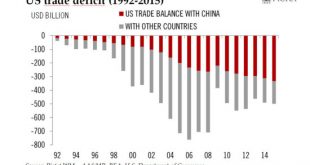

There is a high risk that tensions between the US and China over the latter’s rise are set to come to a head under Trump’s presidency and become an important source of market volatility.The relationship between the US and China is of vital importance for the world both from an economic and a geopolitical perspective. Competition between the two powers could be set to come to a head under Donald Trump’s presidency. First, the trade relationship with China is a central issue in the Trump...

Read More »Systemic risks remain low ahead of euro area elections

While we believe upcoming elections are unlikely to shake the European edifice, investors are turning cautious, if only because opinion poll accuracy has proved questionable over the past year.There are good reasons for investors to worry about political risks in Europe. The most legitimate concerns, in our view, come from the timing of elections this year in the largest euro area countries. They are coming against the backdrop of a broad shift towards protectionism, and at a time when ECB...

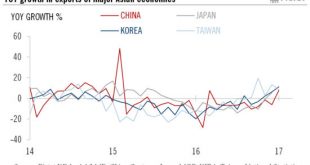

Read More »Japan: an export-led recovery is underway

Fourth straight quarter of growth poses upside risk to our Japanese GDP forecast.The first preliminary reading of Japan’s real GDP growth for Q4 2016 came in at 1% q-o-q annualised, roughly in line with the consensus forecast of 1.1% but below the 1.3% growth in Q3. The growth in Q4 almost all came from external demand (+1.0%), while the contribution from domestic demand was virtually 0%. Japanese exports have shown clear signs of improvement in recent months, consistent with the export...

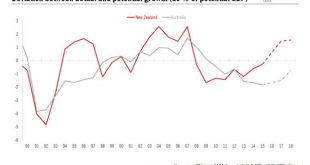

Read More »Currency opportunities emerge Down Under

The difference in macro outlooks means prospects are brightening for the New Zealand dollar against its Australian equivalent.At their February monetary meeting, both the Reserve Bank of Australia (RBA) and the Reserve Bank of New Zealand (RBNZ) kept their official cash rates unchanged at 1.50% and 1.75% respectively.However, given our view that New Zealand’s economic fundamentals are better than Australia’s, the temporary weakness of the New Zealand dollar that stemmed from the forward...

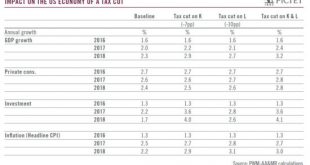

Read More »The potential impact of a Trump fiscal stimulus

Using in-house modelling, we are able to assess the broad consequences of a much-mooted fiscal stimulus on the US economy and the main asset classes.Our core scenario for the US is for real GDP growth of 2% in 2017 and 2.3% in 2018. This assumes that fiscal policy will be only modestly stimulative. However, with the election of Donald Trump as US president, the possibility of a radical change in public policy has increased markedly—possibilities, which enter into our alternative scenarios...

Read More »The unleashing of animal spirits

Published: 6th February 2017Download issue:Donald Trump’s presidential win has unleashed animal spirits in the US that are likely to continue to drive equities forward in 2017. So argues Frank Bigler, head of equity investment research at Pictet Wealth Management, in the latest special edition of Perspectives. There are undoubtedly risks, but for the moment, “the overall direction of the market is still up,” according to Bigler “and any pull-back would be taken as an opportunity to...

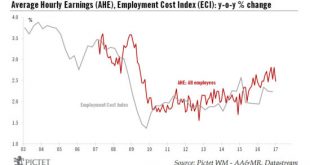

Read More »Wage growth eases in the U.S. despite strong job creation

The first US jobs report of 2017 saw employment beat consensus. But some details were disappointing, including wage growth.Non-farm payroll employment in the US rose by 227,000 month on month in December, above consensus expectations (180,000). The unemployment rate rose slightly further, to 4.8% in December while the broader U6 unemployment rate rebounded to 9.4%. Overall, however, the underlying picture remains one of ongoing improvement in US labour market conditions. As we highlighted in...

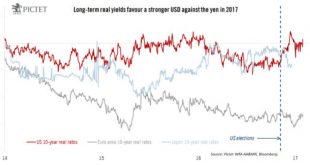

Read More »US dollar looks well supported this year

Given a widening real yield differential, we see the dollar continue to rise, especially against the yen, while further sterling downside looks limited.Our latest forecasts for individual currencies in 2017 can be summarised as follows:US dollar. The USD is likely to remain strong on the back of an improving US growth and inflation outlook as well as continued monetary policy divergence. Our base case scenario is for a Trump administration that puts the emphasis on growth without too much by...

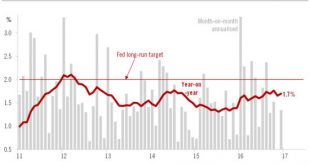

Read More »US inflation still low at end-2016, our forecast unchanged for 2017

Virtually static in 2016, we continue to believe that core inflation will pick up only modestly in 2017.Core PCE inflation in the US settled at 1.7% y-o-y in December, in line with consensus and exactly the same rate as in February 2016. We continue to believe that PCE core inflation will pick up only modestly in 2017, ending the year at around 2.1%.Following a significant pick-up between October 2015 and February 2016 , y-o-y core PCE inflation stabilised at around 1.6%-1.7% for the...

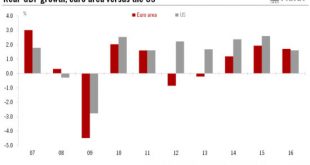

Read More »Euro area: latest figures raise our 2017 GDP forecast to 1.5%

Growth in the euro area outstripped growth in the US last year, while the latest indicators suggest 2017 has gotten off to a strong start. Our GDP forecasts are pushed up mechanically. Euro area real GDP expanded by 0.5% q-o-q in the fourth quarter, marking an acceleration from Q3’s 0.4% gain. The euro area economy grew at an annual average of 1.7% in 2016, compared with 1.9% in 2015. Last year was the first time since 2008 that real GDP growth in the euro area was above that of the...

Read More » Perspectives Pictet

Perspectives Pictet