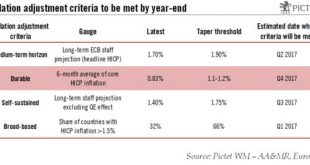

Euro area inflation was well above consensus in January. However, we believe that the ECB will look through this spike in (imported) inflation as underlying price pressures remain subdued.Although euro area headline inflation jumped to 1.8% in January, the closest it has been to ECB’s 2% target since Q1 2013, core inflation remained low at 0.9%. We continue to expect the ECB to wait until September before it announces a tapering of its asset purchases in 2018.A “sustained adjustment in...

Read More »Euro area: strong rebound in bank lending

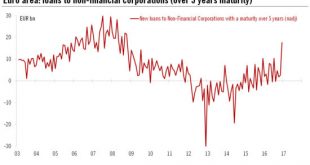

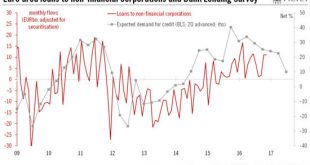

The euro area M3 and credit report strengthened in December after a few months of weakness. However, the latest Bank Lending Survey signalled more modest gains in credit flows in the months ahead.Euro area credit flows to non-financial corporations increased again in December, by EUR13 bn in adjusted terms. The large rebound in long-terms loans, in particular, bodes well for business investment spending.With loans to households still expanding at a healthy pace (+EUR9 bn in December), the...

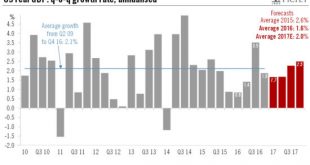

Read More »US GDP picked up in 2H 2016; outlook for 2017 unchanged

In spite of softness in headline Q4 GDP figure, growth momentum in the US picked up in the second half of 2016 and should be underpinned by fiscal stimulus later this year.US GDP growth decelerated from 3.5% in Q3 to 1.9% quarter-on-quarter annualised in Q4, below consensus expectations of 2.2%. However, this soft reading was mainly due to a reversal of the surge in soybean exports in the previous quarter, while growth in final domestic demand picked up from 2.1% in Q3 to 2.5% in Q4....

Read More »Outlook 2017: Investing in a reflationary environment

[embedded content] Published: Wednesday January 25 2017Cesar Perez Ruiz, Chief Investment Officer at Pictet, discusses how the return of inflation this year will impact different asset classes.

Read More »Pictet Perspectives : Outlook for 2017 – Investing in a reflationary environment

Cesar Perez Ruiz, Chief Investment Officer at Pictet, discusses how the return of inflation this year will impact different asset classes.

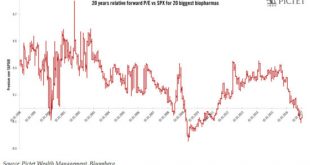

Read More »US biopharma set to rebound

The sector may remain prone to volatility until the Trump administration provides more policy clarity. But a weak 2016 at least helped reset expectations and US biopharm is riding a crest of innovation.Biopharma suffered a poor 2016 after years of strong performance. Political rhetoric was the main source of volatility, but the sector also suffered from poor execution. We think 2016 helped reset expectations and created an attractive opportunity to build long-term positions. Uncertainty will...

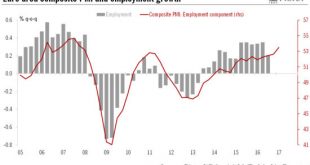

Read More »Business activity, job creation and price pressures remain strong in euro area

Preliminary purchasing manager indices from Markit suggest the outlook for the euro area continues to brighten. Growth forecasts for this year are tilted to the upside.The euro area composite PMI eased slightly to 54.3 in January, from 54.4 in December. Importantly, the breakdown by subindices showed that employment rose at its fastest rate since 2008, which bodes well for domestic demand. Overall, PMI indices look consistent with real euro area GDP growth of 0.5% q-o-q in Q1, slightly above...

Read More »China: near-term prospects good, mid term less clear

Rising debts and the risk that the Trump administration introduces protectionist policies are headwinds for the Chinese economy.Chinese GDP grew by 6.8% in Q4 2016 and by 6.7% in 2016 as a whole, in line with our forecast. The pickup in fixed-asset investment in the second half was probably the key contributor to this solid performance.The likelihood of a sharp deceleration in fixed-asset investment in Q1 2017 has declined greatly. Growth in infrastructure should pick up again this month and...

Read More »Patient ECB to wait for underlying inflation to improve

There were no policy changes at today's meeting of the ECB’s governing council (GC). Central bank seems intent on looking through short-term spikes in imported inflation.At today’s press conference following the GC meeting, ECB President Mario Draghi’s message was one of continuity, very much as expected. The stronger momentum in economic activity and headline inflation, he suggested, was no reason to declare victory as long as downside risks remain. Importantly, the ECB’s statement suggests...

Read More »First tightening of euro area credit standards in three years

The latest Bank Lending Survey (BLS) from the ECB, showed that credit standards tightened somewhat in Q4 2016. But the details were much more upbeat than the headline reading.Credit standards on loans to euro area enterprises tightened in Q4 2016 for the first time in three years. The move was essentially driven by developments in the Netherlands. Demand for credit continued to rise across all categories of loans, once again driven by generally low interest rates and M&A activity.Looking...

Read More » Perspectives Pictet

Perspectives Pictet