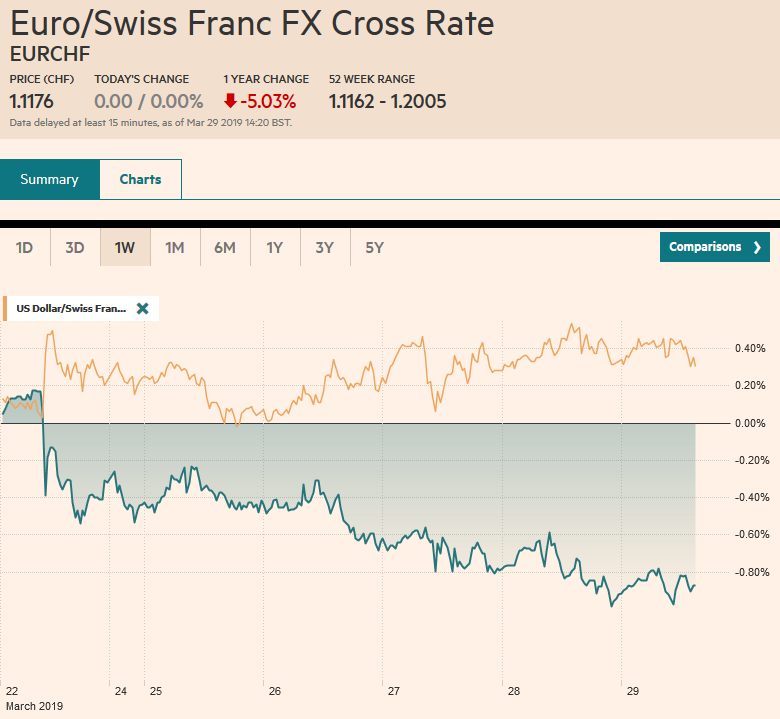

Swiss Franc The Euro has keep position 0.00% at 1.1194 EUR/CHF and USD/CHF, March 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The global growth scare may be subsiding. It had been fanned by the ECB and Fed statements and projections. Poor US jobs growth reported in early March and the poor flash EMU PMI late in the month contributed. The slowdown in China and the flurry of measures to combat it also had a role. The economic soft patch, late in the business cycle, spooked investors and policymakers but better data has already begun, and more is likely in the coming days. These include Chinese over the weekend and US jobs report next week. Global equities

Topics:

Marc Chandler considers the following as important: 4) FX Trends, AUD, CAD, EUR, Featured, GBP, JPY, newsletter, USD

This could be interesting, too:

Eamonn Sheridan writes CHF traders note – Two Swiss National Bank speakers due Thursday, November 21

Charles Hugh Smith writes How Do We Fix the Collapse of Quality?

Marc Chandler writes Sterling and Gilts Pressed Lower by Firmer CPI

Michael Lebowitz writes Trump Tariffs Are Inflationary Claim The Experts

Swiss FrancThe Euro has keep position 0.00% at 1.1194 |

EUR/CHF and USD/CHF, March 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The global growth scare may be subsiding. It had been fanned by the ECB and Fed statements and projections. Poor US jobs growth reported in early March and the poor flash EMU PMI late in the month contributed. The slowdown in China and the flurry of measures to combat it also had a role. The economic soft patch, late in the business cycle, spooked investors and policymakers but better data has already begun, and more is likely in the coming days. These include Chinese over the weekend and US jobs report next week. Global equities are rallying after the S&P 500 found a base near 2800, led by a 3%+ rally in China. With the EU’s deadline at hand and the DUP continuing to reject the Irish backstop, the choice seems to be between leaving with no deal and a long delay, sterling is heavy near $1.30. The Turkish lira remains under pressure. It seems less to do with the weekend’s local election and more in the unintended consequences of the government’s response. It is not just the price, but access as many fear more capital controls. |

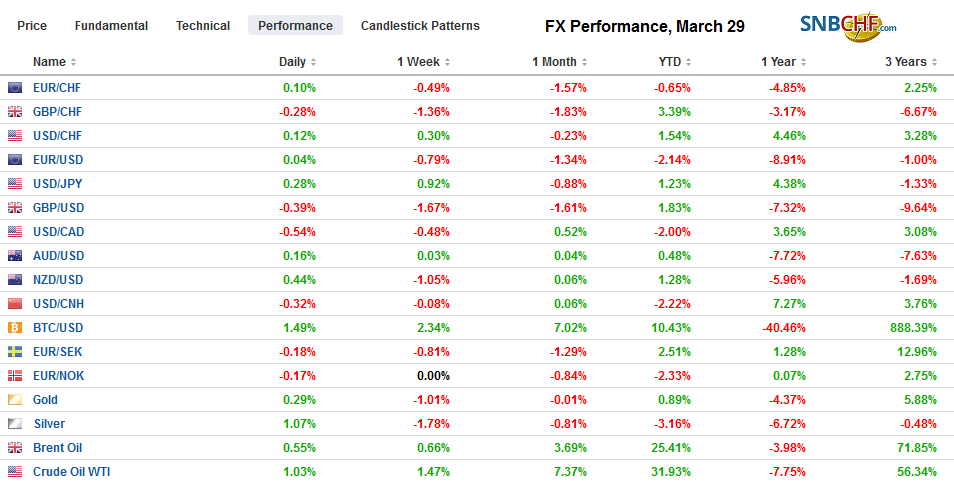

FX Performance, March 29 |

Asia Pacific

The Japanese economy contracted in Q318 and recovered, though not fully in Q4 18. The economy began the New Year very poorly and is also recovering as the quarter progressed. Earlier today Japan reported an unexpected drop in unemployment to 2.3% from 2.5%. This matches the cyclical low from last year. February industrial production bounced back 1.4% after falling 3.4% in January. Retail sales rose 0.2% in February after a 1.8% decline in January (initially was a 2.3% fall). Early Monday, the Bank of Japan will report the results of the Tankan survey. A soft report is expected, especially for large manufacturers. Capital expenditure plans likely were scaled back.

