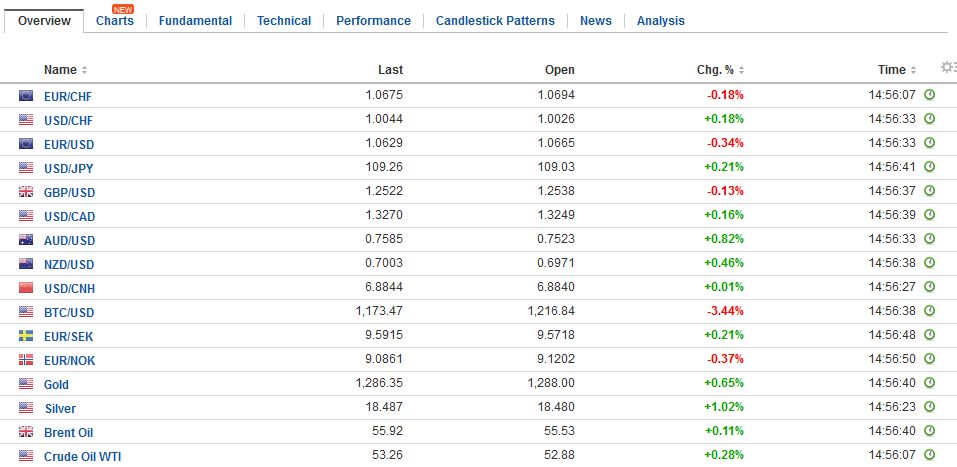

Swiss Franc Switzerland Producer Price Index (PPI) YoY March 2017(see more posts on Switzerland Producer Price Index, ) Source: investing.com - Click to enlarge FX Rates The US dollar slid after US President Trump complained about its strength. The sell-off extended into early Asian activity, before stabilizing. It is mixed in late morning European turnover, which is already lightening up due to the extended Easter holiday. The dollar bloc is stronger, led by the Australian dollar’s 0.8% advance that was encouraged by an employment report that was considerably stronger than expected. Australia added nearly 61k jobs, three times more than the median forecast in the Bloomberg survey and the February series was revised from a loss of 6.4k jobs to gain of 2.8k. These jobs are full-time. In fact, full-time positions rose 74.5k, while part-time positions fell 13.6k. Even the unchanged unemployment rate of 5.9% was impressive given that the participation rate rose to 64.8% from 64.6%. The Australian dollar may also be attracting flows over the holiday period. Also, strong trade figures from China may have also helped. China reported a March trade surplus of nearly bln, which nearly twice as large as expected. Exports jumped 16.

Topics:

Marc Chandler considers the following as important: AUD, China, China Exports, China Imports, China Trade Balance, EUR, EUR/GBP, Featured, FX Trends, Germany Consumer Price Index, Italy Consumer Price Index, JPY, Korea, newslettersent, U.S. Initial Jobless Claims, U.S. Michigan Consumer Sentiment, U.S. Producer Price Index, USD, Yuan

This could be interesting, too:

Eamonn Sheridan writes CHF traders note – Two Swiss National Bank speakers due Thursday, November 21

Charles Hugh Smith writes How Do We Fix the Collapse of Quality?

Marc Chandler writes Sterling and Gilts Pressed Lower by Firmer CPI

Michael Lebowitz writes Trump Tariffs Are Inflationary Claim The Experts

Swiss Franc |

Switzerland Producer Price Index (PPI) YoY March 2017(see more posts on Switzerland Producer Price Index, ) Source: investing.com - Click to enlarge |

