In the official narrative, the economy is robust and resilient. The fundamentals, particularly the labor market, are solid. It’s just that there has arisen an undercurrent or crosscurrent of some other stuff. Central bankers initially pointed the finger at trade wars and the negative “sentiment” it creates across the world but they’ve changed their view somewhat. A few billion in tariffs, even if we include what is to...

Read More »FX Daily, June 05: Dollar Remains on Back Foot

Swiss Franc The Euro has fallen by 0.09% at 1.115 EUR/CHF and USD/CHF, June 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The Federal Reserve’s patience never excluded a rate cut should conditions warrant. The acknowledgment of this without signaling a change its stance is being seized upon to justify aggressive pricing of rates. At the same time, there has...

Read More »If You’ve Lost The ISM…

These transition periods are often just this sort of whirlwind. One day the economy looks awful, the next impervious to any downside. Today, it has been the latter with the BLS providing the warm comfort of headline payrolls. For now, it won’t matter how hollow. Yesterday, completely different story. Apple got it started downhill and the ISM pushed it off the cliff. The tech giant’s CEO admitted the global economy is...

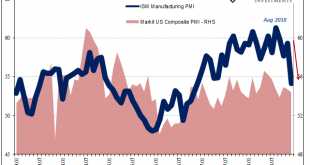

Read More »Global PMI’s Hang In There And That’s The Bad News

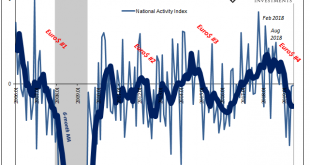

At this particular juncture eight months into 2018, the only thing that will help is abrupt and serious acceleration. On this side of May 29, it is way past time for it to get real. The global economy either synchronizes in a major, unambiguous breakout or markets retrench even more. That’s been the basis of this thing from Day 1; or, more accurately, Day 3.01. Reflation #3 wasn’t really any different in type from...

Read More »FX Daily, June 5: Sterling Jumps Ahead, While US Equities Have Small Coattails

Swiss Franc The Euro has fallen by 0.23% to 1.1526 CHF. EUR/CHF and USD/CHF, June 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates There are several euro options that expire today and are stacked every quarter of a cent from $1.1675 to $1.1750. The size of the options increase with the price beginning with 688 mln euros at $1.1675, then 775 euros at $1.17, 1.1 bln euros...

Read More »FX Daily, April 04: Trade Specificities Rattle Markets

Swiss Franc The Euro has risen by 0.31% to 1.1799 CHF. EUR/CHF and USD/CHF, April 04(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Late yesterday, the US announced that specific tariffs and goods that would be targeted for intellectual property violations. China had warned of a commensurate response and earlier today made its announcement. This sent reverberations...

Read More »FX Daily, March 05: Italian Election Weighs on Italian Assets, but Little Systemic Risk Seen

Swiss Franc The Euro has fallen by 0.08% to 1.1549 CHF. EUR/CHF and USD/CHF, March 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is narrowly mixed. The Japanese yen remains firm. The dollar appears stuck in a narrow range. Near JPY105.20 the seems to be some short-covering pressure in front of JPY105. On the top side, the greenback is encountering offers...

Read More »FX Daily, February 21: Markets Mark Time

Swiss Franc The Euro has fallen by 0.02% to 1.1544 CHF. EUR/CHF and USD/CHF, February 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The economic data stream is picking up, but there is an uneasy calm in the markets. It is almost as if the dramatic drop in stocks has left many with a sense of incompleteness, like waiting for another shoe to drop. The price action has...

Read More »FX Daily, February 05: Dollar Consolidates while Equity Rout may be Ebbing

Swiss Franc The Euro has risen by 0.19% to 1.1622 CHF. EUR/CHF and USD/CHF, February 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Asian equity markets were weighed down by losses in the US markets ahead of the weekend. The MSCI Asia Pacific Index was off 1.4% after the 1.0% pre-weekend loss. The Nikkei gapped lower and shed 2.5% and has fallen in eight of the past...

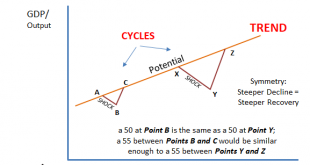

Read More »The Dismal Boom

There is a fundamental assumption behind any purchasing manager index, or PMI. These are often but not always normalized to the number 50. That’s done simply for comparison purposes and the ease of understanding in the general public. That level at least in the literature and in theory is supposed to easily and clearly define the difference between growth and contraction. But is every 50 the same? That’s ultimately at...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org