Swiss Franc The Euro has fallen by 0.15% to 1.1475 CHF. EUR/CHF and USD/CHF, August 04(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates There are some chunky option strikes that could come into play today. There are 920 mln euros struck at .1850 that expire today. There are A3 mln struck at %excerpt%.7950 expiring today. There are 0 mln struck at CAD1.2550 that will be cut. The MSCI Asia Pacific Index eked out a small gain today and gained 0.8% on the week. It is the fourth consecutive weekly advance. The Dow Jones Stoxx 600 is up about 0.25% on the week, and nearly half of it is being recorded today. Recall that it fell 2.7% in June and 0.4% in July. Benchmark 10-year

Topics:

Marc Chandler considers the following as important: AUD, Australia Retail Sales, EUR, Featured, FX Trends, Germany Factory Orders, JPY, newsletter, U.S. Average Earnings, U.S. ISM Non-Manufacturing PMI, USD

This could be interesting, too:

Eamonn Sheridan writes CHF traders note – Two Swiss National Bank speakers due Thursday, November 21

Charles Hugh Smith writes How Do We Fix the Collapse of Quality?

Marc Chandler writes Sterling and Gilts Pressed Lower by Firmer CPI

Michael Lebowitz writes Trump Tariffs Are Inflationary Claim The Experts

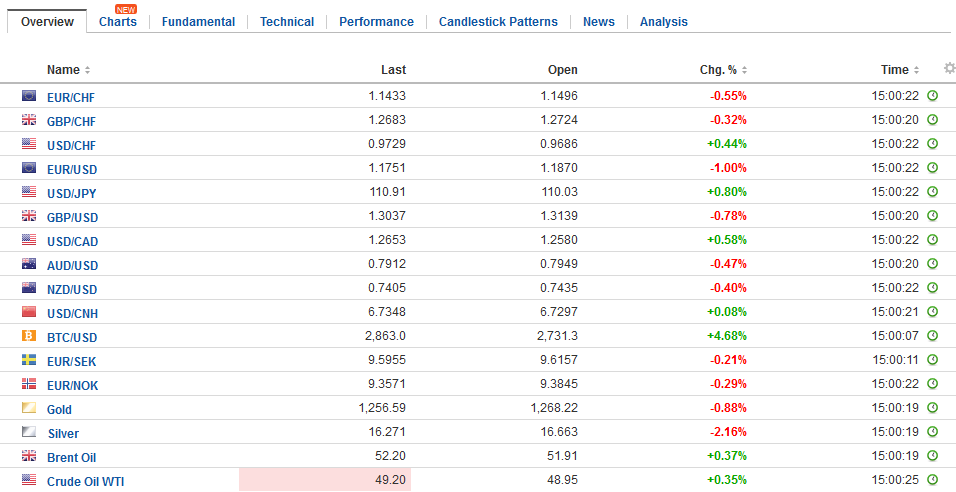

Swiss FrancThe Euro has fallen by 0.15% to 1.1475 CHF. |

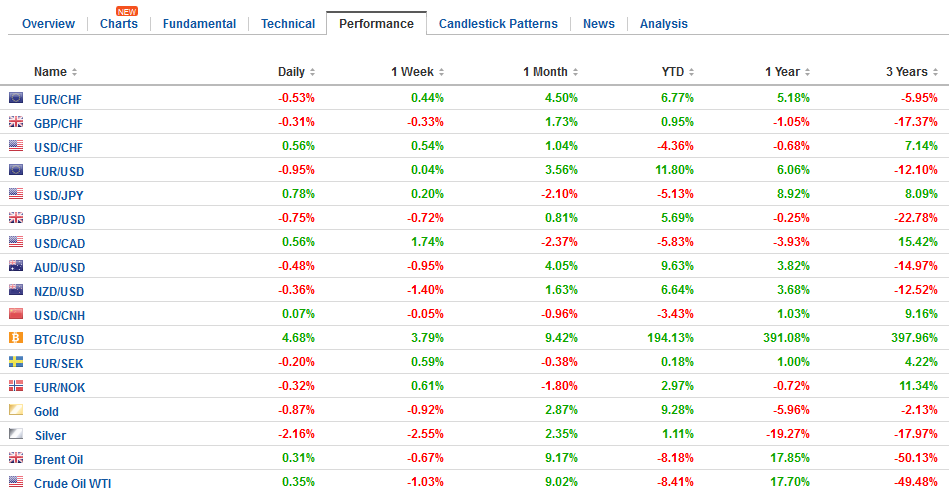

EUR/CHF and USD/CHF, August 04(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

