[embedded content] Interview with Joe Calhoun about BiWeekly Economic Review 01/06/2018. Related posts: The Currency of PMI’s Why The Last One Still Matters (IP Revisions) The Dismal Boom Central Bank Transparency, Or Doing Deliberate Dollar Deals With The Devil What About 2.62 percent? More Pieces of Impossible Not Do We Need One, But Do We Need...

Read More »Get “Positioned In Gold” Now As “You Will Not Have Time To Get Positioned” Later

Get “Positioned In Gold” Now As “You Will Not Have Time To Get Positioned” In Physical Later Guest post by Dominic Frisby of Money Week This year’s “gold standard” of gold-related research has just come out. Conveniently enough – given gold’s “safe haven” reputation – it’s arrived just in time for another major financial market scare, this time in the form of Italy. Below, I consider some of the most pertinent points…...

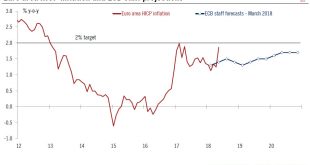

Read More »Euro area inflation close to ECB target in May

Euro Area HICP Today’s release of euro area flash HICP surprised to the upside both in terms of headline inflation (which surged from 1.2% to 1.9% y-o-y in May, above consensus expectations of 1.6%) and, crucially, in terms of core inflation (HICP excluding energy, food, alcohol and tobacco rose from 0.7% to 1.1%). This sharp rebound in inflation will provide the ECB with a critical input for its looming decision on...

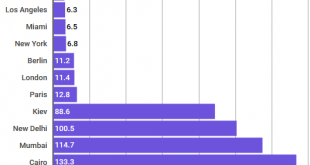

Read More »Pay in Zurich and Geneva highest in the world

A survey of the cost of living in 77 cities, by UBS, ranks Zurich (1st) and Geneva (2nd) as the most expensive. But while these cities are the most expensive, their workers are also the highest paid. In Zurich, less than five days pay affords an iPhone X. In Geneva, the same device requires less than six days of labour. Los Angeles (6.3 days) and Miami (6.5 days) complete the top four. At the other end of the ranking, a...

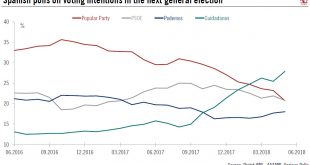

Read More »Spain Snap Elections in Sight

Political instability in Spain has added to turmoil in other peripheral countries. The situation is not comparable with the one that Italy is experiencing at the moment, but since it comes at the same time it is increasing market volatility. Last Friday, Spain’s main oppositionparty, the Socialist party (PSOE) filed a no confidence vote against Prime Minister Mariano Rajoy. The debate will start on May 31 with a vote...

Read More »Over 1,000 jobs threatened by OVS liquidation

Italian fashion brand OVS has 140 stores across the country. (Keystone) The Sempione Retail company, owner of the OVS fashion stores in Switzerland, has begun bankruptcy proceedings. Some 140 outlets will close their doors, with 1,150 workers affected. The Italian clothes brand announced in a statement on Wednesday evening that it had reached a financial dead-end. It did not go into specific details, but said that it...

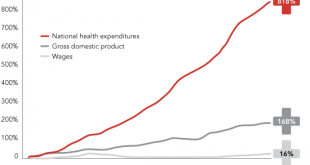

Read More »Burrito Index Update: Burrito Cost Triples, Official Inflation Up 43 percent from 2001

Welcome to debt-serfdom, the only possible output of the soaring cost of living. Long-time readers may recall the Burrito Index, my real-world measure of inflation. The Burrito Index: Consumer Prices Have Soared 160% Since 2001 (August 1, 2016). The Burrito Index tracks the cost of a regular burrito since 2001. Since we keep detailed records of expenses (a necessity if you’re a self-employed free-lance writer), I can...

Read More »FX Daily, June 01: Ironic Twists to End the Tumultuous Week

Swiss Franc The Euro has risen by 0.30% to 1.1558 CHF. EUR/CHF and USD/CHF, June 01(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The week is ending quite a bit different than it began. The main banking concern is not in Italy but in German, where shares in Deutsche Bank shares fell to a record low yesterday, and S&P Global cut its credit rating one step to BBB+...

Read More »Bricht die Italien-Krise der SNB das Genick?

Am 7. April 2017, dem Tag der Generalversammlung der Schweizerischen Nationalbank, war die Welt der Notenbank noch in Ordnung. Der Euro notierte bei 1.20 zum Franken, und SNB-Chef Thomas Jordan konnte einen Jahresgewinn für das vergangene Geschäftsjahr von 54 Milliarden Franken vorweisen. Ein Sieg auf der ganzen Linie, konnte man meinen. Die Lage an den Devisenmärkten kann so rasch drehen wie das Wetter in den Alpen....

Read More »Italy heads towards new elections

Fragmented politics and the risk of a financial crisis continue to hang over the country. This weekend, the Five Star Movement and the League decided to pull the plug on their attempt to form a coalition government after the President of the Republic Sergio Mattarella vetoed the appointment of anti-euro professor Paolo Savona as minister of finance. Mattarella has granted ex-International Monetary Fund official, Carlo...

Read More » SNB & CHF

SNB & CHF