Swiss Franc EUR/CHF - Euro Swiss Franc, April 05(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF The Swiss Franc may come under pressure tomorrow after Consumer Price Index inflation numbers are released. Inflation is expected to fall from 0.6% to 0.5% for the month of March and any weakening in the numbers could see the Swiss Franc weaken. Fridays unemployment data from Switzerland could also give a good indication as to the performance of the Swiss economy. Unemployment in Switzerland is currently sitting at a very respectable 3.3%. Any improvement is likely to see additional strength for the Swiss Franc. GBP CHF is struggling once again after an improvement in the exchange rates which took levels to almost 1.26 for this pair at the end of March as Article 50 approached. Now that Article 50 has been invoked GBP CHF is under pressure yet again due to the remaining uncertainties surrounding Brexit and how the negotiations will take place at this early stage. It is well known that the EU wish to resolve the issue of a final settlement for Britain to pay for future commitments before any future trade deal between Britain and the EU can be discussed.

Topics:

Marc Chandler considers the following as important: $CNY, AUD, CAD, China, EUR, Eurozone Markit Composite PMI, Eurozone Services PMI, Featured, FX Trends, GBP, JPY, newslettersent, U.K. Services PMI, U.S. ISM Non-Manufacturing PMI, U.S. Markit Composite PMI, U.S. Services PMI, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss Franc |

EUR/CHF - Euro Swiss Franc, April 05(see more posts on EUR/CHF, ) |

GBP/CHFThe Swiss Franc may come under pressure tomorrow after Consumer Price Index inflation numbers are released. Inflation is expected to fall from 0.6% to 0.5% for the month of March and any weakening in the numbers could see the Swiss Franc weaken. Fridays unemployment data from Switzerland could also give a good indication as to the performance of the Swiss economy. Unemployment in Switzerland is currently sitting at a very respectable 3.3%. Any improvement is likely to see additional strength for the Swiss Franc. GBP CHF is struggling once again after an improvement in the exchange rates which took levels to almost 1.26 for this pair at the end of March as Article 50 approached. Now that Article 50 has been invoked GBP CHF is under pressure yet again due to the remaining uncertainties surrounding Brexit and how the negotiations will take place at this early stage. It is well known that the EU wish to resolve the issue of a final settlement for Britain to pay for future commitments before any future trade deal between Britain and the EU can be discussed. Britain however seeks to discuss both parts to Brexit in tandem and until there is agreement on this a great deal of uncertainty remains for the pound. Those clients selling Swiss Francs would be wise to get in touch as the rates of exchange available for selling are extremely attractive at present. As the dust eventually settles over Brexit there is a every chance and even a strong likelihood that the pound could rally substantially against the Swiss Franc away from these recent lows. |

