At its quarterly policy assessment, the Swiss National Bank (SNB) decided to leave its monetary policy unchanged. The SNB could afford not to cut its reference rate after last week’s ECB stimulus failed to have much impact on the Swiss franc versus the euro. The target range for the 3-month Libor was kept between -1.25% and -0.25%; the interest rate on sight deposits with the SNB was maintained at a record low of -0.75%; and the SNB reiterated its willingness to intervene on the foreign...

Read More »Financial markets looking for a second wind

Published: 17th March 2016 Download issue: Financial markets search for a second wind Equity markets in developed economies rebounded in February, after spending December and January in an attitude of crisis. We think that this is just a tactical rebound, rather than a return to the bull market that prevailed on equity markets from 2009 to 2014. The fundamentals that limit the upside for equities have not changed; meanwhile, the limits of central bank policy are becoming increasingly...

Read More »US consumption: disappointing retail sales report

Today’s retail sales report was a clear disappointment, particularly at the core level. However, we continue to expect solid consumption growth in Q1 and overall in 2016. Nominal total retail sales dropped by 0.1% m-o-m in February, slightly above consensus expectations (-0.2%). However, January’s number was revised down markedly from +0.2% to -0.4%. Total sales were dented by a 4.4% m-o-m fall in nominal sales at gasoline stations (on the back of sharply lower gasoline prices). Nominal...

Read More »Euro area: quantifying ECB’s stimulus – an extra 0.3% boost to inflation

In this post, we provide a rough assessment of the reflationary impact of the newly-announced ECB’s measures through a simple framework. Ahead of the December 2015 meeting, we used a simple method based on the ECB’s leaked models in the German press in order to guestimate the impact of QE on inflation, and thus the potential for additional easing based on the ECB’s own forecasts. We use the same framework to assess the potential macro impact of the new measures announced by the ECB last...

Read More »The ECB delivers a bigger-than-expected package to support bank lending

The ECB announced measures that exceeded expectations, targeting the refi rate, its monthly asset purchases, a new corporate bonds purchase programme, new TLTROs and a negative rate. The deposit rate was cut as expected, but Draghi said that “no more cuts” were anticipated at this stage. The ECB’s Governing Council delivered a comprehensive policy package that exceeded market expectations by a large margin. The 10bp deposit rate cut to -0.40% was expected but other measures were not,...

Read More »Corporate bonds: February marked by singularly high volatility

Macroview US HY corporate bonds have benefited from the rise in the oil price, whereas European HY corporates are still looking for reassurance from the banking sector. Spreads on corporate bonds widened quite noticeably in February: those on US high-yield issues hit highs not seen since 2011 before narrowing again as China-related fears, worries over the oil price and concern about banks' profitability diminished. The energy and mining sectors were both boosted by the rise in the oil...

Read More »Hedge funds: risk-off mode in equities

Macroview Macro managers have reduced their equity exposure amid modest positive returns year-to-date, while long/short equity managers have been challenged by sharp market rotations. Equity risk in macro managers' portfolios is below the historical average. Many expect stock markets to trend lower – not necessarily because of a coming recession but because of peak margins and outflows from petrodollar-dependent sovereign wealth funds. The effectiveness of QE programmes is also being...

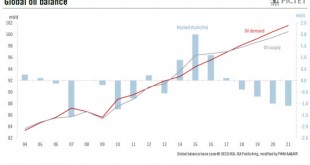

Read More »Oil price likely to be back to $50/barrel in 2017

The influence of the oil price on financial markets has grown in importance recently. The dampening effect of low oil prices on import prices makes the work of central bank work more difficult as they are already struggling to bring back low inflation closer to their targets. The fall in the oil price has increased concerns about deflation and exacerbated investors’ sentiment that monetary authorities are running out of effective tools to reflate economies. We have argued in the past few...

Read More »United States: Better-than-expected job gains in February

February’s employment report showed strong job gains and further reduction in labour market slack. Wage numbers were noticeably lower than expected and the average workweek fell markedly. Nevertheless, the US labour market remains quite healthy overall. Non-farm payroll employment rose by a robust 242,000 m-o-m in February, well above consensus expectations (195,000). Moreover, January’s figure was revised up (from 151,000 to 172,000), as was December’s number (from 262,000 to 271,000)....

Read More »United States: ISM Manufacturing index bounces back slightly in February

Even though the ISM Manufacturing index remains stuck at quite low levels, we continue to expect GDP growth to reach 2.0% q-o-q annualised in Q1 and 2.0% as well on average in 2016. The ISM Manufacturing index bounced back a little in February, but its Non-Manufacturing counterpart eased marginally. We don’t see any reason to alter our growth scenario. Our forecast that GDP will grow by 2.0% in Q1 and 2.0% overall in 2016 remains unchanged. ISM Manufacturing index bounced back in...

Read More » Perspectives Pictet

Perspectives Pictet