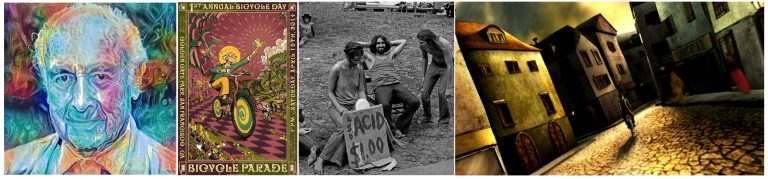

Turn on, Tune in, Drop out Back in the drug-soaked, if not halcyon, days known at the sexual and drug revolution—the 1960’s—many people were on a quest for the “perfect trip”, and the “perfect hit of acid” (the drug lysergic acid diethylamide, LSD). Dr. Albert Hoffman and his famous bicycle ride through Basel after he ingested a few drops of LSD-25 by mistake. The photograph in the middle was taken at the Woodstock festival and inter alia serves as a reminder that monetary inflation has a considerable effect on the purchasing power of the US dollar over time. - Click to enlarge The photograph in the middle was taken at the Woodstock festival and inter alia serves as a reminder that monetary inflation has a

Topics:

Keith Weiner considers the following as important: Debt and the Fallacies of Paper Money, Featured, newsletter, On Economy, On Politics, Precious Metals

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Turn on, Tune in, Drop outBack in the drug-soaked, if not halcyon, days known at the sexual and drug revolution—the 1960’s—many people were on a quest for the “perfect trip”, and the “perfect hit of acid” (the drug lysergic acid diethylamide, LSD). |

Dr. Albert Hoffman and his famous bicycle ride through Basel after he ingested a few drops of LSD-25 by mistake. The photograph in the middle was taken at the Woodstock festival and inter alia serves as a reminder that monetary inflation has a considerable effect on the purchasing power of the US dollar over time. - Click to enlarge The photograph in the middle was taken at the Woodstock festival and inter alia serves as a reminder that monetary inflation has a considerable effect on the purchasing power of the US dollar over time. |

| We will no doubt generate some hate mail for saying this, but we don’t believe that anyone ever attained that goal. The perfect drug-induced high does not exist. Even if it seems fun while it lasts, the problem is that the consequences spill over into the real world.

Today, drunk on falling interest rates, people look for the perfect speculation. Good speculations generally begin with a story. For example dollar-collapse. And then an asset gets bid up to infinity and beyond (to quote Buzz Lightyear, who is not so close a friend as our buddy Aragorn). It happened in silver in 2010-2011. It happened more recently in bitcoin. Most speculators don’t care about the economic causes and effects of bubbles. They just want to buy an asset as the bubble begins inflating, and sell just before it pops. But bitcoin and many gold proponents are different. They promise that their favorite asset will cure many social ills, fix many intractable problems, and increase liberty. Oh yeah, and get rich quick. |

One thing is absolutely certain: not a lot of useful soldiering can be done on acid. Here a squad of volunteers slowly disintegrates during drill exercises in Alabama. “There was much laughter as the group attempted to give expression to inner emotions… the squad, although starting out well, gave a sluggish and ragged performance… after a few minutes, the men found it difficult to follow orders…” Perhaps the allies should have considered spraying the SS with the stuff. |

| We been pounding the table for going on a decade, sometimes even bellowing from the rooftops, that gold does not go up. Even the gold bugs claim that the dollar is collapsing. Our point — which has so far gone unanswered — is that you cannot use something which is collapsing to measure other things. Especially not the economic constant (gold).

Either the dollar is collapsing, in which case if gold is going up then the dollar could not be used to measure this. Or else it is not collapsing, in which case maybe it could measure gold — but then remind us why these folks are buying gold. In response, some argue “well yeah, we don’t necessarily want a higher price of gold for its own sake—we want to grow our purchasing power.” Gold, they say, will increase in purchasing power when the masses dump their dollars and buy gold. Maybe. As an aside, we are not sure how they square this with their oft-stated assertion that purchasing power in gold has been constant since Rome. We have heard this a million times. A fine toga back then supposedly cost one ounce of gold, as does a fine suit today. We don’t know where they shop, but we have bought pretty nice-looking suits for a lot less than $1,350 and we have also paid multiples of that for a handcrafted Italian sartorial masterpiece. There is no reason why prices should be constant, but we suppose this myth is necessary to bolster the belief that the value of money is 1/P (P being prices). Anyways, suppose it were true that prices will fall in gold terms (while they hyper-inflate in dollar terms). So? Is that a good thing? Bear with us, as we get to the answer to that question. |