GBP/CHF - British Pound Swiss Franc, April 05(see more posts on GBP/CHF, ) |

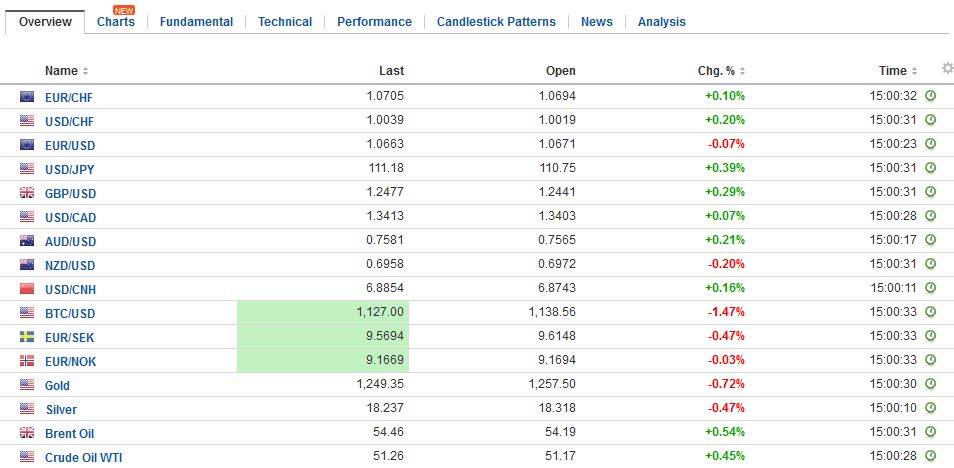

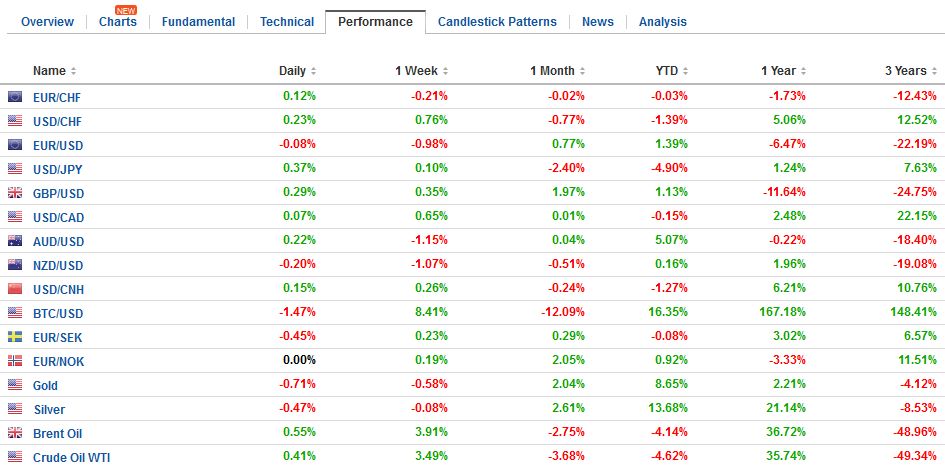

FX RatesThe dollar is practically unchanged against the euro and yen in the first two sessions of the week. The pace can be expected to pick up starting Wednesday. Although the euro slipped through $1.0650, it was not sustained, and on Monday and Tuesday, the euro finished near its highs. Barring a surprise, the euro can firm a cent over the next few sessions. The technicals look constructive. The dollar looks better technically against the yen. Buying emerges as JPY110 is approached. Initial resistance is seen near JPY111.20. The $1.2350-$1.2400 may deter a deeper pullback in sterling. |

FX Daily Rates, April 05 |

| The dollar-bloc has been heavy, but it too may have found reasonable technical support. The Aussie fell a little through $0.7550 before catching a bid. The $0.7600-$0.7620 could now draw prices. Most of the Tuesday’s sell-off in the Canadian dollar took place in Asia and Europe. In North America, the Canadian dollar recovered. A move back to CAD1.33 after turning lower from CAD1.3450 simply return it to where it was before. |

