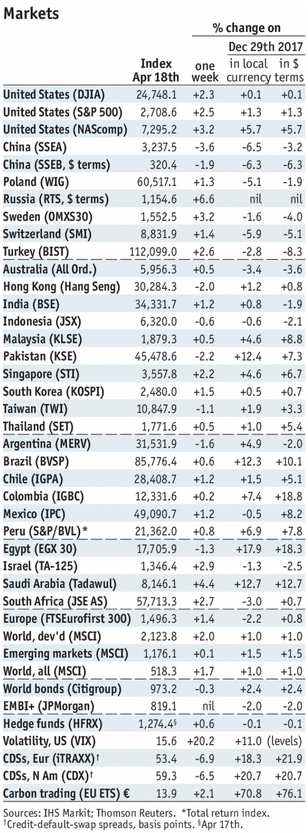

Stock Markets EM FX came under renewed pressure last week as US yields rose to new highs for the cycle. RUB and TRY were the top performers last week, while MXN and COP were the worst. There are no Fed speakers this week due to the embargo ahead of the May 2 FOMC meeting. While we see little chance of a hike then, markets are likely to remain nervous. Stock Markets Emerging Markets, April 18 - Click to enlarge Singapore Singapore reported March CPI today. It rose 0.2% rather than 0.5% y/y. March IP will be reported Thursday, which is expected to rise 5.3% y/y vs. 8.9% in February. Economic data have come in on the soft side, and so we expect the MAS to keep policy steady at its next meeting in October.

Topics:

Win Thin considers the following as important: 5) Global Macro, emerging markets, Featured, newsletter, win-thin

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Stock MarketsEM FX came under renewed pressure last week as US yields rose to new highs for the cycle. RUB and TRY were the top performers last week, while MXN and COP were the worst. There are no Fed speakers this week due to the embargo ahead of the May 2 FOMC meeting. While we see little chance of a hike then, markets are likely to remain nervous. |

Stock Markets Emerging Markets, April 18 |

SingaporeSingapore reported March CPI today. It rose 0.2% rather than 0.5% y/y. March IP will be reported Thursday, which is expected to rise 5.3% y/y vs. 8.9% in February. Economic data have come in on the soft side, and so we expect the MAS to keep policy steady at its next meeting in October. PolandPoland reported March retail sales today. They rose a stronger than expected 9.25 in March vs. 7.9% in February, which was a bit better than expected. Central bank minutes will be released Friday. The bank tilted more dovish at that meeting, with Glapinski saying there was even a chance for another rate cut. Next policy meeting is May 16, no change is expected then. TaiwanTaiwan reported March IP today. It rose 3.1% after a revised 2.2% decline in February (initially it fell 1.9%). Q1 GDP will be reported Friday, with growth expected at 2.8% y/y vs. 3.3% in Q4. The recovery remains sluggish, with price pressures remaining low. We expect the central bank to remain on hold this year, though markets are looking for a hike by year-end. HungaryNational Bank of Hungary meets Tuesday and is expected to keep rates steady at 0.90%. CPI rose 2.0% y/y in March, right at the bottom of the 2-4% target range. As such, there is the possibility that the bank adds more stimulus via unconventional measures. MexicoMexico reports mid-April CPI Tuesday, which is expected to rise 4.7% y/y vs. 5.2% in mid-March. If so, it would be the lowest since January 2017 but still above the 2-4% target range. Banco de Mexico releases its minutes Thursday. Next policy meeting is May 17, no change is expected then if the peso remains stable. March trade will be reported Friday. TurkeyCentral Bank of Turkey meets Wednesday and is expected to hike the Late Liquidity rate 50 bp to 13.25%. However, the market is split. Of the 15 analysts polled by Bloomberg, 3 see steady rates, 1 sees a 25 bp hike, 6 see a 50 bp hike, 3 see a 75 bp hike, and 2 see a 100 bp hike. Much will depend on the lira. If it comes under renewed pressure next week, then a hike becomes more likely. BrazilBrazil reports March current account and FDI data Wednesday. Central government budget data will be reported Thursday. The budget numbers have improved due to the economic recovery, but the lack of pension reforms means this improvement will only be temporary. KoreaKorea reports Q1 GDP Thursday, with growth expected at 2.9% y/y vs. 2.8% in Q4. CPI rose only 1.3% y/y in March, well below the 2% target. As such, the Bank of Korea is likely to proceed cautiously with its tightening cycle. Next policy meeting is May 24, no change is expected then. RussiaCentral Bank of Russia meets Friday and is expected to keep rates steady at 7.25%. The bank restarted the easing cycle back in 2016, but recent ruble weakness should keep it on hold for the time being. Much will depend on whether the US enacts more sanctions on Russia. ColombiaColombia central bank meets Friday and is expected to cut rates 25 bp to 4.25%. CPI rose 3.1% y/y in March, just above the 3% target and within the 2-4% target range. The central bank is likely nearing the end of its easing cycle, with perhaps one more cut after this to 4.0%. |

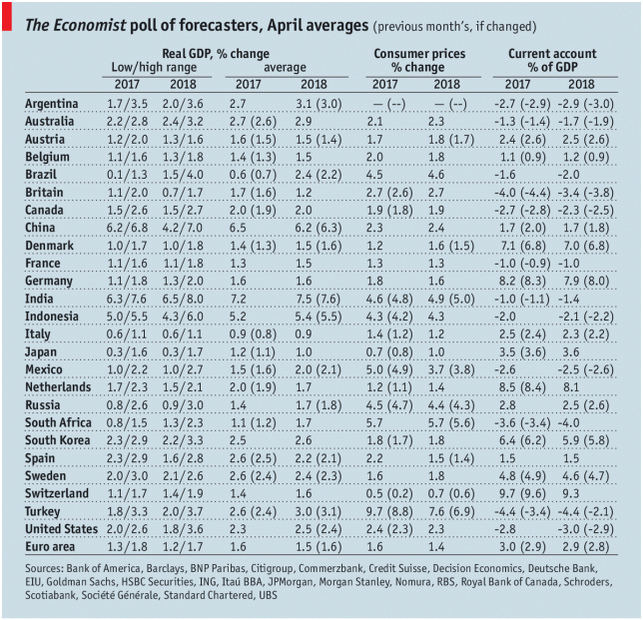

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, April 2018 Source: economist.com - Click to enlarge |

Tags: Emerging Markets,Featured,newsletter,win-thin