Solid PMI figures indicate stable growth for the Chinese economy in Q1 2017, but we maintain our below-consensus forecast for GDP growth this year.China’s official manufacturing purchasing managers’ index (PMI) in February came in at 51.6, compared with 51.3 in January, while the Caixin (Markit) manufacturing PMI rose by 0.7 from the previous month to 51.7. The official non-manufacturing PMI in February remained an elevated 54.2, only slightly below the reading of 54.6 in January.In summary, China’s February PMI numbers generally point to steady momentum in the Chinese economy for Q1. While we are still waiting for “hard” data on the Chinese economy, available evidence suggests that Q1 growth will likely be solid, with our forecast standing at 6.7% y-o-y, compared with 6.8% in Q4 2016.Looking further ahead, however, there could be significant headwinds to China’s growth this year as a whole. The slowdown in property investment remains the greatest concern for the domestic economy. As the government continues to fret about the financial risks related to the property sector, tightening measures will likely be kept in place. This will inevitably weigh on property investment going forward. On the external front, the rebound in exports may start to moderate in 2017 as the benefits of low base effects fade.

Topics:

Dong Chen considers the following as important: China growth forecast, Chinese manufacturing, Chinese PMI, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Solid PMI figures indicate stable growth for the Chinese economy in Q1 2017, but we maintain our below-consensus forecast for GDP growth this year.

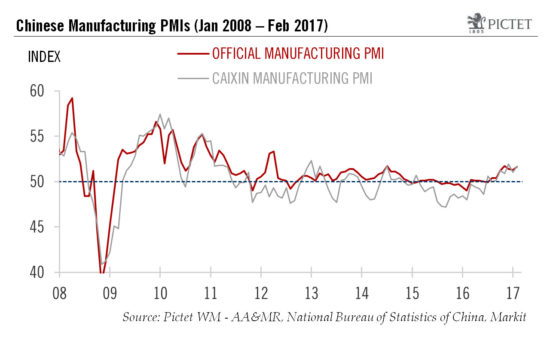

China’s official manufacturing purchasing managers’ index (PMI) in February came in at 51.6, compared with 51.3 in January, while the Caixin (Markit) manufacturing PMI rose by 0.7 from the previous month to 51.7. The official non-manufacturing PMI in February remained an elevated 54.2, only slightly below the reading of 54.6 in January.

In summary, China’s February PMI numbers generally point to steady momentum in the Chinese economy for Q1. While we are still waiting for “hard” data on the Chinese economy, available evidence suggests that Q1 growth will likely be solid, with our forecast standing at 6.7% y-o-y, compared with 6.8% in Q4 2016.

Looking further ahead, however, there could be significant headwinds to China’s growth this year as a whole. The slowdown in property investment remains the greatest concern for the domestic economy. As the government continues to fret about the financial risks related to the property sector, tightening measures will likely be kept in place. This will inevitably weigh on property investment going forward. On the external front, the rebound in exports may start to moderate in 2017 as the benefits of low base effects fade. In addition, there are still significant uncertainties regarding the Trump administration’s trade policies, which we believe will likely have a negative impact on China and the rest of emerging Asia. With those considerations in mind, we continue to maintain our below-consensus forecast of 6.2% for the Chinese economy for full-year 2017.