FX Performance, April 05 |

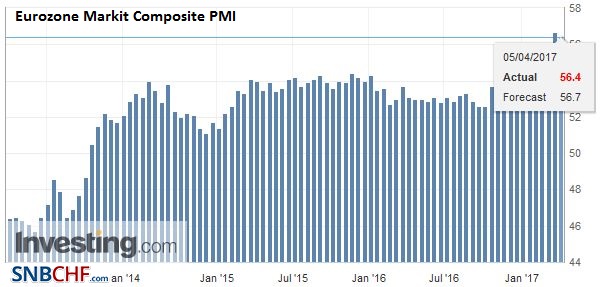

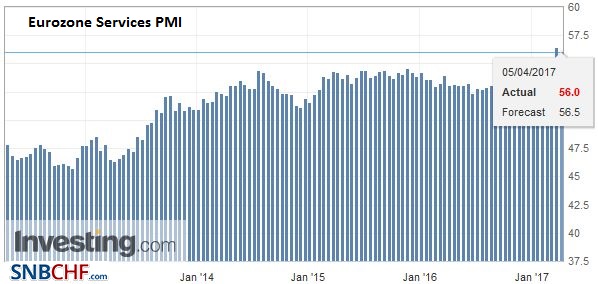

EurozoneEurope reports service and composite March PMI figures. Recall that the flash estimates were for 56.5 and 56.7 respectively, new records for both. It will put nice finishing touches on the survey data for March. There are two problems. First, the surveys are running well ahead of real sector data. Aggregate growth is not the problem; it is that price pressures, outside of energy and some weather-induced spike in some food prices, are practically non-existent. |

Eurozone Markit Composite PMI, March 2017(see more posts on Eurozone Markit Composite PMI, ) Source: Investing.com - Click to enlarge |

Eurozone Services PMI, March 2017(see more posts on Eurozone Services PMI, ) Source: Investing.com - Click to enlarge |

|

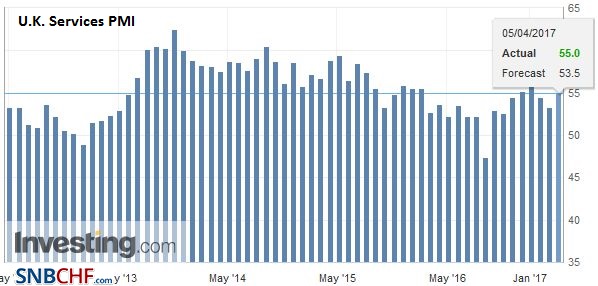

United KingdomThe UK may hit a trifecta. The manufacturing and construction PMIs were below expectations. The median forecast in the Bloomberg survey is for a small uptick. The risks are on the downside. The last few months of 2016 were particularly strong. The service PMI averaged 55.3. Even giving the median its due, the average for Q1 would be around 53.7. |

U.K. Services PMI, March 2017(see more posts on U.K. Services PMI, ) Source: Investing.com - Click to enlarge |

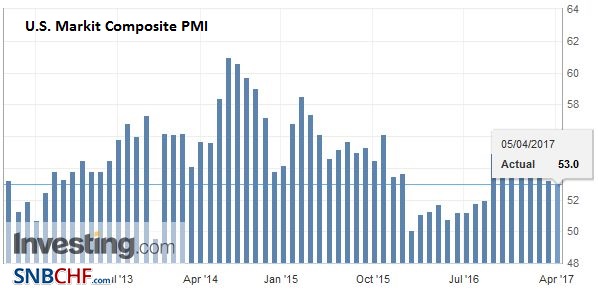

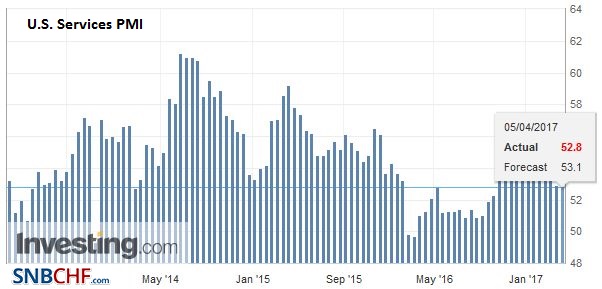

United StatesAlthough the US reports both the ISM and Markit PMI for the non-manufacturing sector, the focus will be elsewhere. Specifically, market participants will be more interested in the ADP jobs estimate and the FOMC’s minutes later in the day. The first quarter is over. The Fed hiked at the end of the quarter. What is does next will have little to do with economic conditions of the past few months. |

U.S. Markit Composite PMI, March 2017(see more posts on U.S. Markit Composite PMI, ) Source: Investing.com - Click to enlarge |