|

Waving the Magic WandMainstream speculators — fueled by the rubbish economics that passes for theory in our modern monetary era — believe that the Fed can create wealth. You see, if the economy gets into a bit of trouble, the Fed can just, you know, wave its magic wand and abracadabra presto-chango-aggregated-demand, and we’re growing and getting richer again. Like after 2008. It’s the perfect monetary hit, with no consequences. |

When they cease to work, the common man ends up either getting “Cyprused”, or “Weimared” – depending on how the authorities react to a systemic bankruptcy that can no longer be hidden. In the worst case one can be “Argentined” (this is when one first gets Weimared, then gets Cyprused, and just as one thinks there may finally be light at the end of the tunnel, one gets Weimared again). |

| But gold and bitcoin proponents know this is not so. A key reason for their love of the metal and the… umm… bit… is that neither the Fed nor anyone else can increase their quantity arbitrarily. They know that if the Fed gives a billion bucks to a bank, then maybe the bank is enriched but everyone else is impoverished. That this is a transfer of some kind.

People are trained to think — recall those rubbish theories — that if the quantity of money increases, there is a dilution of all monetary units. Those who get the money first may be enriched, but everyone else is impoverished — the Cantillon Effect. Diluted. Like pouring more water into a giant pot of soup. The same amount of food is still there, but there is more water which means each spoonful contains less nutrition. So if this is so, then we have no worries about the rush to gold. Sure purchasing power will increase for those who already own the metal, but there is no increase in quantity of gold. There is no central bank. There is no dilution. And no Cantillon effect. Therefore it’s all good, all part of the path to the gold standard, wherein the right (i.e., very high) gold price brings about the gold standard. Oh yeah, and the massive enrichment of current gold owners. |

The Fed’s party bus… we should point out at this juncture that the Cantillon effect does indeed exist, as newly created money always enters the economy at discrete points (i.e., there are earlier and later receivers of it, and the former will invariably gain wealth to the detriment of the latter). - Click to enlarge Moreover, the purchasing power of money is definitely not independent of its supply. Obviously the supply of money is not the only variable determining its purchasing power, hence there is no 1:1 correlation, and the way in which new money percolates through the economy ensures that the effect will only become noticeable with an often considerable time lag. Nevertheless, it is clearly one of the four variables that determine the money relation, which are: the supply of and demand for money and the supply of and demand for the goods and services that can be exchanged for money. People who buy gold for insurance purposes to protect their wealth against the effects of monetary inflation are certainly not wrong for doing so. There is a difference between trying to defend one’s hard-earned nest egg and hoping to make short term speculative profits. We would point out though that there is nothing wrong with speculation either. In fact, every entrepreneurial activity is speculative in nature and the activities of speculators are necessary for the smooth and optimal allocation of resources. The problem is rather that monetary authorities are creating an environment in which speculation thrives to the detriment of more sustainable and productive activities (if partly out of necessity from the perspective of those engaging in speculation; Keith mentions below that he shares our perspective on who deserves the blame). The structure of relative prices in the economy is distorted by central bank-directed manipulation of the money supply and interest rates. This ultimately causes the capital consumption discussed below. In other words, all these effects go hand in hand. |

What is Wealth?Maybe. But this leads to a question. What is wealth? What does it mean to be wealthy? We love to use the parable of the Prodigal Son for many reasons. Today, we will use it because it does not carry any connotations of money supply, money printing, dilution, Cantillon effect, inflation, etc. It is a simple example of a man who consumes his capital. He is on the perfect trip — until the capital runs out. Does being wealthy mean consuming lots of capital — your own or someone else’s? There is a vital reason why we go to such lengths to make the distinction between operating a farm to grow food vs. selling off pieces to buy groceries, as in our Yield Purchasing Power series. And in our discussion of investing vs. speculating. In the former case, you are producing what you consume (or more than you consume). The latter case is different, because you are consuming without producing, which means consuming something previously produced. Consuming capital. Framed in this light, the answer to this question about wealth is now obvious. No, to be wealthy does not mean to consume capital. Just as to be happy does not mean to be high on an acid trip. Now we have established the context to go back to our question at the top: is it good if the purchasing power of gold skyrockets? Even though it does not involve central banks, money printing, increased quantity of money, or the Cantillon effect. It is not good. |

