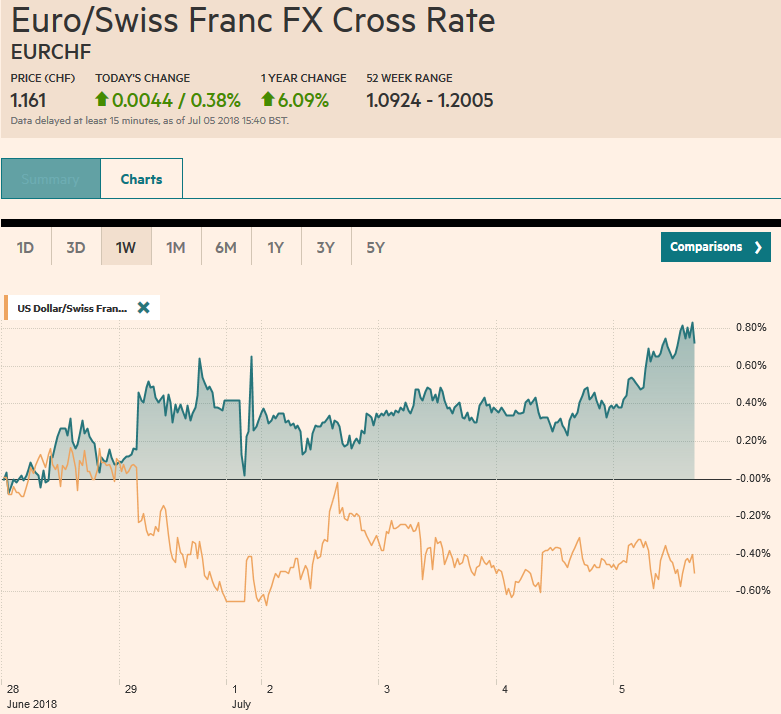

Swss Franc The Euro has risen by 0.38% to 1.161 CHF. EUR/CHF and USD/CHF, July 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge The US dollar is softer against most of the major currencies and mixed against the emerging market currencies. European currencies firmer, with the continued recovery of the Swedish krona on the back of a more hawkish central bank, and the euro poking through .17 for the first time in over a week with the help of strong factory orders report from Germany. Central and East European currencies are leading among emerging markets. Asian equities continued to move south while European bourses are moving higher. Benchmark bond yields are mostly 2-4 bp

Topics:

Marc Chandler considers the following as important: $CNY, 4) FX Trends, EUR, Featured, GBP, JPY, newslettersent, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swss FrancThe Euro has risen by 0.38% to 1.161 CHF. |

EUR/CHF and USD/CHF, July 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

The US dollar is softer against most of the major currencies and mixed against the emerging market currencies. European currencies firmer, with the continued recovery of the Swedish krona on the back of a more hawkish central bank, and the euro poking through $1.17 for the first time in over a week with the help of strong factory orders report from Germany. Central and East European currencies are leading among emerging markets. Asian equities continued to move south while European bourses are moving higher. Benchmark bond yields are mostly 2-4 bp higher.

The PBOC set the yuan’s reference level 0.62% higher, which is the most since last October, but the yuan gave back those gains to trade little changed on the day. On July 3, the dollar reached CNY6.72. Yesterday it reached a low near CNY6.60. Today’s range was roughly CNY6.6490 to CNY6.6260. The loss of the yuan’s downside momentum has failed to support the equity market. Note that the cut in the required reserve ratio, announced in late June, came into effect today. The 0.9% loss in Shanghai Composite is the third loss in the past four sessions and brings the index to a fresh two-year low. Barring a 4% rally tomorrow, the Shanghai Composite drop will extend for the seventh week.

More broadly, the MSCI Asia Pacific Index fell for a fourth consecutive session and the eighth session in the past nine. It rose one week in each of the past two months. It is approaching the 160 level, which was an area of consolidation in Q3 17. Nearly all the markets in the region were lower today, except Australia, India, and Singapore.

