In spite of disappointment on the fiscal policy front and even though we expect a slowdown in growth next year, the US economy remains in fine fettle.Chaotic developments in the White House and ongoing gridlock in Congress have significantly reduced our expectations that the Trump Administration will bring a major fiscal boost to the US economy, particularly in 2018. In other words, we no longer expect a growth- and sentiment-boosting fiscal reform, nor a large-scale infrastructure spending...

Read More »US economy: Too-loose financial conditions versus too-low inflation

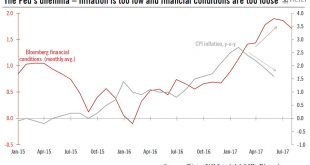

In spite of dilemma, we still think the Fed will announce plans to shrink balance sheet in September and will hike rates again in December.Several Federal Reserve (Fed) officials, and a few foreign central bankers, will meet for their traditional August gathering in Jackson Hole, Wyoming, on 24–26 August. Fed Chair Janet Yellen will give the opening speech on Friday (08:00 local time, 16:00 Geneva), but with neither a Q&A session, nor a scheduled media briefing. Unlike her predecessor,...

Read More »Markets react well to Fed hike

Financial conditions remain accommodative, perhaps setting the stage for next hike in June.In line with what almost every forecaster was expecting, the Federal Open Market Committee (FOMC) decided at its latest policy meeting to raise the Fed funds rate target range by 25bp to 0.75%-1.0%. Fed Chair Janet Yellen explained that the decision to raise rates was appropriate “in light of the economy’s solid progress toward our goals of maximum employment and price stability“. Financial markets...

Read More »Early rate hike means change in our U.S. rates scenario

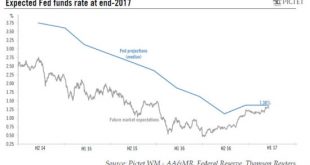

Hawkish comments from several Fed officials mean we now expect three quarter-point rate hikes from the Fed this year, with the first coming this month.As we don’t expect any big negative surprise in the February employment report (to be released on Friday), the probability of a hike next week has risen sharply. We are therefore changing our forecasts for Fed rates this year. Our main scenario is now that the Fed will first hike in March, instead of June. Moreover, to be more consistent with...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org