Looking back on late 2015, it is perfectly clear that policymakers had no idea what was going on. It’s always easy, of course, to reflect on such things with the benefit of hindsight, but even contemporarily it was somewhat shocking how complacent they had become as a global group. In the US, the Federal Reserve “raised rates” for the first time in a decade on the same day they released industrial production figures suggesting the grave possibility of looming recession. In Japan, it was merely more of the usual Keystone Cops routine. On October 11, 2015, BoJ Governor Haruhiko Kuroda told CNBC that he expected expanded QQE undertaken the previous year would despite all the global turmoil be more than sufficient to finally end Japan’s “deflationary mindset.” He actually said, “I think we can approach 2 percent inflation sometime next year”, meaning 2016. Because of his optimistic position, negative interest rates weren’t even being considered: We don’t think it’s necessary. The ECB certainly introduced negative interest rates but after that, they embarked on QE and we have been implementing a large-scale asset purchase program for more than two years, so I don’t think it’s necessary to make interest rates negative.

Topics:

Jeffrey P. Snider considers the following as important: Bank of Japan, bond yields, CPI, currencies, depression, economy, Featured, Federal Reserve/Monetary Policy, Government Bonds, Haruhiko Kuroda, household income, household spending, inflation, Interest rates, Janet Yellen, Japan, Japanification, JGB, Markets, Monetary Policy, newslettersent, QE, QQE, The United States

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Looking back on late 2015, it is perfectly clear that policymakers had no idea what was going on. It’s always easy, of course, to reflect on such things with the benefit of hindsight, but even contemporarily it was somewhat shocking how complacent they had become as a global group. In the US, the Federal Reserve “raised rates” for the first time in a decade on the same day they released industrial production figures suggesting the grave possibility of looming recession. In Japan, it was merely more of the usual Keystone Cops routine.

On October 11, 2015, BoJ Governor Haruhiko Kuroda told CNBC that he expected expanded QQE undertaken the previous year would despite all the global turmoil be more than sufficient to finally end Japan’s “deflationary mindset.” He actually said, “I think we can approach 2 percent inflation sometime next year”, meaning 2016. Because of his optimistic position, negative interest rates weren’t even being considered:

We don’t think it’s necessary. The ECB certainly introduced negative interest rates but after that, they embarked on QE and we have been implementing a large-scale asset purchase program for more than two years, so I don’t think it’s necessary to make interest rates negative.

Kuroda was not alone in his fantasy, however, as almost all of the mainstream saw what he saw. QQE is always “stimulus” and so for all of them it will always work if given enough time. Economists for Societe Generale ,for example, wrote that October:

Given that the government is likely to declare a successful exit from deflation by the time the upper house election is held next summer, the next QE measure will probably be the last one in the current monetary cycle.

The topic of NIRP would come up again in December 2015 as conditions instead worsened all over the world, but Kuroda insisted there would be nothing more. As late as January 21, 2016, right amidst the global liquidations, he still maintained negative rates were not necessary. Appearing before Japan’s parliament he reasoned that because the Fed had “succeeded in stimulating the US economy” without NIRP, there was no reason to expect Japan should adopt what the ECB had almost two years earlier.

Just eight days later, of course, Kuroda completely reversed himself and in a split 5-4 vote the Bank of Japan dropped nominally (and conditionally) below zero.

| Each time one of these central banks does something like this, something supposed to be new and more powerful, there is never, ever any consideration for why it is being done. What I mean by that is incredibly simple, as if whenever a central bank feels it has to do the next big thing then that only means the last big thing wasn’t so powerful and potent as it is always made out to be at the start. The day NIRP was announced in Japan, Deutsche Bank’s leading currency strategist George Saravelos immediately sent out a note to clients, picked up widely in the media, expecting it to send JPY to 125 to the dollar where it hadn’t been since, not coincidentally, early June 2015.

But none of these monetary programs ever does what they are supposed to do, and when it is finally accepted as that case they are all treated almost as if they never occurred, erased from the collective memory as if Stalinist Russia. As noted earlier this week, FRBSF President John Williams gave a speech touting recovery in the US without once mentioning QE. |

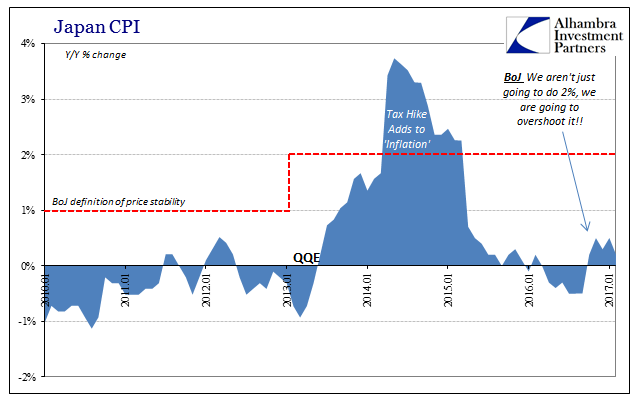

Japan CPI, Jan 2010 - 2017(see more posts on Japan National Consumer Price Index, ) |

| Even a year on, Kuroda keeps insisting 2% inflation is coming and though Japan’s CPI is on the plus side again that still doesn’t mean there is any indication that is or ever will be true. Toward the end of last year, as if nothing more than crying out into the dark of frustration, Kuroda claimed that not only was QQE going to run until 2%, they were going to keep going with it until they far overshot the mark. The closest such a statement will ever guarantee is for BoJ’s balance sheet to eventually hit ¥1 quadrillion, being in the next week or two (depending on Yield Curve Control) half way there already. |