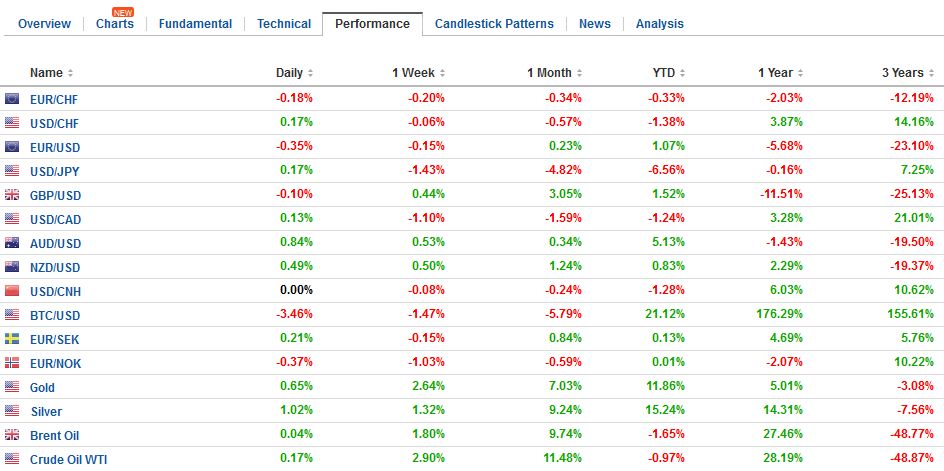

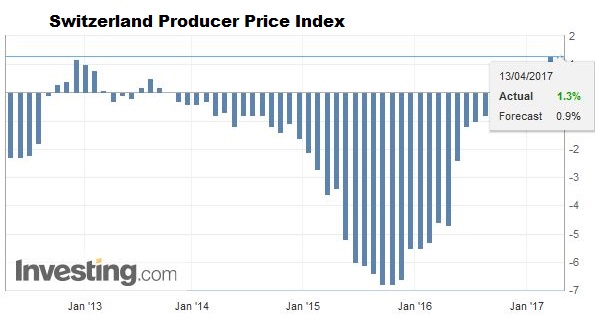

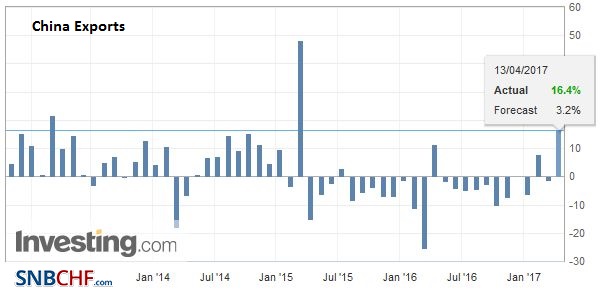

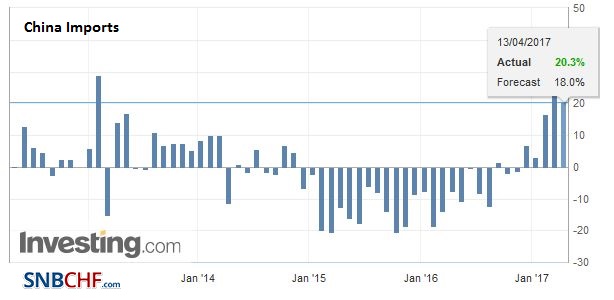

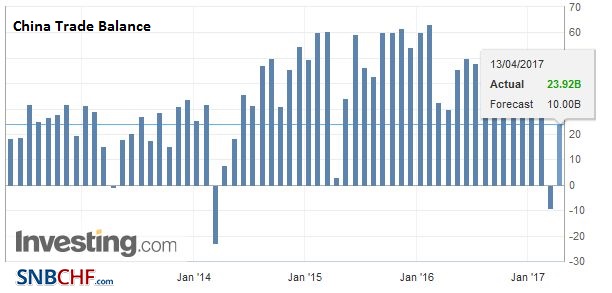

FX RatesThe US dollar slid after US President Trump complained about its strength. The sell-off extended into early Asian activity, before stabilizing. It is mixed in late morning European turnover, which is already lightening up due to the extended Easter holiday. The dollar bloc is stronger, led by the Australian dollar’s 0.8% advance that was encouraged by an employment report that was considerably stronger than expected. Australia added nearly 61k jobs, three times more than the median forecast in the Bloomberg survey and the February series was revised from a loss of 6.4k jobs to gain of 2.8k. These jobs are full-time. In fact, full-time positions rose 74.5k, while part-time positions fell 13.6k. Even the unchanged unemployment rate of 5.9% was impressive given that the participation rate rose to 64.8% from 64.6%. The Australian dollar may also be attracting flows over the holiday period. Also, strong trade figures from China may have also helped. China reported a March trade surplus of nearly $24 bln, which nearly twice as large as expected. Exports jumped 16.4% year-over-year, after a 4% rise in the January-February period (viewed together due to the Lunar New Year distortions). Imports rose 20.3%, moderating fro 26.4% increase in January-February. |

