Paradise in LA LA Land More is revealed with each passing day. You can count on it. But what exactly the ‘more is of’ requires careful discrimination. Is the ‘more’ merely more noise? Or is it something of actual substance? Today we endeavor to pass judgment, on your behalf. Normally, judgment would be passed on a Thursday, but we are making an exception. - Click to enlarge For example, here in the land of...

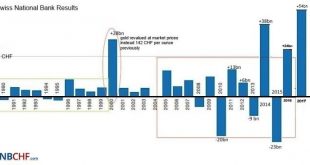

Read More »SNB reports a profit of CHF 47.6 billion for Q1 2018

The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Good years of the Credit Cycle This trend was stopped in 2016, even without the need for a cap on the franc. But one should consider that we are in...

Read More »BNS, une perte révélatrice d’une stratégie potentiellement dévastatrice

BNS, une perte révélatrice d’une stratégie potentiellement dévastatrice: Liliane Held-Khawam L’endettement et la spéculation sont au coeur de la stratégie de la BNS. On met quand et comment le stop? Il semblerait que la BNS fasse des pertes sur ce premier trimestre 2018 de 5 milliards. Une paille au vu de ce que nous pourrions craindre pour l’avenir. Mais le scoop n’est pas là. Il est dans la composition des causes de...

Read More »FX Daily, April 26: Euro Remains Soft Ahead of Draghi

Swiss Franc The Euro has risen by 0.03% to 1.1957 CHF. EUR/CHF and USD/CHF, April 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The euro made a marginal new low early in European turnover and held barely above the spike low on March 1 to $1.2155. So far, today is the first session since January 11 that the euro has not traded above $1.22. The euro stabilized as the...

Read More »Weekly Technical Analysis: 23/04/2018 – USD/JPY, EUR/USD, GBP/USD, AUD/USD, WTI oil futures

USD/CHF The USDCHF pair touched the bullish channel’s resistance that appears on the chart, and the price might be forced to show some temporary decline to test the support base formed above 0.9790 before resuming the rise again. In general, we will continue to suggest the bullish trend supported by the EMA50, depending on the organized trading inside the mentioned bullish channel, noting that our next target is...

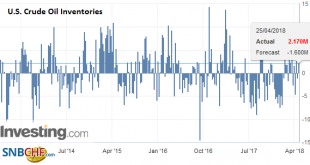

Read More »Oil: Supply and Demand Drivers

Oil prices have recovered more than 50% of the decline since the mid-September peak. The next retracement objectives are found near $82 a barrel for Brent and $76.5 for WTI basis the continuation futures contract. The immediate consideration is that supplies have tightened. OPEC compliance to its agreement has exceeded targets, and Venezuelan output has been halved over the past two years to levels not seen in a more...

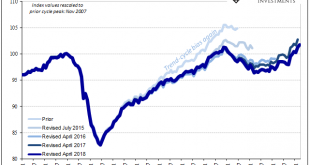

Read More »Why The Last One Still Matters (IP Revisions)

Beginning with its very first issue in May 1915, the Federal Reserve’s Bulletin was the place to find a growing body of statistics on US economic performance. Four years later, monthly data was being put together on the physical volumes of trade. From these, in 1922, the precursor to what we know today as Industrial Production was formed. The index and its components have changed considerably over its near century of...

Read More »FX Daily, April 25: Dollar Regains Luster, but Consolidation Likely Ahead of Key Events and Data

Swiss Franc The Euro has risen by 0.12% to 1.1984 CHF. EUR/CHF and USD/CHF, April 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge GBP/CHF The Swiss Franc has been weakening recently as global investors appear to be moving away from the safe haven of the Swiss banking system. The US Federal Reserve have continued to increase interest rates during last year and have already...

Read More »Russian Gold Rush – Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango Goldfinger Strikes, Sort Of This week, we saw a tweet from a prominent goldbug. He said, “Russia added another 9 tons of gold to its reserves in March. The hits just keep coming.” How many errors in this short quip? We count six, exactly one error for every two words. One, we call this the fallacy of the famous market...

Read More »Swiss authorities allowed isopropanol exports to Syria

A Norwegian soldier takes part in the removal of Syria’s chemical stockpile in 2014 (Keystone) Switzerland authorised the export to Syria of five metric tons of the chemical isopropanol in 2014, which can be used to make sarin gas, Swiss public television, RTS, reports. The Organization for the Prohibition of Chemical Weapons (OPCW) announced in May 2014 that Syria had destroyed its stock of 120 metric tons of...

Read More » SNB & CHF

SNB & CHF