Self-destruction isn’t a bug, it’s a feature of our socio-economic system. The gravitational pull of self-destructive behaviors, choices and incentives is scale-invariant, meaning that we can discern the strange attraction to self-destruction in the entire scale of human experience, from individuals to families to groups to entire societies. The proliferation of self-destructive behaviors, choices and incentives in our...

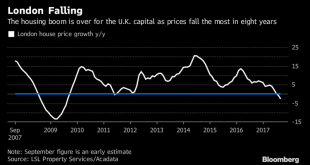

Read More »London House Prices See Fastest Quarterly Fall Since 2009 Crisis

– London house prices fell by 3.2% in the first quarter – Halifax – Brexit, financial and geo-political uncertainty lead to falls– Excluding sale of seven £10m-plus houses in London, prices were down 3.4% in the year– UK house prices climb by just 0.4% in April, the slowest increase since 2008 for same period– Sales transactions fall by 19% and asking versus selling prices show turning into buyers’ market– Homeowner or...

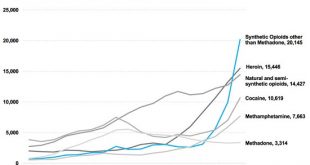

Read More »Getting High on Bubbles

Turn on, Tune in, Drop out Back in the drug-soaked, if not halcyon, days known at the sexual and drug revolution—the 1960’s—many people were on a quest for the “perfect trip”, and the “perfect hit of acid” (the drug lysergic acid diethylamide, LSD). Dr. Albert Hoffman and his famous bicycle ride through Basel after he ingested a few drops of LSD-25 by mistake. The photograph in the middle was taken at the Woodstock...

Read More »Swiss teens and their guns

In Switzerland 15 year olds can learn how to use an assault rifle at their local shooting club. And interest is growing. Nouvo brings you short videos about Switzerland, Swiss current affairs and the wider world. Keep up to date and watch the videos wherever you are, whenever you like. --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles,...

Read More »Swiss Trade Balance Q1 2018: The positive trend continues

We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners. Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade...

Read More »Swiss finance minister sees ‘clearly improved’ ties with US

G20 finance ministers and central bank governors attending the 2018 World Bank Group/IMF Spring Meetings in Washington on April 20, 2018 (Keystone) - Click to enlarge Relations between Switzerland and the United States have improved under the Trump administration, Finance Minister Ueli Maurer told Swiss public radio, SRF, on Saturday. Maurer is heading a Swiss delegationexternal link, together with Economics...

Read More »FX Daily, April 24: Stalled US Rates Steal Greenback’s Thunder

Swiss Franc The Euro has fallen by 0.23% to 1.1944 CHF. EUR/CHF and USD/CHF, April 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge GBP/CHF The pound to Swiss Franc rate has traded in a fairly tight range this week as a lack of any new fresh information to drive financial markets so far. A major driver for the Franc has been risk-sentiment as investors attitudes to risk shape...

Read More »Great Graphic: Aussie Tests Trendline

It is not that the Australian dollar is the weakest currency this month. Its 0.4% decline puts it among the better performers against the US dollar. However, it has fallen to a new low for the year today. The losses have carried to a trendline drawn off of the early 2016 low near $0.6800. The trendline has been drawn on this Great Graphic composed on Bloomberg. It is found today near $0.7625 and rises by about seven...

Read More »Emerging Market Preview: Week Ahead

Stock Markets EM FX came under renewed pressure last week as US yields rose to new highs for the cycle. RUB and TRY were the top performers last week, while MXN and COP were the worst. There are no Fed speakers this week due to the embargo ahead of the May 2 FOMC meeting. While we see little chance of a hike then, markets are likely to remain nervous. Stock Markets Emerging Markets, April 18 - Click to enlarge...

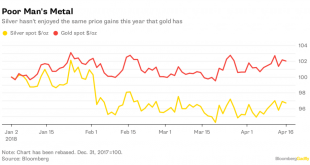

Read More »Silver Bullion Remains Good Value On Positive Supply And Demand Factors

– Silver bullion remains good value on positive supply and demand factors– Industrial demand set to continue to climb from 2017, into 2018 and beyond– Speculators are bearish on silver as net short positions in silver futures reach record– Investment demand sees silver ETF holdings at eight-month high of 665.4 million ozs– 2017 saw fifth consecutive annual physical deficit in scrap silver, of 26 moz– Global silver mine...

Read More » SNB & CHF

SNB & CHF