FX Daily Rates, April 13 |

| Trump also reversed his earlier opposition to the Export-Import Bank. He also returned to an earlier position that health care reform needs to proceed tax reform. He also had spoken well of Yellen and kept the door open to her reappointment. Volcker, Greenspan and Bernanke, the last three Fed chairs, were each appointed by the President of one party and reappointed by the President of the other party. His admission of preferring low interest rate policy is not surprising, though he was accused Yellen during the campaign of keeping rates low to help Clinton. Preferences do not drive exchange or interest rates, and low rates seem to run against the stronger growth that he is advocating.

The heightened geopolitical worries appear to be easing for the second consecutive session. The South Korean won is up 1% to lead the emerging market currencies higher. It is the largest gain in a month. Korea’s Kospi is also the strongest equity market in Asia, posting a 0.9% gain. The MSCI Asia Pacific Index eked out a fractionally gain, its fourth rise in the past five sessions. The euro’s three-day advance is in jeopardy today. After approaching $1.0680 in Asia, the euro has come back offered, but finding support near $1.0640 in ahead of the US open. The dollar fell to its 200-day moving average against the yen (~JPY108.75). The subsequent stabilization looks fragile, and the JPY107.90 area may be the next target, which corresponds to a 61.8% retracement of the rally since the US election. Sterling rose to $1.2575 before slipping back to $1.2435. Support is seen in the $1.2500-$1.2520. Its four-day rally coming into today is its longest streak of the year. The Dollar Index held 100.00, which is the 50% retracement of the rally since March 27 low near 98.85. It will likely struggle to resurface above 100.40. That said a move back above 100.60 would help stabilize the tone. |

FX Performance, April 13 |

ChinaOf note, China imported a record amount of oil in March, pushing it ahead of the US as the largest buyer in the first three months of 2017. Stocking piling and strong demand by booming refiners coupled with a decline in domestic output appear to be the driver. China’s oil output in January-February fell 8% year-over-year after output fell last year. In contrast, the US official data yesterday showed US oil output at the highest in more than a year, though inventories slipped from a record. |

China Exports YoY, March 2017(see more posts on China Exports, ) Source: Investing.com - Click to enlarge |

| Trump’s comments are the main talking point today. His claim that the dollar is too strong is not new, but it is the first time he has ventured down that path since the inauguration. His comments follow a three-month decline in the broad measure of the dollar. If a leader of another country said what he did, they likely would be accused of manipulating their currency. That said, in the US Treasury’s criteria of currency manipulation, jawboning does not count. Still, it seems a departure from the G7 and G20 agreements, and like areas, this is an example of unilateralism. |

China Imports YoY, March 2017(see more posts on China Imports, ) Source: Investing.com - Click to enlarge |

| Trump made several other revelations that may be important for investors. He revealed that China will not be cited as a manipulator, but refused to be drawn into a discussion whether this was partly in exchange for cooperation from China on North Korea. A few hours before Trump’s interview was released, China abstained from the UN Security Council resolution condemning the chemical attack in Syria. Since 2011, China has vetoed US-sponsored Security Council resolutions on Syria. Russia vetoed it yesterday. Abstaining sent an important diplomatic signal.

The US President also changed his stance regarding NATO. He said it is not longer obsolete. However, he still harangued NATO head Stoltenberg about compensation for the US carrying the NATO. Two overlooked points should be noted. First, Germany’s Vice Chancellor has argued that in addition to the country’s 1.2% defense budget, it spent around 0.7% on dealing with refugees in part from past military efforts, like in Libya. Second, in a ground war, Germany and Europe will likely pay much more than 2% of GDP. The US may pay in advance, Europe later. |

China Trade Balance (USD), March 2017(see more posts on China Trade Balance, ) Source: Investing.com - Click to enlarge |

