As the ECB comes closer to a decision on the future of its quantitative easing programme, we look at the choices and dilemmas it faces.With the economic recovery in the euro area looking increasingly robust and broadbased, the ECB appears set to embark on a policy normalisation path, gradually phasing out of negative interest rate policy (NIRP) and quantitative easing. The ECB’s new narrative implies that the era of crisis-fighting unconventional monetary measures is over, as deflation risks have all but disappeared.Another consideration for the ECB is that it is getting closer to the limits of what monetary policy can do within its mandate. Technical constraints (scarcity of bonds to buy in particular countries, notably Germany) will, in our view, force the ECB to end QE in H2 2018 in

Topics:

Frederik Ducrozet considers the following as important: ECB exit strategy, ECB policy normalisation, ECB quantitative easing, ECB tapering, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

As the ECB comes closer to a decision on the future of its quantitative easing programme, we look at the choices and dilemmas it faces.

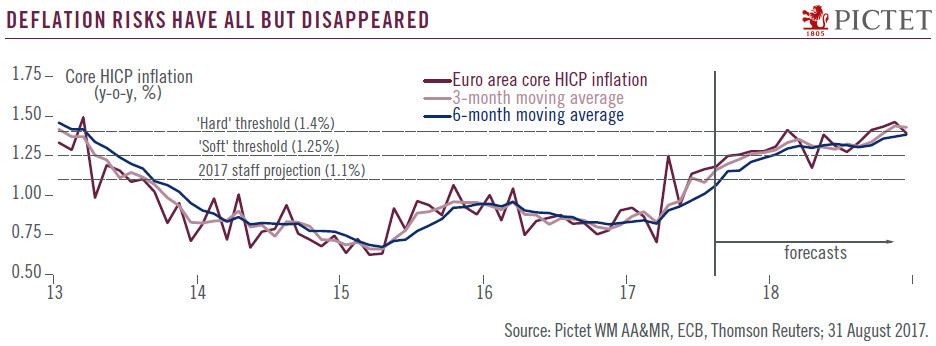

With the economic recovery in the euro area looking increasingly robust and broadbased, the ECB appears set to embark on a policy normalisation path, gradually phasing out of negative interest rate policy (NIRP) and quantitative easing. The ECB’s new narrative implies that the era of crisis-fighting unconventional monetary measures is over, as deflation risks have all but disappeared.

Another consideration for the ECB is that it is getting closer to the limits of what monetary policy can do within its mandate. Technical constraints (scarcity of bonds to buy in particular countries, notably Germany) will, in our view, force the ECB to end QE in H2 2018 in any case.

For the Governing Council to try and avoid a ‘taper tantrum’, any reduction in asset purchases will likely be described not as tapering, but as an “adjustment in parameters” aimed at keeping the monetary policy stance “broadly constant” amid improving economic fundamentals, i.e. in order to keep implied real rates stable when (core) inflation eventually picks up.

Our baseline scenario is for the ECB to announce by the end of this year that it will reduce the pace of asset purchases, from EUR60bn to EUR40bn, starting in January 2018, with the aim of winding down the programme completely by the end of 2018. We have long expected a one-off deposit rate hike in 2018, but do not expect a proper rate-hiking cycle to start before 2019–and risks are tilted towards an even slower policy normalisation. The EUR’s recent appreciation may also complicate the ECB’s task.

The pace and timing of the ECB’s exit from its highly accommodative monetary policies will be a major focus for markets in the coming months. Unless carefully handled, the gradual withdrawal of central bank support is liable to increase anxiety on markets. Our interpretation is that the FX market has started to price in ECB QE tapering to a larger extent than the bond market, which could experience volatility spikes in coming months. Given the robust growth outlook, we remain bullish on European equities, especially domestically-oriented stocks, although we recognise that further EUR strengthening could weigh on export-oriented ones. In any case, the risk of increased volatility in markets as central bank support is gradually withdrawn remains consistent with the need to build some degree of protection into our portfolios ahead of policy shifts.