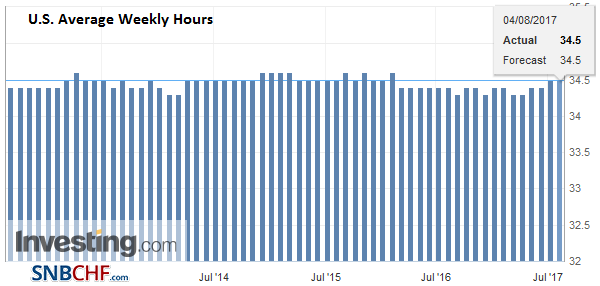

FX RatesThere are some chunky option strikes that could come into play today. There are 920 mln euros struck at $1.1850 that expire today. There are A$523 mln struck at $0.7950 expiring today. There are $680 mln struck at CAD1.2550 that will be cut. The MSCI Asia Pacific Index eked out a small gain today and gained 0.8% on the week. It is the fourth consecutive weekly advance. The Dow Jones Stoxx 600 is up about 0.25% on the week, and nearly half of it is being recorded today. Recall that it fell 2.7% in June and 0.4% in July. Benchmark 10-year yields fell in Asia after US rates fell yesterday. European rates and the US are up around one basis point today. |

FX Daily Rates, August 04 |

| It is not that the update on the US labor market is unimportant, but the question for investors is its impact on the powerful trends in the market. Given the current drivers, even a fairly strong jobs report is unlikely to change the direction change views on the US economy and the trajectory of monetary policy.

The note of caution that has peppered comments by some officials is not based on disappointment with the labor market per se. Job growth continues at a pace that is gradually absorbing slack in the labor market. The three-month average stands at 194k, just above the 2016 average of 187k. |

FX Performance, August 04 |

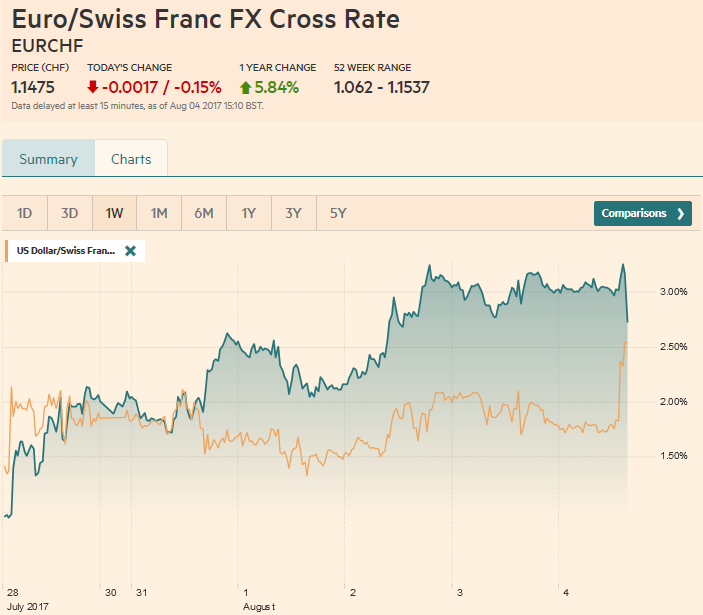

United StatesThe main challenge is the price pressures remain subdued. Remember that in the traditional view, headline inflation converges with core inflation and core inflation is driven by wages. The average hourly earnings component of the jobs report is the most important in the current environment. Last July hourly earnings rose 0.4%. That means that a 0.4% increase is needed in July simply to keep the year-over-year pace at the 2.5% seen in June. It has not risen by more than that since November 2008 (0.5%). The three, six, and 12-month average is at 0.2%. Not to put too fine of a point on it, but the real issue is how much will the year-over-year pace slow: 2.3%-2.4%. It finished last year at 2.9%. There have been three economic developments to report. First, in the context of the US employment report, Japan is also experiencing little wage pressure despite its tight labor market conditions. Cash wages fell 0.4% in June year-over-year. This was a shock. Economists expected a 0.5% gain after 0.7% in May. It is even worse when adjusted for the inflation. Real cash earnings fell 0.8% year-over-year. It is the weakest in two years. Prime Minister Kuroda has not recovered in the polls. This week’s cabinet reshuffle may better protect the LDP, but it is not clear if there is an alternative to Abenomics. |