In contrast, European bourses are higher. The Dow Jones Stoxx 600 is up a little more than 0.5% in late morning turnover in Europe, led materials, consumer discretion, and information technology. Consumer staples, real estate, and telecoms are lower. Barring a reversal, it would be the third consecutive advance of the benchmark. It was nearly flat on the week coming into today.

For the first time this year, Germany reported an increase in factory orders. The 2.6% increase in May was more than twice the median forecast and April’s decline was revised to -1.6% from -2.5%. The geographic breakdown showed domestic orders rose by 4.3% while orders from within the EMU rose a sharp 6.7%. Orders from outside the euro area fell 1.3%. Earlier this week, the composite PMI for June rose more than the flash reading suggested to stand at a three-month high.

It seems that some hawks at the ECB have again taken their argument to Bloomberg. The newswire reports that some members are not happy with the ECB’s commitment not to raise rates until after next summer. The market had been favoring a hike in September 2019 since the ECB meeting last month, and following the story, the odds firmed a bit closer to 80%. This seems to be a pattern now, whereby the ECB makes a decision and the hawks take their case to media.

The euro firmed in thin conditions when the “news” first broke yesterday, though in early Asia today, it had given back most of those gains. The Germany factory orders propelled the euro higher again, and the single currency briefly pushed through the $1.17 level for the first time since June 26. Today is the fifth consecutive session that the euro is recording higher lows. There is a 2.3 bln euro option struck at $1.17 that expires today. There is another option at $1.1745 for roughly 930 mln euros that will also be cut. On the downside, there are about 1.3 bln euros struck between $1.1620 and $1.1625 that expire today. Short-term participants may be hesitant about pushing the euro much higher ahead of the US jobs data tomorrow, but a push above $1.1720, the highs from late June would target $1.1850,

Sterling is snapping a two-day downdraft that broke a six-day advance in seven sessions. The weaker dollar tone is the main driver, but yesterday’s PMI surprised on the upside, and investors are falling more comfortable about a BOE hike next month. The focus is shifting back to Brexit. Ahead of tomorrow’s key cabinet meeting, Prime Minister May is sounding out support for her new initiative to stay close to the EU post-Brexit for goods trade. However, reports suggest that the UK’s chief Brexit negotiator has warned that the Prime Minister’s plan is not workable.

Sterling is also posting higher lows for the fifth session as this corrective/consolidative phase continues. It is bumping against the 20-day moving average (~$1.3245), which it has not managed to close above since mid-June. Expiring options today above $1.33 do not seem relevant. Sterling has not traded above $1.33 since June 22. The euro slipped against sterling over the past two sessions but found a good bid near GBP0.8800, near its 20-day moving average.

After testing the JPY111 area earlier in the week, the dollar backed off to nearly JPY110.25 yesterday and found bids still near there today. Firmer European (and US stocks are trading higher in Europe) coupled with firm Treasury and European bond yields could see the greenback re-challenge the JPY111 area ahead of the weekend if US jobs data is supportive. Several expiring options that may be in play today. Between JPY110.50 and JPY110.75, there are roughly $1.5 bln in options being cut today. There are another $630 mln struck at JPY111.00 that are expiring.

Separately, Japan’s MOF weekly portfolio data, covering the last week in June, showed Japanese investors bought what appears to be a record amount of foreign equities (~JPY985 bln) and nearly JPY295 bln of foreign bonds. For their part, foreign investors sold Japanese equities for a sixth week into the end of June. However, foreigners bought JPY951 bln of Japanese bonds. It is the most since early March and completely unwinds that JPY862 bln of bonds sold the previous week. Retail investors in the futures market appear to be continuing to shift away from Turkish lira and into South African rand.

The North American session features the US ADP jobs estimate, which steals some of the thunder of the official report, ISM/PMI non-manufacturing survey results, and the FOMC minutes from last month’s meeting at which the Fed hiked 25 bp and the median dot plot pointed to two hikes in the second half of the year. Recall that the change in the was the result of one member altering their forecast.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$CNY,$EUR,$JPY,Featured,newslettersent