Subscribe to Fashion Snapz: https://goo.gl/rzx5J2 Daily uploads of your favorite fashion designers, beauty and fashion magazines and fashion shows from snapchat and instagram stories. Fashion Snapz is your daily dose of what is happening in fashion NOW with a behind-the-scenes view of tutorials, techniques and interviews! Find the latest in fashion trends here daily! Subscribe today!

Read More »Xue Dong Chen, Austin Mahone, and Luka Sabbat for Dolce and Gabbana FW 2018 Campaign

Subscribe to Fashion Snapz: https://goo.gl/rzx5J2 Daily uploads of your favorite fashion designers, beauty and fashion magazines and fashion shows from snapchat and instagram stories. Fashion Snapz is your daily dose of what is happening in fashion NOW with a behind-the-scenes view of tutorials, techniques and interviews! Find the latest in fashion trends here daily! Subscribe today!

Read More »When headlines start to matter

[embedded content] Published: Tuesday March 28 2017Alexandre Tavazzi, Global Strategist at Pictet Wealth Management on factors that might hit market valuations.

Read More »Time to deliver, ‘Perspectives’, March-April 2017

Published: 28th March 2017Download issue:With President Trump’s plans to ‘reform and repeal’ Obamacare suffering a serious setback in Congress in March, attention is once again turning to the new administration’s plans for tax cuts and fiscal reform. The so-called ‘reflationary trade’, while in large part based on improving economic dynamics, also owes something to expectations that the new US administration will push through with other parts of its economic agenda. This means, writes Pictet...

Read More »Pictet Perspectives – When headlines start to matter

Alexandre Tavazzi, Global Strategist at Pictet Wealth Management on factors that might hit market valuations.

Read More »Euro bank credit still strong in spite of February weakness

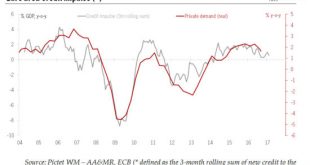

But today's credit report means ECB will have to tread carefully when it comes to reducing the degree of monetary accommodation.The euro area M3 and credit report for February was slightly disappointing overall. Broad money growth (M3) eased from 4.8% to 4.7% y-o-y. Bank loans to non-financial corporations fell back to 2.0% y-o-y in February, from 2.3% in January, as a result of weaker lending flows across the region.Notwithstanding this modest setback, the euro area credit cycle remains...

Read More »Profit dynamics support further upside for equity markets

Corporate results are in keeping with our central scenario of 10% total returns for global equities this year.Our 2017 scenario, drawn up last December, called for a total annual return of 10% for global equities this year. We attributed the bulk of this performance to a double-digit rise in estimated corporate profits. As the Q4 2016 reporting season draws to a close, 2017 earnings expectations are proving resilient or are being revised upwards. Yet the earnings cycle is turning out to be...

Read More »Another spectacular rise in euro area PMIs

PMI surveys surprised to the upside in March. The euro area composite PMI surged to 56.7, its highest level since April 2011.The average composite PMI is now consistent with a GDP growth rate of about 0.6% q-o-q in Q1, above our forecast. At the same time, hard data came in slightly weaker than expected, suggesting that business surveys might be overstating the pace of growth to some extent. As a result, we are keeping our growth forecast unchanged at 1.5% for 2017Both the euro area...

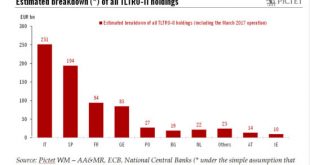

Read More »Take-up of TLTRO loans is good news for euro bank credit

The ECB’s scheme of negative interest rate loans to banks has also helped boost inflation in the euro area.The fourth and final of the ECB’s Targeted Long-Term Refinancing Operations (TLTRO) today attracted EUR233bn in demand from 474 euro area banks, well above consensus (EUR110bn). Expectations of an ECB deposit rate hike may have boosted demand for this operation, as it provided a last opportunity for banks to secure four-year funding at a rate that can go as low as -0.40%.There is no...

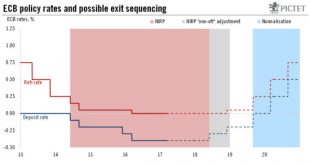

Read More »Escaping from planet NIRP

The ECB could announce further changes to its forward guidance in June as part of its exit strategy from negative rates. But we think proper rates normalisation will only start in late 2019.The debate over the ECB’s exit strategy from its negative interest rate policy (NIRP) has started in earnest. Recent comments point to a possible reversal in the exit sequencing, with a deposit rate hike preceding the end of net asset purchases.A one-off adjustment in negative rates would have some...

Read More » Perspectives Pictet

Perspectives Pictet