On the heels of continued dollar strength, output increases by OPEC (and US production at 2 year highs), and Libya restarting its biggest oilfield, WTI prices are tumbling for the 3rd time this week, back below to their lowest in 3 weeks... As Bloomberg notes, while oil rallied into a bull market last month on the ...

Topics:

Tyler Durden considers the following as important: Business, Cartels, Chronology of world oil market events, Energy crisis, Gulf of Mexico, Mexico, OPEC, Organization of Petroleum-Exporting Countries, Petroleum, Petroleum industry, Primary sector of the economy, Saudi Arabia, Vladimir Putin, World oil market chronology from, Zurich

This could be interesting, too:

Marc Chandler writes Fragile and Consolidative Tone Starts the Week in FX

Marc Chandler writes Higher Yields Help Extend the Dollar’s Gains

Marc Chandler writes The Dollar Remains Bid, While the Euro and Swiss Franc are Sold Through Last Week’s Lows

Marc Chandler writes US Dollar Soars and US Rates Jump

On the heels of continued dollar strength, output increases by OPEC (and US production at 2 year highs), and Libya restarting its biggest oilfield, WTI prices are tumbling for the 3rd time this week, back below $50 to their lowest in 3 weeks...

As Bloomberg notes, while oil rallied into a bull market last month on the prospect of stronger demand, prices struggled to hold above $52 a barrel as supply grew from the U.S. and two members of the Organization of Petroleum Exporting Countries that are exempt from making cuts. Saudi Arabia and Russia reaffirmed their cooperation during a visit from King Salman bin Abdulaziz this week, with President Vladimir Putin saying he is open to extending the agreement with OPEC until the end of 2018 if required.

“Higher OPEC production in September as well as the prompt return of supplies from Libya after the brief closure of their biggest field weighed on oil futures this week,” said Giovanni Staunovo, an analyst at UBS Group AG in Zurich.

The result is clear - 3 legs lower and back to 3-week lows...

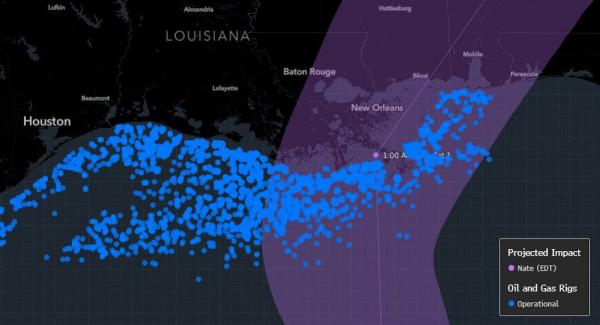

Companies from BP Plc to Chevron Corp. are shutting platforms in the Gulf of Mexico to prepare for Tropical Storm Nate, which is forecast to become a hurricane south of Louisiana on Saturday.