U.S. Average Weekly Hours, July 2017(see more posts on U.S. Average Earnings, ) Source: Investing.com - Click to enlarge |

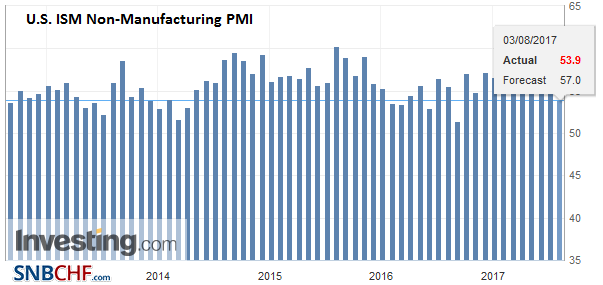

| News that the Special Counselor is looking into the Russia’s attempt to influence the US election is now working with a grand jury, and new leaks of the President’s private telephone conversations, despite some recent personnel changes, appeared to weigh on sentiment late yesterday when news broke. When coupled with an unexpected and dramatic slide in the non-manufacturing ISM (53.9 from 57.4, the lowest since last August) suggest little on the horizon that will boost growth. The US 10-year yield fell five bp yesterday and is pinned near 2.23% now. A month ago it stood at 2.35%. The market sees practically no chance of a September rate hike.

Moreover, if anything, the Washington drama raises concerns about the debt ceiling and the spending authorization that Congress must act on with limited time to maneuver in September. Some see these issues impacting the Fed’s decision on its balance sheet. There have been some distortions in the T-bill market as investors seek to avoid the period in which the problem may be most acute (mid-October). |

|

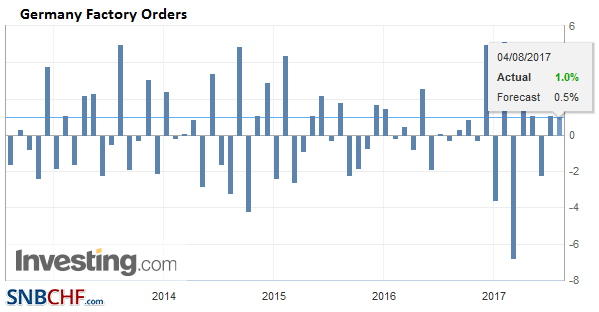

GermanyGerman factory orders rose 1.0% in June, more than the market expected. The year-over-year rate rose to 5.1% from the prior month’s 3.8% pace. Domestic orders rose 5.1%, while foreign orders fell 2%. It is a volatile report, and not much should be made of one month, but the rise of the euro and the decline in orders for export warns that German exporters may be feeling a competitive pressure. That said if German exporters are being squeezed from the stronger euro so would other exporters, especially in the south. |

Germany Factory Orders, June 2017(see more posts on Germany Factory Orders, ) Source: Investing.com - Click to enlarge |

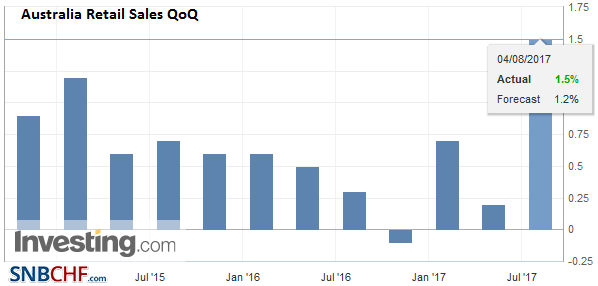

AustraliaThe Reserve Bank of Australia shaved this year’s growth forecast (through mid-2018) by 0.25%-0.5%, with the strong currency providing a headwind. It did revise up 2019 growth by 0.25% to 3%-4%. Separately, Q2 retail sales were a bit firmer than expected at 1.5% (vs. 1.2% median forecast in the Bloomberg survey). I Retail sales rose 0.2% in Q1. |

Australia Retail Sales QoQ, Q2 2017(see more posts on Australia Retail Sales, ) Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$AUD,$EUR,$JPY,Australia Retail Sales,Featured,Germany Factory Orders,newsletter,U.S. Average Earnings,U.S. ISM Non-Manufacturing PMI