Summary:

Pictet Wealth Management’s positioning in fast-evolving markets.Asset allocationImproved earnings growth should support attractive returns on developed-market equities.We still expect Treasury yields to rise this year. The 35-year fall in long-term interest rates, during which government bonds provided both strong returns and protection, has probably ended. The protection that government bonds provide for portfolios is therefore set to come at a cost again.Volatility on equity markets is currently low, but tail events look underpriced. Although this stands to be a risk-on year, volatility could be sharply higher than in 2016. We shall continue to keep well diversified portfolios and look for smart ways to protect them.Developed-market (DM) equities are likely to offer superior returns and less volatility than emerging-market (EM) equivalents in 2017: strategically we still prefer to play EM through DM. However, EM assets may offer attractive opportunities on a tactical basis.CurrenciesThe US dollar (USD) lost momentum in January, in tandem with political and market developments and lack of details on the Trump administration’s fiscal plans.However, although maturing, we expect the USD’s long-term appreciation trend to continue this year, on the back of an improving US growth and inflation outlook as well as divergent monetary policy.

Topics:

Perspectives Pictet considers the following as important: asset allocation, Macroview, market stance, Pictet positioning, Pictet strategy

This could be interesting, too:

Pictet Wealth Management’s positioning in fast-evolving markets.Asset allocationImproved earnings growth should support attractive returns on developed-market equities.We still expect Treasury yields to rise this year. The 35-year fall in long-term interest rates, during which government bonds provided both strong returns and protection, has probably ended. The protection that government bonds provide for portfolios is therefore set to come at a cost again.Volatility on equity markets is currently low, but tail events look underpriced. Although this stands to be a risk-on year, volatility could be sharply higher than in 2016. We shall continue to keep well diversified portfolios and look for smart ways to protect them.Developed-market (DM) equities are likely to offer superior returns and less volatility than emerging-market (EM) equivalents in 2017: strategically we still prefer to play EM through DM. However, EM assets may offer attractive opportunities on a tactical basis.CurrenciesThe US dollar (USD) lost momentum in January, in tandem with political and market developments and lack of details on the Trump administration’s fiscal plans.However, although maturing, we expect the USD’s long-term appreciation trend to continue this year, on the back of an improving US growth and inflation outlook as well as divergent monetary policy.

Topics:

Perspectives Pictet considers the following as important: asset allocation, Macroview, market stance, Pictet positioning, Pictet strategy

This could be interesting, too:

Joseph Y. Calhoun writes Weekly Market Pulse: The Cure For High Prices

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Pictet Wealth Management’s positioning in fast-evolving markets.

- Improved earnings growth should support attractive returns on developed-market equities.

- We still expect Treasury yields to rise this year. The 35-year fall in long-term interest rates, during which government bonds provided both strong returns and protection, has probably ended. The protection that government bonds provide for portfolios is therefore set to come at a cost again.

- Volatility on equity markets is currently low, but tail events look underpriced. Although this stands to be a risk-on year, volatility could be sharply higher than in 2016. We shall continue to keep well diversified portfolios and look for smart ways to protect them.

- Developed-market (DM) equities are likely to offer superior returns and less volatility than emerging-market (EM) equivalents in 2017: strategically we still prefer to play EM through DM. However, EM assets may offer attractive opportunities on a tactical basis.

Currencies

- The US dollar (USD) lost momentum in January, in tandem with political and market developments and lack of details on the Trump administration’s fiscal plans.

- However, although maturing, we expect the USD’s long-term appreciation trend to continue this year, on the back of an improving US growth and inflation outlook as well as divergent monetary policy.

Equities

- The reporting season is well under way, and corporate results have generally been positive, especially among financials (which we like globally at present). This validates our scenario of double-digit earnings per share growth for DM equities 2017 as nominal GDP picks up.

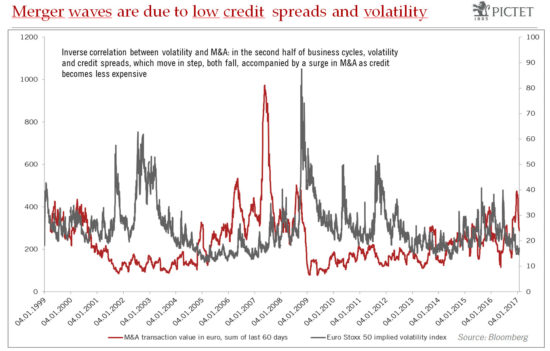

- A rise in M&A activity in Europe is another sign of improving confidence among corporates.

- We expect euro area periphery bond spreads to widen this year. However, markets are likely to remain more concerned about political risks and potential ECB tapering than about debt sustainability. We continue to believe the ECB will not begin tapering before 2018 and may even prefer to raise interest rates before changing its asset-purchase programme given upward pressure on periphery bond spreads.

Alternatives

- January may have marked the beginning of a more favourable environment for active managers. We expect hedge funds to outperform a 60/40 portfolio this year.

- We expect private equity to continue to offer attractive returns. Strategies that offer opportunities in 2017 include those with a focus on a hands-on approach, on unusual markets and complex transactions, as well as those with a focus on finely tuned strategies/a special angle, and on the small-to-mid-cap market.

- Real estate debt strategies look interesting in a reflationary environment. Prime opportunities are in mezzanine and senior debt tranches.