Rising core prices, along with wage growth, should help the ECB along the road to policy normalisation.Euro area cyclical inflation has been slowly rising over the past few months, from low levels. Several measures of underlying inflation have broken out of the tight range around which they have fluctuated for the past three years.The ECB’s ‘super core’ inflation rate rose to a three-year high of 1.04% in August, with other indicators showing a stronger upward momentum. Today’s...

Read More »Euro area, revisiting the past once again

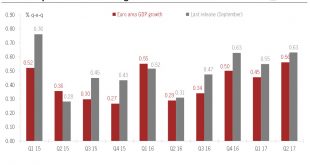

GDP figures have been considerably revised in the euro area and in Switzerland in the wake of Q2 data, leading to mechanical changes in our growth forecasts for this year.Revisions to GDP figures have been massive in the euro area and in Switzerland following the publication of Q2 GDP data. The resultant changes in our forecasts are mechanical, and do not reflect a change in our growth profile for H2 2017 and beyond.Recent data released by Eurostat have resulted in a further upward revision...

Read More »QE put to bed, the focus shifts to rate hikes

In line with our expectations, the Fed announced 'normalisation' of its balance sheet at its September meeting. Our scenario for a December Fed rate hike remains unchanged.As widely expected, the Federal Reserve announced at its 20 September meeting the start of the ‘normalisation’ of its balance sheet; some of its bond holdings will not be reinvested from October on. The Fed’s balance sheet should therefore start to shrink gradually. Fed chair Janet Yellen justified this decision by saying...

Read More »High equity valuations leave no room for disappointment

Our updated core scenario for global equities foresees earnings growth as the primary driver of returns over the next 18 months. We expect current high valuations to persist.Our core scenario for global equities for the next 18 months is built on three active risk factors (drivers): earnings growth, valuations and currency fluctuations. Of the three, earnings growth will be the most significant for return generation.After two strong quarterly reporting seasons, the positive base effect that...

Read More »Wealth, the mobile application from Pictet Wealth Management

Pictet’s clients can remain in constant contact with the Bank by using its state-of-the-art digital services. With Pictet’s mobile application "Wealth", you can interact digitally with Pictet and have your portfolio at your fingertips. Pictet Wealth is currently available to all clients who hold an account at one of our offices.

Read More »”惡意逼車檢舉成立“ 汽車駕駛多次惡意逼車企圖重機攔下!!超扯!!ROAD RAGE IN TAIWAN

感謝網友分享至爆料公社!!!! “可直接將影片快轉至50秒觀看“ 9/16下午17時 於環東大道往南港方向 一自小客車號DC-5787 多次惡意逼車 並兩度將前方重機於高架道路上攔下 非常危險極誇張 本影片為負面教材 收發文號: 北市警南分交字 第201709202068號 信件編號: 201709202068 檢舉日期: 2017-09-20 檢舉車號: DC-5787 檢舉內容: 惡意逼車危險駕駛 回覆機關: 臺北市政府警察局 處理情形: 親愛的網路朋友您好:您向本分局(大隊、隊)檢舉之交通違規案件,經派人深入查處,謹說明如下:有關您檢舉車輛於本轄道路涉交通違規案,經審核檢附之檢舉內容資料,本分局(大隊、隊)業按「道路交通管理處罰條例」相關規定舉發在案;對您關懷本市交通市政等問題,特致謝忱,如有說明未及之處,謹致歉意。如對以上答復內容尚有疑義,歡迎來電洽詢 南港分局 (聯絡電話:(02)2783-9110),謝謝您來信與指教,並祝您平安順心 萬事如意 臺北市政府警察局南港分局 敬上。 回覆日期:2017-10-16...

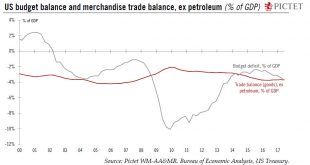

Read More »Trump more focused on trade deficit than budget deficit

The Trump administration is noticeably more focused on trade issues than on the ongoing deterioration in public finances.Second-quarter current account data from the US Bureau of Economic Analysis showed once again a sizeable trade deficit, particularly in merchandise trade excluding energy. The energy boom driven by shale gas and light oil has reduced the US’s dependency on energy imports, in turn improving the headline current-account reading. But the US is still a net petroleum importer...

Read More »Moderate deceleration underway in China

The latest data releases seem to confirm our view that Chinese growth is decelerating, but our GDP forecast of 6.8% growth for 2017 remains unchanged.The latest data on China’s economic activity point to a slowdown in China’s growth momentum in the third quarter, after the positive surprise of the first half of the year. We expect growth to continue to moderate for the rest of 2017 and into 2018, but the pace of deceleration may be fairly modest. We have thus decided to keep our GDP forecast...

Read More »Deceptive calm

[embedded content] Published: Tuesday September 19 2017With the return of solid growth, Cesar Perez Ruiz, Chief Investment Officer at Pictet Wealth Management, discusses how anxiousness about turns in the monetary policy cycle is being expressed in forex rather than equity markets, where volatility remains low.

Read More »Pictet Perspectives – Deceptive calm

With the return of solid growth, Cesar Perez Ruiz, Chief Investment Officer at Pictet Wealth Management, discusses how anxiousness about turns in the monetary policy cycle is being expressed in forex rather than equity markets, where volatility remains low.

Read More » Perspectives Pictet

Perspectives Pictet