Commodity prices continued to fall last month. According to the World Bank’s Pink Sheet catalog, non-energy commodity prices accelerated to the downside. Falling 9.4% on average in May 2019 when compared to average prices in May 2018, it was the largest decline since the depths of Euro$ #3 in February 2016. Base metal prices (excluding iron) also continue to register sharp reductions. Down 16% on average last month,...

Read More »China’s Export Story Is Everyone’s Economic Base Case

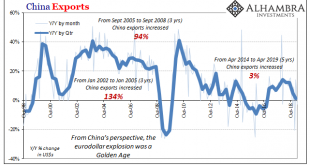

The first time the global economy was all set to boom, officials were at least more cautious. Chastened by years of setbacks and false dawns, in early 2014 they were encouraged nonetheless. The US was on the precipice of a boom (the first time), it was said, and though Europe was struggling it was positive with a more aggressive ECB emerging. Even Japan was looking forward to a substantial QQE-based pickup – after the...

Read More »Coloring One Green Shoot

China’s Passenger Car Association reported last week that retail sales of various vehicles totaled 1.78 million units in March 2019. The total was 12% less than the number of automobiles sold in March 2018. This matches the government’s data, both sets very clear as to when Chinese economic struggles accelerated: May 2018. For decades, there was just one way for China’s car market: up. Once the trend abruptly reversed...

Read More »Spreading Sour Not Soar

We are starting to get a better sense of what happened to turn everything so drastically in December. Not that we hadn’t suspected while it was all taking place, but more and more in January the economic data for the last couple months of 2018 backs up the market action. These were no speculators looking to break Jay Powell, probing for weakness in Mario Draghi’s resolve. There are real economic processes underneath....

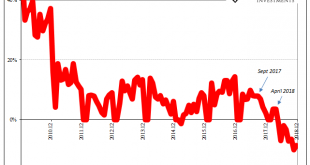

Read More »What Chinese Trade Shows Us About SHIBOR

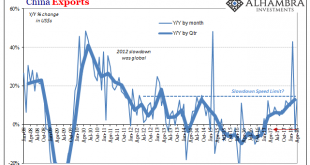

Why is SHIBOR falling from an economic perspective? Simple again. China’s growth both on its own and as a reflection of actual global growth has stalled. And in a dynamic, non-linear world stalled equals trouble. Going all the way back to early 2017, there’s been no acceleration (and more than a little deceleration). The reflation economy got started in 2016 but it never went anywhere. For most of last year, optimists...

Read More »Chinese Inflation And Money Contributions To EM’s

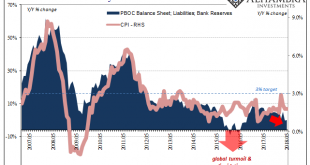

The People’s Bank of China won’t update its balance sheet numbers for May until later this month. Last month, as expected, the Chinese central bank allowed bank reserves to contract for the first time in nearly two years. It is, I believe, all part of the reprioritization of monetary policy goals toward CNY. How well it works in practice remains to be seen. Authorities are not simply contracting one important form of...

Read More »What China’s Trade Conditions Say About The Right Side Of ‘L’

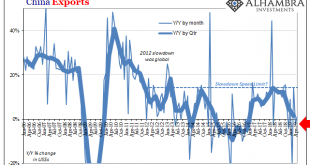

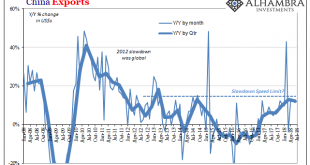

Chinese exports rose 12.9% year-over-year in April 2018. China Exports, Jan 2008 - Apr 2018(see more posts on China Exports, ) - Click to enlarge Imports were up 20.9%. As always, both numbers sound impressive but they are far short of rates consistent with a growing global economy. China’s participation in global growth, synchronized or not, is a must. The lack of acceleration on the export side tells us a lot...

Read More »FX Daily, May 08: Dollar Races Ahead

Swiss Franc The Euro has fallen by 0.56% to 1.1885 CHF. EUR/CHF and USD/CHF, May 08(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar’s surge continues. The Dollar Index is testing the space above 93.00. A month ago it was below 90. It does not appear to require fresh developments. The market continues to trade as if there are short dollar positions that are...

Read More »China’s Exports Are Interesting, But It’s Their Imports Where Reflation Lives or Dies

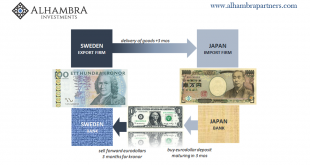

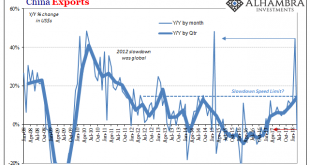

Last month Chinese trade statistics left us with several key questions. Export growth was a clear outlier, with outbound trade rising nearly 45% year-over-year in February 2018. There were the usual Golden Week distortions to consider, made more disruptive by the timing of it this year as different from last year. And then we have to consider possible effects of tariffs and restrictions at the start of what is called a...

Read More »FX Daily, April 13: Markets Struggle to Find Footing while News Stream Improves

Swiss Franc The Euro has fallen by 0.03% to 1.1858 CHF. EUR/CHf and USD/CHF, April 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates It had looked to many investors that world was headed for a trade war and an escalating risk war in Syria. But now it seems less clear. US President Trump’s rhetoric on trade took a more constructive tone, and a divided Administration...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org