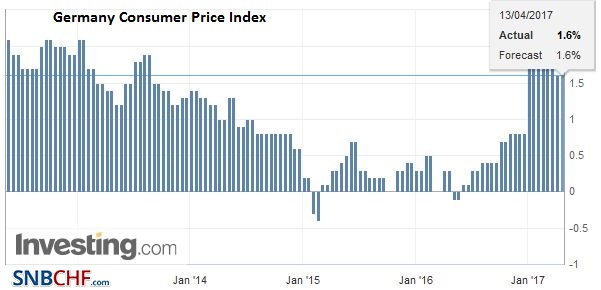

GermanyIn Europe, the French 10-year premium over German has narrowed for the second day as well. To be sure it is elevated near 72 bp, but the momentum has faded. At the two-year tenor, the French premium has edged higher, though it is holding a little below the peak from a couple of days ago. Although the French yield is slightly softer, the German two-year yield is pushing beyond minus 85 bp for the first time in nearly a month. |

Germany Consumer Price Index (CPI) YoY, March 2017(see more posts on Germany Consumer Price Index, ) Source: Investing.com - Click to enlarge |

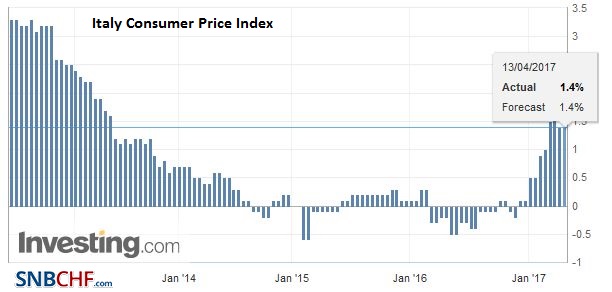

Italy |

Italy Consumer Price Index (CPI) YoY, March 2017(see more posts on Italy Consumer Price Index, ) Source: Investing.com - Click to enlarge |

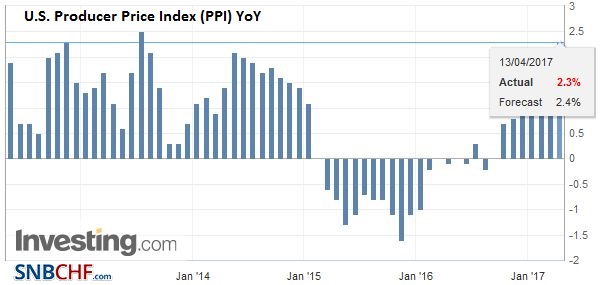

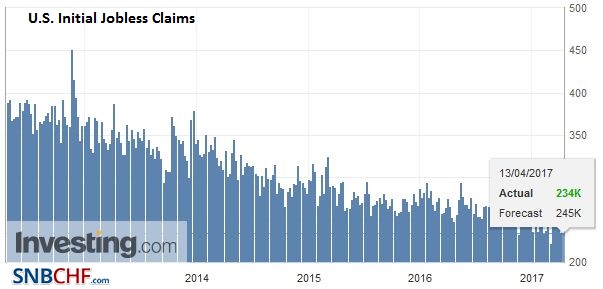

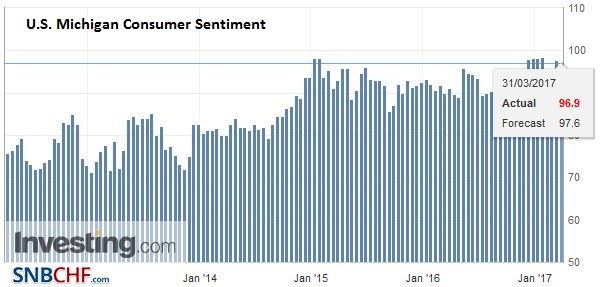

United StatesUS economic data include PPI, initial jobless claims and the University of Michigan consumer sentiment. These are not typically market movers. Tomorrow the US report retail sales and CPI. |

U.S. Producer Price Index (PPI) YoY, March 2017(see more posts on U.S. Producer Price Index, ) Source: Investing.com - Click to enlarge |

U.S. Initial Jobless Claims, March 2017(see more posts on U.S. Initial Jobless Claims, ) Source: Investing.com - Click to enlarge |

|

U.S. Michigan Consumer Sentiment, March 2017(see more posts on U.S. Michigan Consumer Sentiment, ) Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$AUD,$EUR,$JPY,China,China Exports,China Imports,China Trade Balance,EUR/GBP,Featured,Germany Consumer Price Index,Italy Consumer Price Index,Korea,newslettersent,U.S. Initial Jobless Claims,U.S. Michigan Consumer Sentiment,U.S. Producer Price Index,yuan