In spite of disappointment on the fiscal policy front and even though we expect a slowdown in growth next year, the US economy remains in fine fettle.Chaotic developments in the White House and ongoing gridlock in Congress have significantly reduced our expectations that the Trump Administration will bring a major fiscal boost to the US economy, particularly in 2018. In other words, we no longer expect a growth- and sentiment-boosting fiscal reform, nor a large-scale infrastructure spending plan. This is the main reason for the recent reduction in our 2018 US growth forecast to 1.7%, from 2.3% previously. This under-delivery could come at a time of a possible mild cyclical slowdown, led by the automobile market and apartment-building construction. But a recession is still unlikely,

Topics:

Thomas Costerg considers the following as important: Macroview, US economic forecast, US Fed rate forecast, us financial conditions, US fiscal easing

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

In spite of disappointment on the fiscal policy front and even though we expect a slowdown in growth next year, the US economy remains in fine fettle.

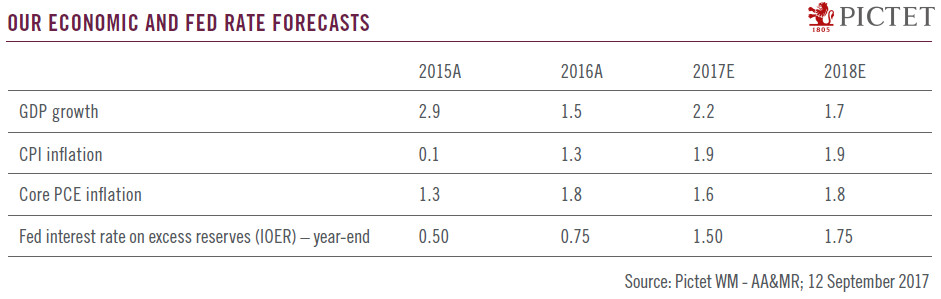

Chaotic developments in the White House and ongoing gridlock in Congress have significantly reduced our expectations that the Trump Administration will bring a major fiscal boost to the US economy, particularly in 2018. In other words, we no longer expect a growth- and sentiment-boosting fiscal reform, nor a large-scale infrastructure spending plan. This is the main reason for the recent reduction in our 2018 US growth forecast to 1.7%, from 2.3% previously. This under-delivery could come at a time of a possible mild cyclical slowdown, led by the automobile market and apartment-building construction. But a recession is still unlikely, barring a significant tightening in financial conditions.

Our prudence about 2018 contrasts with our relative enthusiasm about near-term growth prospects. Underlying momentum is robust, led by very favourable market conditions, a sharp rebound in US oil production, and good export prospects on the back of stronger global growth. We see the US macro backdrop taking the political noise in its stride in the short term. The next important political deadline is December 8, when the federal government’s spending authority expires.

We think anxiety about too loose financial conditions are front-and-centre at the Fed. With full employment having been de facto reached, we see the Fed continuing to normalise policy in the coming months, ignoring recent low inflation prints. We expect the Fed to announce on 20 September that it will start to gradually shrink its balance sheet, and to raise rates again at its December meeting. However, we expect only one rate hike in 2018 (in March) as there could be a mini Fed regime shift by mid- 2018: the Fed could pause its tightening, if growth and inflation do not both pick up above 2%. In the medium term, the Fed could find it hard to justify raising rates much above its nominal neutral rate estimate of around 2%.

We remain comfortable with our positioning. With US economic growth holding up and the Fed still poised to tighten monetary policy, we expect the USD to rebound in the coming months. However, the prospect of softer US growth in the latter part of 2018 and only one Fed rate hike next year mean that we now see the dollar weakening in 2018. We are still constructive on US stocks for next year, partly because currency trends will help provide a buffer against softer US economic growth. Meanwhile, bond yields should gradually rise, which will provide an opportunity to increase duration.