The euro has traded between roughly $1.0485 and $1.1100 so far this year. The average is about $1.08, where it traded above yesterday for the first time in 2 ½ weeks. Recall that the euro rallied from around $1.05 in mid-March (amid speculation that the banking stress was going to force the Fed to cut) to around $1.1100, where it stalled in late April and early May. We argued that the rate cut expectations had swung too far and that as they converged back with...

Read More »FX Daily, July 06: Greenback Shows Some Resilency after Follow-Through Selling Dried up

Swiss Franc The Euro has fallen by 0.13% to 1.0921 EUR/CHF and USD/CHF, July 06(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Follow-through dollar selling stalled as key levels were approached, including $1.19 in the euro, $1.3900 in sterling, $0.7600 in the Australian dollar, and CAD1.2300. Sentiment is mixed after the greenback sold-off before last weekend despite the fastest jobs growth in 10-months....

Read More »FX Daily, December 8: Consolidative Moment as Markets Wait for Fresh Developments

Swiss Franc The Euro has fallen by 0.08% to 1.0771 EUR/CHF and USD/CHF, December 8(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Three brinkmanship dramas continue to play out. The UK-EU trade talks have reportedly made little progress and may have even moved backward, according to some reports, over the past two days. The EU and Poland, and Hungary will be butting heads at the leaders’ summit that begins...

Read More »FX Daily, December 7: Holy Mackerel Will UK-EU Talks Really Flounder?

Swiss Franc The Euro has fallen by 0.21% to 1.0794 EUR/CHF and USD/CHF, December 7(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Optimists see the belabored talk between the UK and EU as providing for a dramatic climax of a deal, while the pessimists warn that the divergence is real. Sterling opened three-quarters of a cent lower in early turnover and is now off around two cents. This, coupled with new US...

Read More »FX Daily, December 4: The Employment Report may not Give Greenback much of a Reprieve

Swiss Franc The Euro has fallen by 0.06% to 1.081 EUR/CHF and USD/CHF, December 4(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: After wobbling late yesterday on what appears to be old news from Pfizer about a disruption of the vaccine’s supply chain, equity markets have recovered, and risk appetites remain intact. With more than 1% gains in South Korea’s Kospi and Taiwan’s Taiex, the MSCI Asia Pacific...

Read More »Cool Video: Dollar, Trade, and China on TDA Network

I began my career as a reporter on the floor of the Chicago Mercantile Exchange, covering the currency futures and short-term interest rate futures for a news wire. Among other things, I learned that often, the locals, people trading with their own money and wits, would take the opposite side of trades of the institutional players. The institutional operators had deeper pockets but were looking to lay-off risk. It was a David vs. Goliath story often. It is,...

Read More »Cool Video: TD Ameritrade-Stocks, the Dollar and the Trap Laid by the German Court

Here is a nine-minute clip of a chat I had with Ben Lichtenstein at TD Ameritrade. Ben captures futures traders’ energy and breadth of vision. Often in institutional settings, one develops a specialization, but in my experience, futures traders are more likely to look across the markets and asset classes. It is one of the lasting lessons learned early in my career on the floor of the CME. We focus on the S&P 500 and yesterday’s German court decision, which I...

Read More »Cool Video: CNBC Asia

As the markets were re-opening in Asia earlier today, I joined Martin Soong and Sir Jegarajah on CNBC Asia. I had returned from a business trip and visited our summer house on the Jersey shore for what I thought was going to be a weekend more than a month ago. Oil prices had initially reacted positively to the OPEC+ agreement. Still, I was skeptical as the cuts seemed inadequate to meet the dramatic compression in demand, let along the notorious non-compliance by...

Read More »FX Weekly Preview: The Week Ahead is not about the Week Ahead

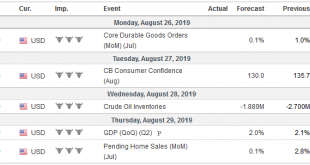

It’s the last week of August. Several economic reports will be released in the coming days. They include the US deflator of consumer expenditures that the Federal Reserve targets, China’s PMI, and the eurozone’s preliminary August CPI. It is not that the data do not matter, but investors realize the die is cast. They are looking further afield. The next US tax increase on Chinese imports goes into effect on September 1, and Beijing has threatened to retaliate. The...

Read More »FX Daily, August 22: Tick Up in EMU PMI Does Little, Waiting for Powell

Swiss Franc The Euro has risen by 0.17% to 1.0905 EUR/CHF and USD/CHF, August 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Soft data in Asia and the continued decline in the yuan (six days and counting) prevented Asian equities from following the US lead from yesterday when the S&P 500 advanced by 0.8%. European shares are paring yesterday’s 1.2% advance despite an unexpected gain in the EMU flash PMI....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org