It’s actually pretty easy to see why the IMF is in a hurry to secure more resources. I’m not talking about potential bailout candidates banging down the doors; that’s already happened. The fund itself is doing two contradictory things simultaneously: telling the world, repeatedly, that it has a highly encouraging $1 trillion in bailout capacity at the same time it goes begging to vastly increase that amount. Very reassuring. The IMF is becoming like the Federal...

Read More »Dollar Stalls as Market Sentiment Improves

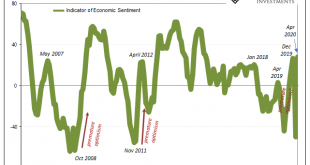

The virus news stream remains mixed; oil remains at center stage with still extreme volatility. The White House and House Democrats struck a deal on a new aid package worth $484 bln Canada reports March CPI; Mexico delivered a surprise 50 bp cut to 6.0% yesterday afternoon ECB will consider accepting sub-investment grade bonds as collateral in its operations; reports suggest Italy will boost its fiscal stimulus efforts UK reported March CPI data; Turkey is expected...

Read More »Why Markets Are Rallying as Millions Become Unemployed

[unable to retrieve full-text content]The US economy is imprisoned, most of the population is under house arrest, and the inmates in Washington are running the asylum. And yet while the nation appears to be walking the green mile, investors residing in the Wall Street cell block have been extended pardons from the market gods.

Read More »Coronavirus: the age difference behind lower Swiss death rate

© Absolut_photos | Dreamstime.com Switzerland’s Covid-19 death rate has been lower than much of the rest of Europe. A lower infection rate among older people appears to be one reason. The rates of deaths among those either recovering or dying have been particularly high in Belgium (40%), France (34%) and Italy (31%). In other countries such as Austria (4%), Germany (5%) and Switzerland (7%) they have been much lower. There are many reasons for variations in these...

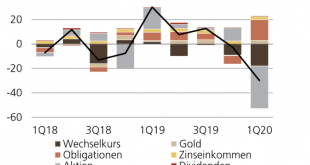

Read More »SNB dürfte im ersten Quartal 30Milliarden Franken verlieren

Die SNB dürfte im ersten Quartal des laufendenJahres einen Verlust von rund CHF 30 Mrd.ausweisen. Die Coronakrise führte zu einem Kurssturz anden Aktienmärkten und zu einer Aufwertung desFrankens auf breiter Basis, beides schadete demErgebnis der SNB. Tiefere Zinsen und ein stärkererGoldpreis wiederum verhinderten einen nochhöheren Verlust Angesichts einer Ausschüttungsreserve von fast CHF85 Mrd. sind die Auszahlung an Bund und Kantoneselbst nach diesem Rückschlag...

Read More »FX Daily, April 22: Investors Catch Collective Breath, but Sentiment remains Fragile

Swiss Franc The Euro has risen by 0.09% to 1.0562 EUR/CHF and USD/CHF, April 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Risk-appetites appear to have stabilized for the moment. Most equity markets are higher. Japan and Malaysia were exceptions, but the MSCI Asia Pacific Index rose for the first time this week. In Europe, the Dow Jones Stoxx 600 is recouping about a third of yesterday’s loss. The S&P...

Read More »5 Schritte um mit dem Vermögensaufbau zu Beginnen ??

Heute möchte ich mit euch über die 5 Schritte sprechen, mit denen ihr Vermögen aufbauen könnt. Dieser Beitrag richtet sich eher an die Leute, die mit dem Vermögensaufbau beginnen wollen. Ich gebe euch heute eine kleine Guideline, wie man die ersten Schritte richtig macht. Vieles davon ist aus meiner eigenen Erfahrung, wie ich mit meinem heutigen Wissen nochmal starten würde. 1. Ausgaben messen Der erste Schritt hört sich sehr langweilig an, aber so beginnt es eben,...

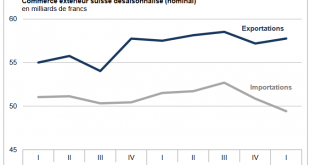

Read More »Swiss Trade Balance Q1 2020 : chemistry-pharma keeps exports in black numbers

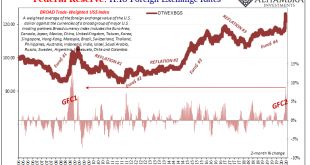

We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners. Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade partners decided to spend more. This is partially...

Read More »The Greenspan Bell

What set me off down the rabbit hole trying to chase modern money’s proliferation of products originally was the distinct lack of curiosity on the subject. This was the nineties, after all, where economic growth grew on trees. Reportedly. Why on Earth would anyone purposefully go looking for the tiniest cracks in the dam? My very first day on the job, as an intern my first boss told me to prepare myself. I was embarking on a career in the most absurd industry...

Read More »The Experts Have No Idea How Many COVID-19 Cases There Are

In the early days of the COVID-19 panic—about three weeks ago—it was common to hear both of these phrases often repeated: “The fatality rate of this virus is very high!” “There are far more cases of this out there than we know about!” The strategy of insisting that both these statements are true at the same time has been used by politicians to implement “lockdowns” that have forced business to close and millions to lose their jobs. For instance, on March 12, Ohio...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org