There is an ongoing tug-of-war between trade tensions and fundamentals

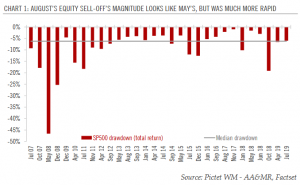

Due to renewed trade tensions, the S&P 500 corrected by 6.0% and the Stoxx Europe 600 by 5.8% from the late July peak to the 5 August low. Because the pullback was clustered around just a few days, its intensity was reminiscent of the worst market days of past major crises.

Safe haven assets benefitted significantly, with gold gaining 7.4% from the late July equity market peak to the 5 August low and 10-year US Treasuries returning 2.3% over the same period. Meanwhile, the US reporting season provided some reassurance, with better corporate results than generally feared. Current preannouncements remain in line with average Q3 2019 earnings growth expectations.

Developed market earnings growth

Articles by Jacques Henry

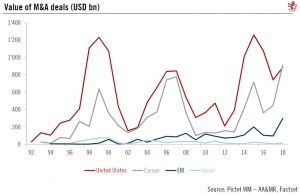

The global M&A value is running close to its 2015 peak

August 16, 2018Despite a disappointing equity market performance this year, M&A activity remains buoyant.Mergers and acquisitions (M&A) activity has proven resilient so far this year, despite higher volatility and lower equity returns. However, the derating of equities has neither depressed target valuations nor premiums paid by acquirers, particularly in Europe. The acceleration of M&A in 2018 could even approach the previous peak reached in 2015, at around USD 1.2 trillion in the US.Since January, 84 deals above USD 1bn have been announced in the US, 47 in Europe and 35 in emerging markets (EM). The aggregate value of deals has been even more impressive—USD 706bn in the US, USD 374bn in Europe and USD 118bn in EM. Annualising figures shows that in terms of market capitalisation, M&A so far this year

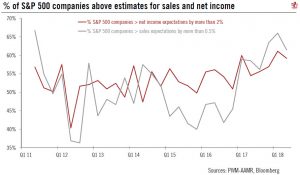

Read More »Half way into Q2 18 earnings reporting season

July 31, 2018US corporate earnings remain strong, even though some high-flying names announce negative surprises.By 30 July, 267 S&P 500 companies had reported earnings for Q2 18. Despite Facebook’s profit warning, the Q2 reporting season in the US was good, with around 60% of S&P 500 companies significantly beating top-line and bottom-line expectations.Positive surprises in the US were higher in Q1 (66% for sales and 61% for net income), the first quarterly results to reflect Trump’s tax cuts of end-December, but the deceleration is modest and Q2 is turning out to be another good one for US corporate results.If average sales surprises have improved since Q1, that is not the case for net income surprises, which have declined. Data excluding financials shows an even greater deceleration in net income

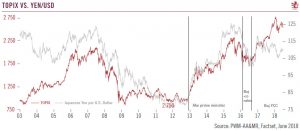

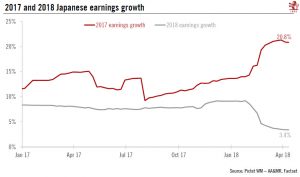

Read More »Japanese Equities: an uneven picture

July 5, 2018There are plenty of arguments for and against a Japanese equity market whose fortunes are tightly linked to the strength of the yen and the success of Abenomics.Since mid-December 2012, when Shinzo Abe came to power, to end-June 2018, the TOPIX increased by 12% in local currency terms on an annualised total return basis, a significant achievement that owes much to ‘Abenomics’. At the same time, the Bank of Japan (BoJ) has had a direct impact on equities through its commitment to buy 6 trillion yen of equity ETFs annually.Not only corporate governance has improved in Japan but also shareholder returns. Currently at 2%, the average dividend yield has been on a par with the US for two years and buy-backs turned positive in 2016. ROE and operational margin have improved steadily as well, but

Read More »M&A buoyant so far this year

May 1, 2018M&A activity has started the year strongly, especially in Europe, with cash-only deals to the fore as funding conditions continue to tighten.So far this year equity returns have been fairly disappointing and market volatility has significant increased compared with 2017. However, disappointment has been driven neither by poor economic conditions nor by a worsening of company fundamentals, and mergers and acquisitions (M&A) remain supportive. The acceleration of M&A in some regions illustrates that investor sentiment is not that pessimistic, which should help equity markets in the coming months.M&A activity kicked off this year strongly. Since January, 41 deals above USD1bn have been announced in the US, 30 in Europe and 20 in emerging markets (EM). Annualising those figures shows an

Read More »Japanese equities bolstered by the Bank of Japan

April 19, 2018Foreign outflows from Japanese equity markets are being more than offset by the BoJ’s purchases of ETFs.Japanese equities received net inflows in March. Nevertheless, foreigners were net sellers – with the highest monthly net foreign redemptions in the past 18 months. Thanks to the Bank of Japan’s (BoJ) purchases of Exchange Traded Funds (ETFs), there have still been net inflows into Japanese equities despite the strong foreign outflows.The BoJ is buying ETFs according to plan, currently running at a pace of JPY 6000 trillion per year. The central bank did not significantly increase its purchases in March.The share of equity ETFs in the BoJ’s purchase programme has increased from 4.3% in September 2016 to nearly 11% today.Japanese equity valuations have fallen back, as they have in

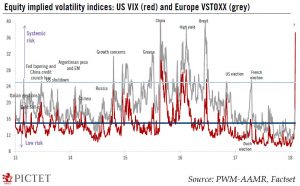

Read More »Equity markets in a new regime

February 9, 2018The recent ‘flash crash’ in equities was unusual by several measures. After ‘goldilocks’, equity markets have entered a new regime.The global equity market sell-off of late January and early February was rather unusual in a number of respects.Equity and bond prices declined simultaneously in the recent market sell-off, a pattern that has only occurred in a quarter of the last 25 equity market sell-offs.The recent sell-off is far above the levels seen in the past two years, because the timings of the increase in long-term rates and of the acceleration in the equity market sell-off were different. Furthermore, only one third (8 out of 25 equity sell-offs) were more severe in the US than in Europe.The pattern in implied volatility was even more unusual. Starting from a very low level (for

Read More »Japan: a year of normalisation – still appealing, but risk-reward is not as good as before

November 27, 2015Our 2016 scenario reaffirmed our preference for developed equities over emerging equities. Overall our total return expectation in Japan is similar to expectations in the US and Europe in a 7%-10% range.

A number of concerns hang over the outlook for Japanese equities in 2016. The first phase of Abenomics had only mixed success, and plans for the second phase are still vague. Although there are some encouraging signs, the economy’s trajectory remains weak. Earnings have been resilient, but this may not be sustained. Japanese equities saw an especially sharp sell-off in the global market turmoil of August-September as external investors, who play a key role in the market, sold. Japan remains an attractive market overall, but probably less so than in recent years – and risks have increased.

From Abenomics 1.0 to 2.0 Prime Minister Abe was elected at the end of 2012 and launched a massive programme to revive the Japanese economy after two decades of deflation. The programme was based on the so-called ‘three arrows’: loose monetary policy, fiscal stimulus and structural reforms. The most important element to date has been monetary policy: the quantitative easing (QE) that was launched in April 2013 and extended in October 2014. Since 2013, Japanese CPI has moved into positive territory and currently stands at 0.9% excluding fresh food and energy.