Although business surveys outpaced expectations and there are signs of rising price pressures, we continue to believe the ECB will not shift its monetary stance in the near term.The euro area composite flash PMI surged to 56.0 in February, the highest reading since April 2011. The main boost came from a surge in the services index due to strong data in Germany and France.The euro area average composite PMI is now consistent with a GDP growth rate of about 0.6% q-o-q in Q1, above our forecast. At the same time, hard data came in slightly weaker than expected at the end of last year, suggesting that business surveys might be overstating the pace of growth to some extent. As a result, we are keeping our growth forecast unchanged at 1.5% for 2017.In France, the composite PMI rose by more than two points, to 56.2 in February, against expectations of a small decline. Other national business surveys have been more mixed recently, but overall momentum in the French economy appears to be fairly strong and certainly not consistent with weaker growth ahead of the elections. In Germany, the flash composite PMI index also rose, contrary to expectations. Overall, the German PMI composite index is consistent with a GDP growth of 0.6% q-o-q in Q1, marking an acceleration from 0.4% in Q4 2016.A key takeaway from PMI report was “a further intensification of inflationary pressures”.

Topics:

Frederik Ducrozet and Nadia Gharbi considers the following as important: ECB policy moves, euro area growth, Euro area inflation, Euro area PMI, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Although business surveys outpaced expectations and there are signs of rising price pressures, we continue to believe the ECB will not shift its monetary stance in the near term.

The euro area composite flash PMI surged to 56.0 in February, the highest reading since April 2011. The main boost came from a surge in the services index due to strong data in Germany and France.

The euro area average composite PMI is now consistent with a GDP growth rate of about 0.6% q-o-q in Q1, above our forecast. At the same time, hard data came in slightly weaker than expected at the end of last year, suggesting that business surveys might be overstating the pace of growth to some extent. As a result, we are keeping our growth forecast unchanged at 1.5% for 2017.

In France, the composite PMI rose by more than two points, to 56.2 in February, against expectations of a small decline. Other national business surveys have been more mixed recently, but overall momentum in the French economy appears to be fairly strong and certainly not consistent with weaker growth ahead of the elections. In Germany, the flash composite PMI index also rose, contrary to expectations. Overall, the German PMI composite index is consistent with a GDP growth of 0.6% q-o-q in Q1, marking an acceleration from 0.4% in Q4 2016.

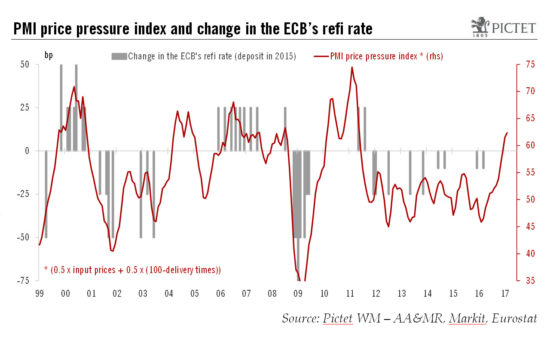

A key takeaway from PMI report was “a further intensification of inflationary pressures”. Both input prices and output prices rose in February. Our own price pressure (see chart above) gauge has moved further into ECB policy tightening territory. However, we continue to expect the ECB to resist any shift in its monetary stance during the first half of this year.