There are plenty of arguments for and against a Japanese equity market whose fortunes are tightly linked to the strength of the yen and the success of Abenomics.Since mid-December 2012, when Shinzo Abe came to power, to end-June 2018, the TOPIX increased by 12% in local currency terms on an annualised total return basis, a significant achievement that owes much to ‘Abenomics’. At the same time, the Bank of Japan (BoJ) has had a direct impact on equities through its commitment to buy 6 trillion yen of equity ETFs annually.Not only corporate governance has improved in Japan but also shareholder returns. Currently at 2%, the average dividend yield has been on a par with the US for two years and buy-backs turned positive in 2016. ROE and operational margin have improved steadily as well, but

Topics:

Jacques Henry considers the following as important: Abenomics, Japan economy, Japanese equities, Japanese Yen, Macroview, Topix

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Jeffrey P. Snider writes You Don’t Have To Take My Word For It About Eliminating QE

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

There are plenty of arguments for and against a Japanese equity market whose fortunes are tightly linked to the strength of the yen and the success of Abenomics.

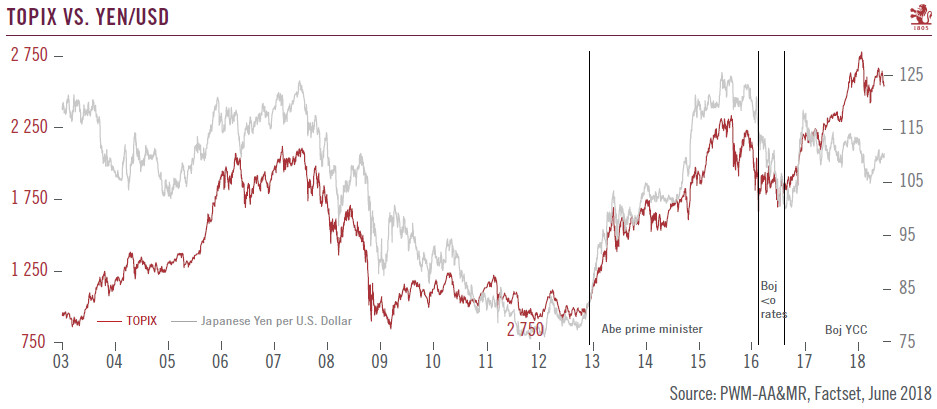

Since mid-December 2012, when Shinzo Abe came to power, to end-June 2018, the TOPIX increased by 12% in local currency terms on an annualised total return basis, a significant achievement that owes much to ‘Abenomics’. At the same time, the Bank of Japan (BoJ) has had a direct impact on equities through its commitment to buy 6 trillion yen of equity ETFs annually.

Not only corporate governance has improved in Japan but also shareholder returns. Currently at 2%, the average dividend yield has been on a par with the US for two years and buy-backs turned positive in 2016. ROE and operational margin have improved steadily as well, but further progress is needed to bridge the gap with the US and Europe. Half of Japanese companies are net cash, but unevenly across sectors and across company size.

Whether through exports or through currency translation, a weaker yen has been a boost for Japanese earnings and therefore for equity returns. The extent of M&A deals pursued by Japanese companies overseas also means the yen/TOPIX correlation is expected to persist. After superior earnings growth in 2017, earnings growth in 2018 is expected to be relatively anaemic, while valuations are at a par with Europe. In addition, the yen is expected to appreciate slightly over the coming year. All in all, after a strong rise since end- 2012, Japanese equities could post less appealing returns going forward. We currently favour unhedged FX exposure to Japanese equities to benefit from the yen’s defensive features.

The Japanese economy will definitely require more time to exit deflation, even though wage growth is currently supportive and expected to remain going forward. The BoJ is not expected to change monetary policy before 2019. The BoJ is the sole major central bank that directly owns a significant amount of listed equities. Political pressure surrounding prime minister Shinzo Abe has eased recently, meaning that Abenomics has further to go.