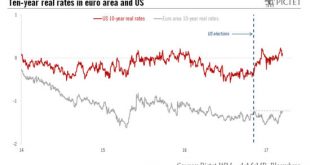

Barring a French election surprise, the downside potential for the euro against the US dollar looks limited in the next few months, but there is still room for the US dollar to strengthen again.The monetary policy meetings of the European Central Bank (ECB) on 9 March and of the Federal Reserve on 15 March have put upward pressure on the euro versus the US dollar. Euro area real rates have risen on prospects for an early rate hike whereas US real rates have declined on the perceived...

Read More »No hint of Swiss rate rise

The Swiss National Bank left monetary policy unchanged at its latest meeting and forecast that the Swiss economy would grow 1.5% in 2017.At its latest policy meeting on 16 March, the Swiss National Bank (SNB) left the interest rate on sight deposits at a record low of -0.75% and the central bank reiterated its willingness to intervene in the foreign exchange market if needed, “taking the overall currency situation into consideration”, as it had mentioned in its previous press release. The...

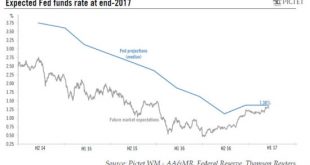

Read More »Markets react well to Fed hike

Financial conditions remain accommodative, perhaps setting the stage for next hike in June.In line with what almost every forecaster was expecting, the Federal Open Market Committee (FOMC) decided at its latest policy meeting to raise the Fed funds rate target range by 25bp to 0.75%-1.0%. Fed Chair Janet Yellen explained that the decision to raise rates was appropriate “in light of the economy’s solid progress toward our goals of maximum employment and price stability“. Financial markets...

Read More »China: growth looking good for first half before possible deceleration in second

Data shows strong fixed investment and industrial production, but consumption has weakened. We still expect 2017 GDP growth of 6.2%.The first batch of hard data on domestic activity for 2017 point to strong momentum in fixed-asset investment (FAI) and industrial production, while consumption has been on the weak side. In the first two months of 2017, FAI grew by 8.9% y-o-y, compared to 6.5% for December 2016 and 8.1% for 2016 as a whole. As FAI has been the key variable that drives China’s...

Read More »Monthly Investment Strategy Highlights, March 2017

Pictet Wealth Management’s latest positioning in fast-evolving markets.Asset allocationWe remain comfortable with our overweight position in developed-market (DM) equities and believe there are good reasons to be positive on Japanese equities,With volatility low and risks looming in the short term, this is a good time to add protection to portfolios. We have bought derivative protection on EUR high yield bonds and a call option on gold.Expecting yields on core sovereign bonds to rise further...

Read More »Healthy job reports open the way to rate increases

Job metrics continue to improve in the US, but our GDP estimate for this year remains unchanged.February’s US non-farm payroll figure was strong (although partly due to temporary factors and unusually mild weather), with non-farm payrolls rising 235,000, above expectations. Other data in the February employment report were also upbeat. The US unemployment rate fell back from 4.8% to 4.7% in February, slightly below the Fed median estimate for full employment (4.8%). And the U6 measure of...

Read More »Returns will likely fall over the next decade

Published: 10th March 2017Download issue:The latest edition of Horizon is out, containing Pictet Wealth Management’s updated secular outlook and expected returns for the main asset classes over the next 10 years.Some of the highlights are as follows: Expected ReturnsEquities: below long-term average but still attractive. Our models suggest that global equities can be expected to post a 6% return in US dollars annually for the next 10 years. Such returns look attractive relative to long-term...

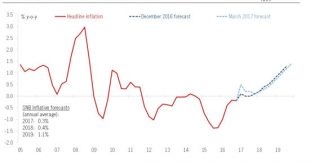

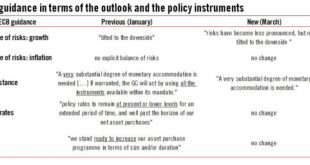

Read More »ECB fine tunes communication as recovery broadens

A generally more optimistic ECB looks set to announce its roadmap for QE tapering in September. QE tapering itself may start in Q1 2018.The ECB delivered a fairly balanced, albeit more optimistic message at today’s press conference, echoing upward revisions to the staff projections for 2017-18 euro area GDP growth and inflation. Crucially, however, the 2019 projection for inflation was left unchanged at 1.7%.Looking ahead, the ECB’s four inflation criteria are unlikely to be fully met before...

Read More »Decline in expected returns for equities and bonds

The latest edition of Horizon is out, presenting Pictet Wealth Management’s expected returns for the main asset classes over the next 10 years. We believe that the returns that can be expected from developed-market equities over the next 10 years will be over a third lower than average of the past 46 years. Growth potential and inflation trends suggest that expected annual returns for US equities could decline to just over 5% over the next 10 years, compared with a historic 10-year average...

Read More »Fixed Income: looking for a place to hide

With sovereign yields rising and little room for significant spread tightening in investment grade corporate debt, conditional exposure to high yield may offer more opportunities.Last year credit posted stellar total returns, and the beginning of 2017 has also started well. Investors need to watch three main macroeconomic risk factors in 2017: Inflation, which will normalize; Monetary policy, which will continue to diverge; and Fiscal policy, which will remain accommodative in both the US...

Read More » Perspectives Pictet

Perspectives Pictet