Frodo gets invaluable investment advice from long-time magician, central bank observer and Sauron opponent Gandalf, himself no stranger to magic tricks. - Click to enlarge Again, we must reiterate that capital consumption does not drop out of the sky unbidden. It is the end result of the effects listed above. Luckily free market capitalism has so far remained a net wealth creating system despite being severely hampered by the efforts of assorted interventionist agencies, but we could obviously be doing a lot better if we had sound money. |

| It is just one more way for people to consume the capital that supports our civilization. Capital is the leverage on human effort. We do not work harder today than people worked during the stone age (probably a lot less hard). Yet we are so much more productive.

Forget the countless tools they could not even have imagined (such as the one you are using to read these words). Today, poor people are often fat. It was taken as an axiom of natural law, that food shortages kept the human population in check. Now even the poorest can be obese. And, in the Fed’s mad falling-interest world full of perverse incentives but with scant opportunity to earn yield (especially for the plebs whom regulators seek to protect), we are trained to dismiss yield. We are trained to seek the perfect speculation. Operating the farm to grow food is old school. Much cooler to dismantle it, and sell off the pieces. After all, operating it produces few crops but selling it off pays for years of groceries. We submit for your consideration that wealth is not purchasing power, if purchasing power is merely the power to liquidate capital to buy consumer goods. Wealth means generating income by producing. The wealthy man is the one who earns 100 ounces of gold a year, spending only 90. Whereas the man who sells off his gold hoard to go on a great trip like the Prodigal Son is not wealthy. He only deceives himself to think he is wealthy, and the trip must end when all his wealth is consumed. We emphasize, as always, that we do not blame the speculators. The Fed, “engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.” These are the words of John Maynard Keynes, quoting Vladimir Lenin on how to destroy the capitalist system. We are all caught up in the Fed’s game, as it engages those hidden forces (i.e. incentives). Our moral condemnation goes to the Fed, not to the people. There may be a grand opportunity for gold owners to consume mass quantities of capital, in the final desperate days of the collapse of the dollar. We predict in the permanent gold backwardation thesis that prices, in gold terms, will be collapsing even while they are going to infinity and beyond in dollar terms. However, we think conditions will deteriorate so badly that most will think twice about partying. As we suspect that not many people are partying in Venezuela right now. |

Venezuela Money Supply, 2008 - 2018 and Venezuela's Annual Inflation Rate, Jul 2017 - Apr 2018 Venezuela: narrow money supply M1 – up from 2.68 million VEF in 1976 to 176,425,396.01 million VEF as of March 2018 (no, this is not a typo), compared to the recent imputed y/y rate of change of CPI (13,357%) – file under “no coincidence”. - Click to enlarge The CPI inflation estimate comes via Professor Steve H. Hanke and is based on black market exchange rates. Historical experience indicates that despite occasional leads and lags, the exchange rate of a hyper-inflating currency against relatively more stable currencies ultimately tends to be fairly closely aligned with its domestic purchasing power, so this is an acceptable way of approaching the issue. This can inter alia be seen in the data on the Weimar Republic garnered by Constantino Bresciano-Turroni. |

| In any case, we regard capital consumption as a cost not a benefit. What the world needs most badly is a stable monetary unit. Not another gyration and another generation of Prodigal Sons. The path to this stability is not paved by a skyrocketing gold price or skyrocketing gold purchasing power, but with the return of the gold interest rate. |

We are in full support of permitting the use of market-chosen money, and it is extremely likely that gold would play an important role in such a system. We would note that if one pleads for stable money, one pleads for stability of purchasing power. This cannot be guaranteed, but it is a very good bet that a major market-chosen currency in a free banking system would be stable enough not to stand in the way of sensible economic calculation, which would prevent boom-bust cycles and consequently a great deal of the (potentially fatal) capital consumption engendered by the current system. |

Keith will give a talk in Las Vegas in early May. Please contact us if you would like to attend.

Charts by trading-economics and Steve H. Hanke of John Hopkins University

Chart and image captions by PT

Tags: Featured,newsletter,On Economy,On Politics,Precious Metals