving our forecasts for two Fed rate hikes next year unchanged for the time being.The decision by the Fed this week to raise the Fed funds rate target range by 25bp to 0.5%-0.75% was widely expected. More surprisingly for the market was certainly the upward revisions in the (in)famous ‘dot plot’. The Federal Open Market Committee’s (FOMC) median forecast for Fed funds rates at the end of 2017 was shifted up by 25bp, to 1.375%,...

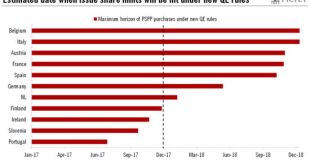

Read More »Sizing up the changes in ECB’s monetary policy

Along with extending its asset-buying programme, the ECB has made a number of changes to the parameters of that programme in a bid to deal with the issue of ‘bond scarcity’. But will it succeed?In December, the ECB made important changes to its quantitative easing (QE) programme, deciding to extend it by at least nine months to December 2017 while scaling down the pace of its asset purchases from EUR80 bn to EUR60 bn from April. The ECB also announced the easing of technical constraints...

Read More »China maintains economic momentum

The latest economic data indicate a steady pace in the Chinese economy as 2016 draws to a close. But while we don’t expect a hard landing, 2017 will bring challenges for China on many fronts.The latest data releases out of Beijing indicate steady momentum in the Chinese economy. Exports are showing signs of recovery and investment in manufacturing is helping to offset a recent drop in property investment. All in all, the latest data releases are consistent with our full-year GDP forecast of...

Read More » Perspectives Pictet

Perspectives Pictet