The most important thing to appreciate is that the market has moved to price not one but two cuts next year. The first is priced into the September Fed funds futures and the second is in the Dec Fed funds futures. This I in response to weaker than expected data that have elevated recession fears. The Atlanta Fed GDPNow puts Q2 growth at -2.1%. Banks have revised down their forecasts, but none of the 59 economists in the Bloomberg survey have forecast a negative...

Read More »FX Daily, December 8: Consolidative Moment as Markets Wait for Fresh Developments

Swiss Franc The Euro has fallen by 0.08% to 1.0771 EUR/CHF and USD/CHF, December 8(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Three brinkmanship dramas continue to play out. The UK-EU trade talks have reportedly made little progress and may have even moved backward, according to some reports, over the past two days. The EU and Poland, and Hungary will be butting heads at the leaders’ summit that begins...

Read More »FX Daily, December 7: Holy Mackerel Will UK-EU Talks Really Flounder?

Swiss Franc The Euro has fallen by 0.21% to 1.0794 EUR/CHF and USD/CHF, December 7(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Optimists see the belabored talk between the UK and EU as providing for a dramatic climax of a deal, while the pessimists warn that the divergence is real. Sterling opened three-quarters of a cent lower in early turnover and is now off around two cents. This, coupled with new US...

Read More »FX Daily, December 4: The Employment Report may not Give Greenback much of a Reprieve

Swiss Franc The Euro has fallen by 0.06% to 1.081 EUR/CHF and USD/CHF, December 4(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: After wobbling late yesterday on what appears to be old news from Pfizer about a disruption of the vaccine’s supply chain, equity markets have recovered, and risk appetites remain intact. With more than 1% gains in South Korea’s Kospi and Taiwan’s Taiex, the MSCI Asia Pacific...

Read More »FX Daily, May 21: Equities Find Some Traction while the Dollar Firms

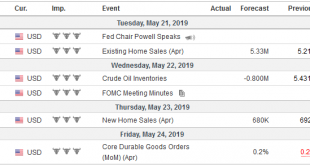

Swiss Franc The Euro has risen by 0.12% at 1.1275 EUR/CHF and USD/CHF, May 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Equities are paring some of their recent losses. The MSCI Asia Pacific Index is posting its first back-to-back gain in a month, led by a more than 1% rally in China. Heightened prospects for an Australian rate cut in a few weeks helped...

Read More »FX Weekly Preview: The Week Ahead featuring the Battle for 7.0

The strategic objective is to integrate China into the world economy. The liberal international solution was trade, investment flows, and cultural exchanges. The rise of nationalism and China’s own willingness to flaunt the international rules are defeating the strategy. President Trump may suggest that China would prefer to negotiate with his main Democrat rival 18-months away from the election, by both Pelosi and...

Read More »April Monthly Currency Outlook

Poor economic data and soft inflation saw several central banks, including the Federal Reserve and European Central Bank, take a dovish turn in March. Contrary to expectations that interest rates would rise as the G3 central banks were no longer adding to their balance sheets on a combined basis. The sharp drop in interest rates and the flattening of curves in March is one of the key factors shaping the investment...

Read More »FX Daily, March 29: Equities Bounce While Bonds Pullback to End Q1

Swiss Franc The Euro has keep position 0.00% at 1.1194 EUR/CHF and USD/CHF, March 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The global growth scare may be subsiding. It had been fanned by the ECB and Fed statements and projections. Poor US jobs growth reported in early March and the poor flash EMU PMI late in the month contributed. The slowdown in China...

Read More »FX Daily, March 28: Brexit Uncertainty Deepens as Parliament is Divided, while Turkey’s Short Squeeze Falters

Swiss Franc The Euro has risen by 0.07% at 1.1192 EUR/CHF and USD/CHF, March 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The lurch lower in global interest rates continue. The US 10-year yield is at new 15-month lows, five basis points through the average effective Fed funds rate. Late yesterday, it appeared that 10-year German Bund yields slipped below...

Read More »FX Daily, March 27: Global Bond Rally Continues, Greenback Remains Firm

Swiss Franc The Euro has fallen by 0.05% at 1.1194 EUR/CHF and USD/CHF, March 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The US 10-year yield is trading below the Fed funds target. The two-year yield is trading below the lower end of the Fed funds target range. A warning by New Zealand that the next rate move could be a cut sent New Zealand and Australian...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org