The inflation rate remains tepid, but we still think there is a greater probability that the Fed hikes rates in December than the market is currently pricing.CPI inflation was 0.4% m-o-m, boosted by gasoline prices, pushing the y-o-y print to a still-tepid 1.9%. Core CPI inflation was up 0.25% m-o-m; the y-o-y reading was stable at 1.7%.While improving from recent lows, there is no sign of a ‘regime shift’ in US inflation, despite the tight labour market. Globalisation and technology continue to dampen prices.Recent low inflation readings have led to tensions within the Fed, with some officials recently calling for a pause in the tightening cycle until it becomes clearer that inflation is indeed trending upward. This latest inflation report, and particularly the 0.25% m-o-m print for core

Topics:

Thomas Costerg considers the following as important: Macroview, US core inflation, US Fed rate forecast, US inflation expectations

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The inflation rate remains tepid, but we still think there is a greater probability that the Fed hikes rates in December than the market is currently pricing.

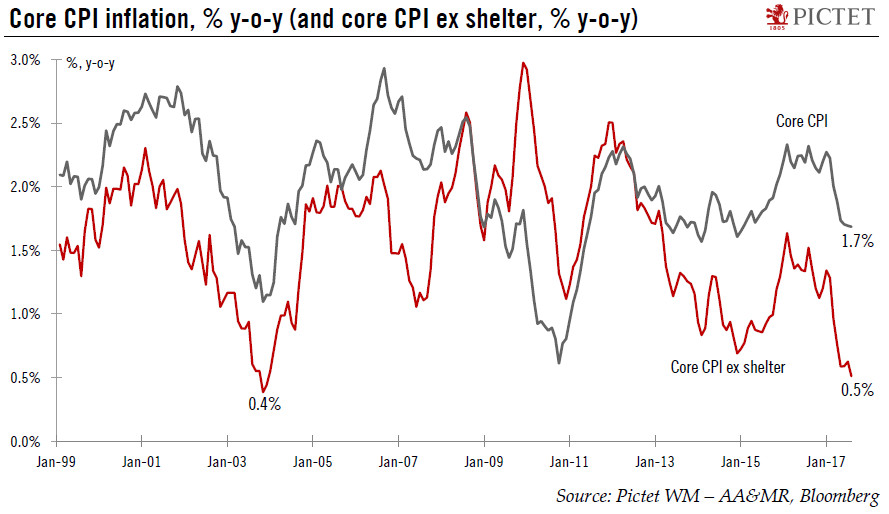

CPI inflation was 0.4% m-o-m, boosted by gasoline prices, pushing the y-o-y print to a still-tepid 1.9%. Core CPI inflation was up 0.25% m-o-m; the y-o-y reading was stable at 1.7%.

While improving from recent lows, there is no sign of a ‘regime shift’ in US inflation, despite the tight labour market. Globalisation and technology continue to dampen prices.

Recent low inflation readings have led to tensions within the Fed, with some officials recently calling for a pause in the tightening cycle until it becomes clearer that inflation is indeed trending upward. This latest inflation report, and particularly the 0.25% m-o-m print for core inflation, is a step in a right direction. Some officials ‘sitting on the fence’ could now be more inclined towards a December rate hike — although we think that views are unlikely to shift materially until further CPI reports are on hand.

We continue to believe the Fed will announce partial balance sheet shrinkage at its 20 Sept. FOMC meeting, and a 25bps rate hike in December.