Someone once said that the stock market is always climbing a wall of worry. Maybe that had been true in some long-ago day, but whether or not it might nowadays is beside the point. The nugget of truth which makes the prosaism memorable is the wall rather than the climber. There’s always something going on somewhere to get worked up over. And it matters to far more than financial actors, the entire global economy must surmount what can seem like an unending series of...

Read More »Counting The Corroborated Stall, Not The Coming Lawfare Election Mess

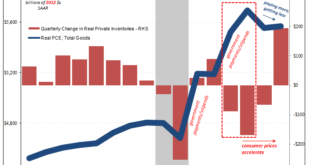

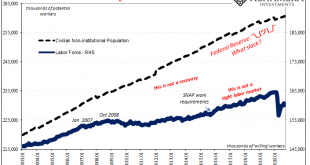

While we wait for the electoral count to be sorted out by what we hope are competent and honest people (not holding our breath), there’s a greater muddle growing where it actually counts and where it’s never fully nor properly accounted. By a large and growing number of accounts, the US economy’s rebound seems to have stalled out back around June or July, an inflection unrelated to COVID case counts, too. The rebound is still rebounding, of course, and this upturn...

Read More »More Trends That Ended 2019 The Wrong Way

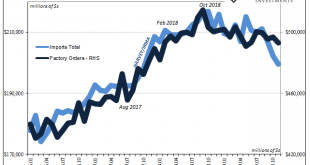

Auto sales in 2019 ended on a skid. Still, the year as a whole wasn’t nearly as bad as many had feared. Last year got off on the wrong foot in the aftermath of 2018’s landmine, with auto sales like consumer spending down pretty sharply to begin it. Spending did rebound in mid-year if only somewhat, enough, though, to add a little more to the worst-is-behind-us narrative which finished off 2019. That’s the version that is being described, Jay Powell’s underlying...

Read More »FX Daily, November 5: Animal Spirits Remain Animated

Swiss Franc The Euro has risen by 0.05% to 1.0994 EUR/CHF and USD/CHF, November 5(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The prospects that the US-China deal could include some rolling back of existing US tariffs helped underpin risk appetites. After new record highs in the US S&P 500 and NASDAQ, Asia Pacific markets marched higher, and the MSCI Asia Pacific reached its highest level since August...

Read More »FX Daily, October 3: Shades of Q4 18?

Swiss Franc The Euro has risen by 0.34% to 1.0959 EUR/CHF and USD/CHF, October 3(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Disappointing economic data again drove US equities lower, which in turn carried into Asia Pacific activity. Losses were recorded throughout the region, with the notable exception of Hong Kong. The Nikkei and Australia’s ASX were off by 2%. After its largest losing session of the year...

Read More »FX Daily, June 5: Sterling Jumps Ahead, While US Equities Have Small Coattails

Swiss Franc The Euro has fallen by 0.23% to 1.1526 CHF. EUR/CHF and USD/CHF, June 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates There are several euro options that expire today and are stacked every quarter of a cent from $1.1675 to $1.1750. The size of the options increase with the price beginning with 688 mln euros at $1.1675, then 775 euros at $1.17, 1.1 bln euros...

Read More »FX Daily, May 03: Respite to Dollar Short Squeeze

Swiss Franc The Euro has fallen by 0.03% to 1.1944 CHF. EUR/CHF and USD/CHF, May 03(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The Australian dollar is higher for a second session. It has been helped today by stronger than expected data in the form of a larger than expected March trade surplus (A$1.57 bln vs. expectations for A$865 mln) and building permits up...

Read More »FX Daily, April 04: Trade Specificities Rattle Markets

Swiss Franc The Euro has risen by 0.31% to 1.1799 CHF. EUR/CHF and USD/CHF, April 04(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Late yesterday, the US announced that specific tariffs and goods that would be targeted for intellectual property violations. China had warned of a commensurate response and earlier today made its announcement. This sent reverberations...

Read More »FX Daily, March 05: Italian Election Weighs on Italian Assets, but Little Systemic Risk Seen

Swiss Franc The Euro has fallen by 0.08% to 1.1549 CHF. EUR/CHF and USD/CHF, March 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is narrowly mixed. The Japanese yen remains firm. The dollar appears stuck in a narrow range. Near JPY105.20 the seems to be some short-covering pressure in front of JPY105. On the top side, the greenback is encountering offers...

Read More »FX Daily, February 05: Dollar Consolidates while Equity Rout may be Ebbing

Swiss Franc The Euro has risen by 0.19% to 1.1622 CHF. EUR/CHF and USD/CHF, February 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Asian equity markets were weighed down by losses in the US markets ahead of the weekend. The MSCI Asia Pacific Index was off 1.4% after the 1.0% pre-weekend loss. The Nikkei gapped lower and shed 2.5% and has fallen in eight of the past...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org