Summary:

Pictet Wealth Management's latest positioning across asset classes and investment themes.Asset AllocationOn a tactical, rolling three-to-six-month basis, we are tilting away from a bullish to a neutral stance on developed-market equities as trade and political frictions are rising. That said, we remain more upbeat on their prospects after the summer.Recent sell-offs have vindicated our cautiousness regarding emerging-market assets in general. But valuations are becoming more interesting, and significant outflows suggest investors in some markets are close to capitulation. Due to their recent decline, Asian equities appear attractive on a valuation basis, but remain sensitive to escalating trade tensions.Core government bonds are providing protection against current uncertainties, so we

Topics:

Perspectives Pictet considers the following as important: asset allocation, House View, Macroview, market stance, Pictet positioning, Pictet strategy

This could be interesting, too:

Pictet Wealth Management's latest positioning across asset classes and investment themes.Asset AllocationOn a tactical, rolling three-to-six-month basis, we are tilting away from a bullish to a neutral stance on developed-market equities as trade and political frictions are rising. That said, we remain more upbeat on their prospects after the summer.Recent sell-offs have vindicated our cautiousness regarding emerging-market assets in general. But valuations are becoming more interesting, and significant outflows suggest investors in some markets are close to capitulation. Due to their recent decline, Asian equities appear attractive on a valuation basis, but remain sensitive to escalating trade tensions.Core government bonds are providing protection against current uncertainties, so we

Topics:

Perspectives Pictet considers the following as important: asset allocation, House View, Macroview, market stance, Pictet positioning, Pictet strategy

This could be interesting, too:

Joseph Y. Calhoun writes Weekly Market Pulse: The Cure For High Prices

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Pictet Wealth Management's latest positioning across asset classes and investment themes.

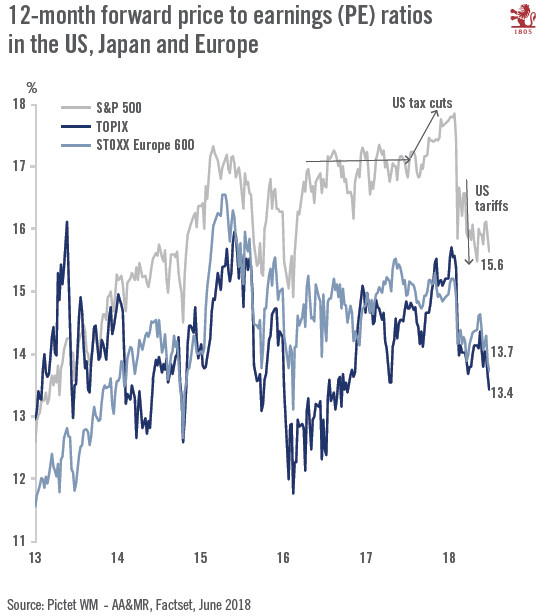

- On a tactical, rolling three-to-six-month basis, we are tilting away from a bullish to a neutral stance on developed-market equities as trade and political frictions are rising. That said, we remain more upbeat on their prospects after the summer.

- Recent sell-offs have vindicated our cautiousness regarding emerging-market assets in general. But valuations are becoming more interesting, and significant outflows suggest investors in some markets are close to capitulation. Due to their recent decline, Asian equities appear attractive on a valuation basis, but remain sensitive to escalating trade tensions.

- Core government bonds are providing protection against current uncertainties, so we have moved from a bearish to a neutral stance on US Treasuries over a three-to-six-month horizon. We continue to avoid the lowest-quality parts of the credit market.

Commodities

- Oil supplies are set to remain tight until mid-2019. We expect a significant risk premium to prevail until at least the middle of next year, so that oil prices remain above their long-term fundamental equilibrium. Our forecasts for the end of 2018 remain at USD 70 / bbl for WTI and USD 77 / bbl for Brent.

Currencies

- A very prudent European Central Bank, poor economic data and Italian politics saw the euro suffer in June. While the euro may still face short-term headwinds, our central scenario sees a progressive upturn in the currency’s fortunes against the US dollar over a 12-month horizon.

- We believe that extensive discounting of Fed rate hikes by the market could check any further substantial rise in the US dollar, which remains in a long-term downtrend.

Equities

- Earnings momentum in the US remains strong, but trade concerns contributed to lower valuations in June, even in tech. We are neutral on US equities but more bullish on less tech-exposed European stock markets.

- The positive legal ruling on the AT&T / Time Warner tie-up led markets to immediately price in further consolidation in the US media sector.

- While our central scenario of a year’s end 3% 10-year US Treasury yield remains unchanged, alternative scenarios are still possible. Overall, safe-haven US Treasuries should perform well if trade tensions persist, putting downward pressure on yields.

- We have turned bearish on US high yield bonds as we believe spreads could finally start to widen again. We have a short-term neutral stance on emerging sovereign debt.

Alternatives

- Heightened M&A activity means we expect event-driven hedge fund managers to continue to benefit from rising opportunities in merger arbitrage.

- But we are monitoring for potential crowding risk in specific deals, as well as the impact that antitrust regulations and a trans-Atlantic trade war could have on these strategies.

- Private equity managers continue to seek to differentiate themselves as the competition for deals heats up. Finding good deals in the secondary space is becoming an especially tough challenge.