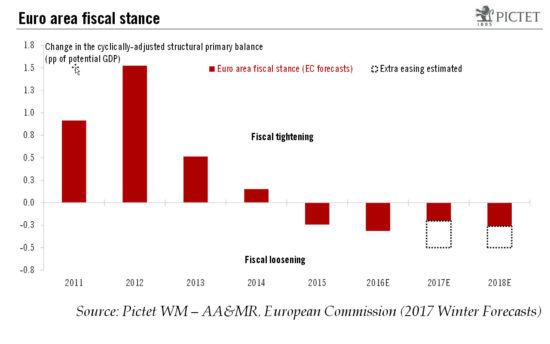

As the emphasis moves away from monetary initiatives, euro area GDP should benefit from a shift in fiscal policy going back to before the US elections.There has been growing evidence of a shift in the policy mix of various developed economies, from monetary to fiscal. In the euro area, we have likely entered a new cycle where the combination of austerity fatigue and greater flexibility on spending rules leads to more sustained fiscal support, however sub-optimal and uneven across countriesIn theory, only Germany and the Netherlands have fiscal space within EU rules. In practice, one-off factors may contribute to further fiscal slippage, including public spending related to the refugee crisis, the election cycle, or the Juncker Plan. There is room for additional fiscal easing within existing European rules, depending on political will and incentives. The quasi-fiscal effects of ECB QE should play a major role from that perspective.As for the euro area as a whole, we expect this year’s fiscal easing to amount to 0.5% of GDP – unevenly spread across countries. This is larger than what is forecasted by the European Commission (0.2% of the GDP, 2017 winter forecast, revised down from the previous forecast of 0.3%). ECB’s supportive policies have led to low interest rates on government debt. Therefore, even countries without fiscal space face no pressures in the short run.

Topics:

Frederik Ducrozet and Nadia Gharbi considers the following as important: euro area, euro fiscal stimulus, Fiscal policy, fiscal space, Macroview

This could be interesting, too:

Dirk Niepelt writes “Governments are bigger than ever. They are also more useless”

Marc Chandler writes US Benchmark Payroll Revisions Over-Hyped? Dollar may Benefit from Buying on Fact after Being Sold on Rumors

Marc Chandler writes Dollar Slips but Dip may Offer New Opportunity

Marc Chandler writes Calmer Capital Markets…for the Moment

As the emphasis moves away from monetary initiatives, euro area GDP should benefit from a shift in fiscal policy going back to before the US elections.

There has been growing evidence of a shift in the policy mix of various developed economies, from monetary to fiscal. In the euro area, we have likely entered a new cycle where the combination of austerity fatigue and greater flexibility on spending rules leads to more sustained fiscal support, however sub-optimal and uneven across countries

In theory, only Germany and the Netherlands have fiscal space within EU rules. In practice, one-off factors may contribute to further fiscal slippage, including public spending related to the refugee crisis, the election cycle, or the Juncker Plan. There is room for additional fiscal easing within existing European rules, depending on political will and incentives. The quasi-fiscal effects of ECB QE should play a major role from that perspective.

As for the euro area as a whole, we expect this year’s fiscal easing to amount to 0.5% of GDP – unevenly spread across countries. This is larger than what is forecasted by the European Commission (0.2% of the GDP, 2017 winter forecast, revised down from the previous forecast of 0.3%). ECB’s supportive policies have led to low interest rates on government debt. Therefore, even countries without fiscal space face no pressures in the short run.

But there are some uncertainties surrounding the potential boost to growth from fiscal easing. Around half part of the recent revisions of the fiscal stance by the European Commission has been related to statistical effects. Potential growth has been revised higher by 0.1-0.2% point since last year, resulting in a slightly larger cyclical budget component that impacted the cyclically-adjusted budget deficit.

A fiscal expansion would reduce political risks and eurosceptic sentiment. Translated into economic activity, 2017 fiscal stimulus, while far from negligible, is not large enough for growth to help growth accelerate materially. Part of the fiscal effect is likely to be spread into 2018, when the ECB is expected to taper its QE programme, with positive tail risks depending on the outcome of the French and German elections.