The combination of trade tensions, the slowing of China, and it looks like some industry-specific developments in semiconductors and autos, has been a blow to the region and the recovery is slow. South Korea reported a 2.6% plunge in February industrial output. The median in the Bloomberg survey was for a 0.7% decline. Adding insult to injury, January’s 0.5% gain was cut to 0.2%. Early Monday, March trade figures will be reported. Although trade improved as the month progressed, rather than gain, the pace of decline (year-over-year) moderated.

The latest round US-China trade talks concluded, and, of course, progress was reported. Exactly what that means and the latest variation on the theme is that officials are going over the documents line-by-line. Media has to say something about the trade negotiations with between the two largest economies. If there is something new here, it may be that the US appears to be using the current tariffs as a bargaining chip. Previously, President Trump suggested they would stay after an agreement is struck until he was convinced it was being implemented. The new suggestion is some could be lifted, unlike with Canada and Mexico who are still subject to US steel and aluminum tariffs on national security grounds. And yes, the enforcement mechanism is a challenge because the US rejects an independent panel or review and insists on being the judge and the jury.

As flows related to the end of fiscal year abated and equities and bonds found more stable footing, the dollar has recovered against the yen. It had been flirting with the JPY110 area, beginning with week below there, and has bounced to reach new highs for the week earlier today just shy of JPY111.00. Nearby support is seen near JPY110.50, where an option of about $520 mln expires today, and a $1.2 bln expire on April 2. Large options at JPY110 expire today and next Tuesday. We think the yen is poised to underperform in the coming month. The Australian dollar is confined to a narrow range below $0.7100. The Reserve Bank of Australia meets and makes its announcement April 2 (local). After the Reserve Bank of New Zealand’s dovish turn earlier this week, the risk is the RBA follows suit.

Europe

Prime Minister May has divided her bill into its two constituent parts: the amputation agreement and the non-binding but important political declaration. Some Labour votes against the Withdrawal Bill were thought to be due to the second part. However, Irish backstop is in the agreement itself, and the DUP is steadfastly opposed. The Tory Party does not support the alternatives, and this is why many still fear the UK crashes out. Consider, the two measures that got the most support in the House of Commons, a customs union and a second referendum. They got 33 and 8 Tory votes respectively. As Bloomberg notes, the only option that saw a majority of Tories support were those variations on leaving without an agreement. The EC gave the UK until the end of the day to approve the agreement and leave in two months, or face a choice by April 12 to seek an extension or leave without and an agreement. Our base case is that when confronted with the brink of leaving without an agreement, and that brink does not really come until April 11, a longer extension will be sought. It is true that the outcome of leaving without an agreement might not be the unmitigated disaster many have depicted, but it is a risk that is not acceptable.

German provided a rare pleasant economic surprise to close the quarter. March unemployment fell to 4.9%, the lowest level since reunification. The bigger surprise was the 0.9% rise in February retail sales. The median Bloomberg forecast was for a 1.0% decline. German retail sales rose 4.7% year-over-year. January’s 3.3% gain was shaved to 2.8%. The flash PMI was miserable, but other data, including car registrations and the IFO survey, suggest a domestic economy that is on the mend.

The euro is little changed, in narrow ranges. Month-end and quarter-end and option-expirations may factors. There is a 1.7 bln euro option at $1.12 that will be cut today. There are almost nearly 950 mln euros at $1.1250 that expire. On the week, the euro is off about 0.7%. We expect next week’s data to show the US economy has some traction (retail sales and the employment report) and expect that see help push the euro into a lower trading range. Sterling is heavy. A break of $1.30 could quickly see the $1.2945 low from earlier this month. There is a GBP225 bln option at $1.30 that expires today.

America

Fed Presidents Williams and Bullard both played down the idea that there was an urgent need to cut rates, which many think is what the price action in the market is saying. Given the wide gap between the Fed’s neutrality and market pricing, we should expect a campaign by Fed officials to try to rein in market expectations, and as suggested, we think the economic data, will do some of the heavy lifting. The US reports February income and January consumption data. Consumption likely rebounded from the 0.5% decline in December. The deflator is important. There sometimes is confusion in the market, but the Fed targets headline PCE deflator, saying that a 2% pace is most consistent with its price stability mandate. The headline deflator is expected to slow to 1.4% from 1.7%, though the core rate is expected to be sticky at 1.9%. If the bond market cannot extend its rally on such news, it may be a warning that this advance is over.

Canada reports January monthly GDP figures. A small gain is expected, though we suspect the risk is on the downside. Year-over-year growth in December of 1.1% was the weakest since August 2016. We expect Bank of Canada comments to recognize the soft patch may require more monetary accommodation in the coming weeks before softening its statement further at the next meeting late April. The US dollar is firm, holding above CAD1.3420 so far today. We have been targeting the CAD1.3470 area seen earlier this month. While the US dollar is practically flat against the Canadian dollar on the week, it is up 2% for the month.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,Featured,newsletter