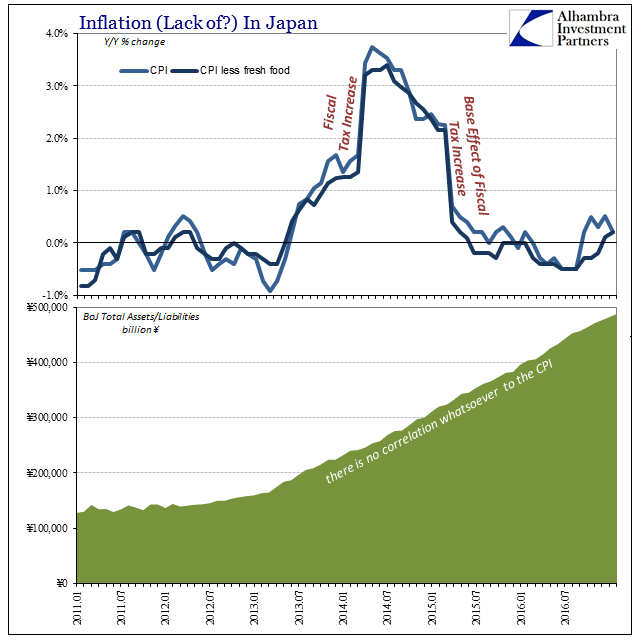

Japan CPI and Bank of Japan, Jan 2011 - 2017(see more posts on Japan National Consumer Price Index, ) |

| Having never visited Japan I cannot help but wonder how Kuroda and the BoJ are received by ordinary Japanese. We know how he is by the Japanese as well as global media, and in the circles of politics where central bankers remain in high regard no matter what, but it is the Japanese people who have borne the brunt of his and his predecessors’ unbroken string of incompetence for so long. Japan has a demographic problem, to be sure, but how much of that can be laid at the doorstep of nearing thirty years without growth, a quarter-century of what was the second largest economy consistently devoid of all opportunity? |

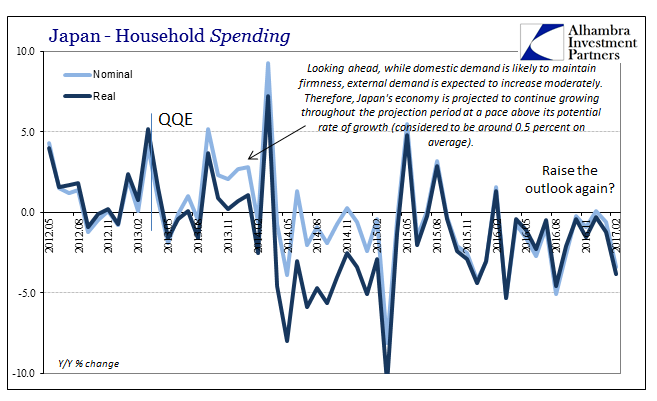

Japan Household Spending, May 2012 - Feb 2017(see more posts on Japan Household Spending, ) |

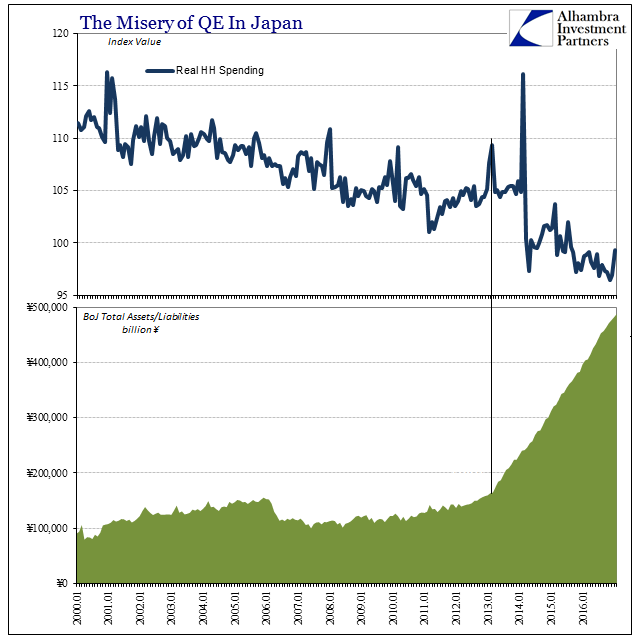

| Just recently, the Bank of Japan upgraded its economic forecasts for the fourth time in the QQE era. But rather than meaning the steadily rising economic fortunes of monetary policy success, that number only refers to how many times to this point they have been forced to give up the fantasy. Having turned optimistic once more, Japanese household spending of course plummeted (-3.8% Y/Y) in February, which, as you can plainly see above, is actually the typical result of the QQE (with or without YCC) economy. |

