Swiss Franc The Euro has risen by 0.34% to 1.1779 CHF. EUR/CHF and USD/CHF, March 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Today may be the last day of full liquidity until next Tuesday, after the Easter holidays. We identify three developments that are characterizing the end of the month, quarter, and for some countries and companies, the fiscal year. Equity...

Read More »FX Daily, March 27: Global Equities Follow US Lead, Dollar Steadies

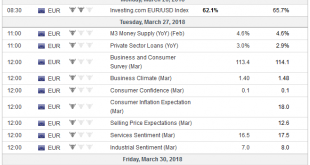

Swiss Franc The Euro has fallen by 0.07% to 1.1755 CHF. EUR/CHF and USD/CHF, March 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates We argued that the talk of trade war was exaggerated. The confrontation, strong demands and a climb down is the Art of the Deal, and is part of the way the Trump Administration negotiates. We see striking parallels between the policymakers...

Read More »Weekly Technical Analysis: 26/03/2018 – USD/JPY, EUR/USD, GBP/USD, AUD/JPY, GBP/JPY, USD/CHF

USD/CHF The USDCHF pair provided negative trades after 0.9488 proved its strength against the recent positive attempts, to keep the bearish trend scenario valid efficiently in the upcoming period, supported by the EMA50 that pushes negatively on the price, waiting to test 0.9373 initially. Breaking the mentioned level will extend the bearish wave to reach 0.9300 as a next station, while holding below 0.9488...

Read More »FX Daily, March 26: Equity Meltdown Aborted, Dollar Eases

Swiss Franc The Euro has risen by 0.43% to 1.1747 CHF. EUR/CHF and USD/CHF, March 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates After a poor start in Asia, equities recovered. The MSCI Asia Pacific initially extended last week’s losses and fell to its lowest level since February 12 before recovering to finish near its highs, 0.4% above last week’s close. European...

Read More »FX Weekly Preview: The Investment Climate

Eurozone The investment meme of a synchronized global upturn has been undermined by the recent string of US and European economic data. The flash March eurozone composite reading fell to 55.3, the lowest reading since January 2017. Although Q4 17 US GDP may be revised higher (toward 2.8% from 2.5%) mostly due to greater inventory accumulation, the curse of weak Q1 GDP appears to be showing its hand again, with...

Read More »Cool Video: Let’s Not Declare Trade War Yet

- Click to enlarge Trade tensions have risen. No doubt about it, but to consider this a trade war is premature. We should not pretend that this is the first time that the US adopted protectionist measures that ensnarled are military allies. We have been to this dance before. Countries will respond with some symbolic retaliation on a small number of goods that make a little more than a rounding error in bilateral...

Read More »FX Daily, March 22: Dollar Trades Off

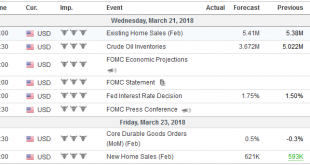

Swiss Franc The Euro has fallen by 0.37% to 1.167 CHF. EUR/CHF and USD/CHF, March 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar has not recovered from the judgment that yesterday’s that Fed was not as hawkish as many had anticipated. There was no indication that officials thought they were behind the curve or prepared to accelerate the pace of hikes....

Read More »Weekly Technical Analysis: 19/03/2018 – USD/JPY, EUR/USD, GBP/USD, NZD/USD, USD/CHF

USD/CHF The USDCHF pair leaned well on 0.9488 level to resume its positive trading, on its way towards our first waited target at 0.9581, as the price moves inside bullish channel that appears on the above chart, supported by the EMA50 that protects trading inside this channel, noting that breaching the targeted level will extend the pair’s gains to reach 0.9675. Therefore, the bullish trend will remain suggested for...

Read More »FX Weekly Preview: The Fed and More

The most significant event in the coming week is the first FOMC meeting under the Chair Powell. At ECB President Draghi’s first meeting he cut interest rates. He cuts rates at his second meeting as well, underwinding the two hikes the ECB approved under Trichet. At BOJ Governor Kuroda’s first meeting, an aggressive monetary policy was announced that was notable not only in its size, but also in the range of assets to be...

Read More »Great Graphic: Potential Topping Pattern for Euro

The euro appears to be potentially carving out a topping pattern. Recall that after correcting lower last September and October, the euro rallied for three months through January before weakening 1.75% in February. That was its biggest decline since February 2017. The euro’s high print was actually on February 16 near $1.2555, when it posted a key reversal, which is when it makes a new high for the move and then closes...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org