At the 14 December meeting, attention will be focused on the ECB staff forecasts and any changes in communication on plans for unwinding QEs. The main talking points ahead of the ECB’s last policy meeting this year on 14 December are the new staff projections for growth and inflation as well as forward guidance on asset purchases. We expect higher oil prices to push ECB staff forecasts for inflation higher, to 1.4% in 2018 and 1.6% in 2019. A lower...

Read More »Slow wage growth to keep Fed on prudent normalisation track

But latest employment report shows the US economy remains in fine fettle. The November employment report revealed another ‘Goldilocks’ set of conditions for investors: employment growth remained firm, especially in cyclical sectors like manufacturing and construction. At the same time, wage growth stayed soft – which means the Federal Reserve is unlikely to shift its current prudent communication on interest-rate hikes (although it is still very...

Read More »Fed rate unlikely to move much above 2% next year

The Fed is expected to raise rates again this week. But it continues to wrestle with low core inflation, while the impact of tax cuts will need to be monitored. After the quarter-point rate rise expected on 13 December, the Federal Reserve will have pushed through the three rate hikes it signalled earlier in the year. For once, it has not under-delivered. Meanwhile, the gradual, ‘passive’ decline in the Fed’s balance sheet has been mostly ignored by...

Read More »A crucial step towards US tax cuts

Approval of the Senate tax bill paves the way for a final congressional bill that leads to tax cuts. Although unchanged, we now see some upside risks to our 2018-19 scenario for US growth and inflation. With the approval of the Senate tax bill in the early hours of Saturday 2 December, a key step has been taken toward tax cuts. The next chapter in the process is to reconcile this tax bill with the House of Representatives’ version, most likely in a...

Read More »Euro area forecast to grow 2.3% in 2018

We have upgraded our growth projection for this year and next. There are upside risks to our forecast that the ECB will start hiking rates in Q3 2019. Taking account of stronger growth momentum, the carryover effect and upward revisions to past data, we have upgraded our euro area annual GDP growth forecasts to 2.3% both in 2017 and 2018. Our forecasts remain consistent with a very gradual slowdown in the quarterly pace of GDP growth, to 2% by...

Read More »如何购买比特币?(简单教学➕分析) 轻松赚钱 稳定回报

平台: ——————————————————————————————————————— Bitmex杠杆平台-10%手续费折扣: https://www.bitmex.com/register/cc33Aj 普通交易平台:Binance(链接奖励): https://www.binance.com/?ref=16085592 普通交易平台:Kucoin(链接奖励): Kucoin 酷币交易平台:https://www.kucoin.com/#/?r=7KN47a 教學:...

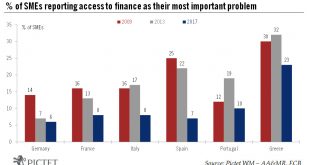

Read More »Further improvement in financial situation of euro area SMEs

The improvement and better access to credit bodes well for investment spending in the euro area as we move into 2018.Small and medium-sized entreprises (SMEs) are crucial for the euro area economy. They constitute about 99% of all euro area firms, employ around 70% of the workforce, and generate around 60% of value added. Their economic importance is above the euro area average in Italy, Spain, Portugal and Greece. Unlike large firms, which have access to alternative sources of finance, such...

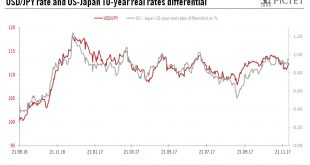

Read More »US likely to peak against yen in first half of 2018

Our 2018 scenario of a deceleration in US economic activity and a slightly less accommodative Bank of Japan should weigh on the dollar versus the yen.From 6 November to 28 November, the Japanese yen gained 2% against the US dollar, outperforming all G10 currencies but the euro.In our view, the key driver of the USD/JPY rate is the 10-year real rate differential, especially since the introduction of the yield-curve-control (YCC) framework by the Bank of Japan (BoJ) on 21 September 2016.In...

Read More »Pictet Perspectives – The Call of Asia

After a period of disappointment, Asian markets have outperformed for the past two years. And with paradigm shifts in businesses and economies, they still hold plenty of opportunities. So argues David Gaud, Chief Investment Officer for Asia at Pictet Wealth Management. https://www.group.pictet/wealth-management http://perspectives.pictet.com

Read More »The Call of Asia

[embedded content] Published: Thursday November 30 2017After a period of disappointment, Asian markets have outperformed for the past two years. And with paradigm shifts in businesses and economies, they still hold plenty of opportunities. So argues David Gaud, Chief Investment Officer for Asia at Pictet Wealth Management.

Read More » Perspectives Pictet

Perspectives Pictet