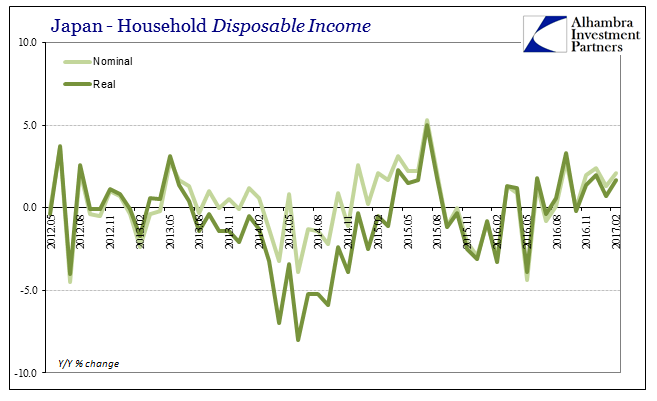

Japan Household Income, May 2012 - Mar 2017(see more posts on Japan Household Spending, ) |

| Because real household incomes are positive, if only slightly, that can only suggest the Japanese people remain wary of BoJ pronouncements whatever the direction. The last thing they can afford is for Kuroda to actually be right for once; the Japanese are stuck between the terrifying prospect of QQE actually working and revisiting them with 2014 conditions, or the usual slow but steady decline that has for many of them been all they can remember or have ever experienced (for the younger Japanese). |

Bank of Japan and Household Spending, Jan 2000 - 2017(see more posts on Bank of Japan, Japan Household Spending, ) |

| And still it only ever continues. That is the part that worries me the most, and why I pay attention to Japan as much as I do. I used to believe, as everyone else, that Japan’s lost decade was a product of hugely mistaken monetary policy in the 1980’s, leading to an enormous asset bubble and collapse; from there the plague of “zombie banks” which kept the Japanese economy trapped in lingering malformations no expert could solve.

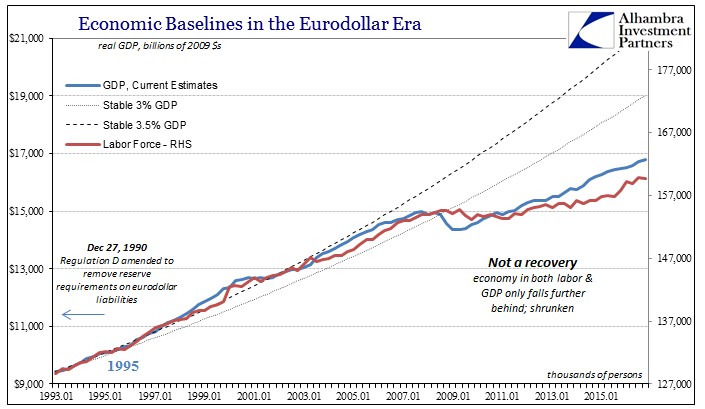

But that isn’t what did it, as Japan eventually cleaned up its banks, to no further avail. Japanification is about people, meaning that the Japanese people allowed the same idiotic ideas to perpetuate with any regard to accountability. The Bank of Japan kept doing more, replacing last year’s big idea with this year’s, to where both years and all that followed turned out the same no matter what. It’s 2017 already, and it is still going on. I’d like to believe that Americans are different and would never simply live in such defeat, but there is the last decade to reconcile for that hope. Despite the (realistic) hope for a different regime under the election of Donald Trump, the most anyone has yet done is to recommend in Congress an audit of the Fed, a proposed squirt gun with which to combat the raging inferno that has been in conflagration for far longer than 2007. Nobody will even ask Janet Yellen why she or her comrades no longer talk much about QE; or even Haruhiko Kuroda why he did such a public U-turn on NIRP. Continued impoverishment is a communal choice, not a destiny. But whether we realize it or not, we have so far chosen Japan, including the visible contours of our own demographics that accompany the choice. |

GDP Baseline Labor Force, January 1993 - 2016(see more posts on Japan Gross Domestic Product, ) |

Tags: Bank of Japan,bond yields,CPI,currencies,depression,economy,Featured,Federal Reserve/Monetary Policy,Government Bonds,Haruhiko Kuroda,household income,household spending,inflation,Interest rates,Janet Yellen,Japan,japanification,JGB,Markets,Monetary Policy,newslettersent,QE,QQE