U.S. ISM Non-Manufacturing PMI, March 2017(see more posts on U.S. ISM Non-Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

|

| The first quarter tends to be a soft one for the US, and Q1 17 does not appear to be an exception, though the NY Fed’s GDP tracker says growth reached 2.9% ( as of March 31). The Atlanta Fed’s GDPNow suggests 1.2% growth is more likely, which would be in line with the average beginning in 2010. In recent days, we have learned Q4 consumption was particularly robust (3.5% annualized) and that Q1 is considerably softer. The disappointing March auto sales threaten to drag headline retail sales lower. We suspect the poor weather likely exacerbated the pullback, which is consistent with our expectation for a rebound in Q2. |

U.S. Services PMI, March 2017(see more posts on U.S. Services PMI, ) Source: Investing.com - Click to enlarge |

Japan

Japan’s service and composite PMI’s rose to 52.9 (from 51.3 and 52.2 respectively). It confirms what we (and others) have recognized, namely that Japanese growth strengthened in the first part the year, and begin Q2 on a solid note.

We have suggested that March jobs report may be subject to mean reversion. After two strong reports, the risk is for slower job growth in March. The increase in weekly jobless claims suggests that as well. Weather may also skew the headline, more for the BLS survey than the ADP estimate.

Some economists have noted that the dollar’s reaction function often looks like a smile. It rallies as a haven when there is high anxiety, and it rallies in exceptionally good times, but normal times the dollar suffers. Perhaps that is the sort of response we should look for now. A shockingly poor report will likely be quickly written off as distorted, and there is little chance of a May hike discounted. A very strong report may raise the odds of a June hike (BBG 50.1%, CME 59.1%). Under both extreme scenarios, the dollar could rally. On the other hand, a report in line with expectations may deter a dollar rally.

There will be two important aspects of the FOMC minutes that will attract attention. First the Fed will introduce confidence cones around its forecasts. This may help investors have a better appreciation for the forecasts, and surely why they are not point specific promises. Second, the FOMC likely had its first formal discussion of the balance sheet. The key issue for the market is when and how it will be addressed.

The modification of the rolling maturing issues into new issues is expected to take place very late this year or early next year. It is not clear whether the Fed will focus on the MBS or Treasury portfolio or both. There are a couple of caveats. These discussions are still early in the process and there will likely be a wide spectrum of views which later will coalesce around two or three. Also, it is important to recognize that the Federal Reserve, especially the Board of Governors will look dramatically different by the middle of next year than it does today. By the end of the month, there will be three vacancies on the seven-person Board. And next year, both the Yellen and Fischer’s terms as Chair and Vice are up, and neither is likely to remain a Governor.

The meeting between the US and Chinese Presidents is at hand. Having seen Chancellor Merkel was treated can only reinforce the cautiousness of President Xi. There is much speculation over the range of issues that could be discussed, though President Trump seemed to play down the trade issue now. The Trump Administration has begun a thorough review of the trade agreements, and it does not seem quite ready to talk specifics.

It is not clear how China sees Trump. He has backed down on two threats–to cite China as a currency manipulator (on day one) and to abandon the US recognition of only one China. China has made two minor concessions. It will not import coal from North Korea, who apparently launched some a projectile on the day before the meeting between the two presidents. Second, China recently granted Trump more than three dozen commercial trademarks.

It is not immediately obvious what the US Secretary of State meant when he said that the period of “strategic patience” with North Korea is over, or what President Trump had in mind saying that the US did not need China’s help with North Korea. Separately, but not totally unrelated, China does not like the missile defense in South Korea.

We expect some commercial deals to be agreed during Xi’s visit. We would not be surprised if the US and China agreed to trade talks, like the ones agreed to with Japan. It is one on this side of Alice’s Looking Glassthat the Chinese President may caution the US President against slipping into mercantilism and abandoning free trade principles.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$CNY,$EUR,$JPY,China,Eurozone Markit Composite PMI,Eurozone Services PMI,Featured,newslettersent,U.K. Services PMI,U.S. ISM Non-Manufacturing PMI,U.S. Markit Composite PMI,U.S. Services PMI