A Failure to Integrate Values The only region in the world that has proactively tried to incorporate western culture in its societies is East Asia — Singapore, Japan, Hong Kong, South Korea, and Taiwan. China, which was a grotesquely oppressed, poor, Third World country not too far in the past, notwithstanding its many struggles today, has furiously tried to copy the West. Famous Greek philosophers: their thoughts are a cornerstone of Western culture. [PT]Western...

Read More »Central Bankers Will Bring Us Economic Stagnation

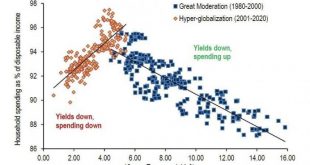

“Our country continues to face a difficult and challenging time….People have lost loved ones. Many millions have lost their jobs. There is great uncertainty about the future. At the Federal Reserve, we are strongly committed to using our tools to do whatever we can, for as long as it takes…to ensure that the recovery will be as strong as possible, and to limit lasting damage to the economy” –Jerome Powell, Chairman of the Federal Reserve, June 10, 2020 America is...

Read More »FX Daily, June 23: Weebles Wobble but they Don’t Fall Down

Swiss Franc The Euro has risen by 0.22% to 1.069 EUR/CHF and USD/CHF, June 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: After early indecision, investors ramped the demand for risk assets, encouraged perhaps by indications that the Trump Administration going to support at least another trillion-stimulus package. The NASDAQ rallied to new record highs, and the dollar got thumped across the board. However,...

Read More »Swiss public transport expected to lose CHF1.5 billion due to Covid-19

On Swiss trains passenger numbers have increased very gradually, and currently stand at around 55% of normal capacity in regional trains and 45% on intercity trains. © Keystone / Christian Beutler The collapse in the number of commuters and other passengers on Swiss trains and buses due to the pandemic is likely to leave a big hole in the finances of public transport companies. The Le Matin Dimanche and SonntagsZeitung newspapers reported on Sunday that Alliance...

Read More »Glencore faces Swiss probe over alleged Congo corruption

Congolese demonstrations protest outside Glencore’s headquarters in Zug, Switzerland, in July 2018. © Keystone / Urs Flueeler The Office of the Attorney General of Switzerland (OAG) has opened a criminal probe into Swiss-based commodity trader and miner Glencore over alleged corruption in the Democratic Republic of the Congo, where it mines copper and cobalt. Glencore said in a statement on June 19 that the Swiss criminal investigation was for the multinational’s...

Read More »Drivers for the Week Ahead

There are some indexing events this week that could add to market volatility; the IMF will release updated global growth forecasts Wednesday The regional Fed manufacturing surveys for June will continue to roll out; Fed speaking engagements are somewhat limited this week Eurozone reports preliminary June PMI readings Tuesday; ECB releases its account of the June meeting Thursday All quiet on the Brexit front; UK reports preliminary June PMI readings Tuesday Japan...

Read More »Defaults Are Coming, Market Report, 22 June

We are reading now about possible regulations for air travel. In brief: passengers might be forced to spend hours at the airport. Authorities will perform medical checks, including possibly needles to draw blood, no lounges, no food or drink on board the plane, masks required at all times, and even denied the use of a bathroom except by special permission. We would wager an ounce of fine gold against a soggy dollar bill that people will hate this. The majority of...

Read More »Some Conservatives Want Americans to Abandon Classical Liberalism. Don’t Listen to Them.

Donald Trump’s economic populism, and his break with the established post-war conservative movement, has created an opening for new types of conservatism. Among these is the anti-market wing of the movement characterized by a renewed enthusiasm for trade controls, more spending on welfare programs, and more government regulation in the everyday lives of ordinary Americans. The economic agenda has been voiced perhaps most enthusiastically by pundit Tucker Carlson and...

Read More »7 Powerful Reasons to Become Financially Independent

(Disclosure: Some of the links below may be affiliate links) You have probably heard a lot about Financial Independence. A lot of things on this blog are about my path to Financial Independence (FI). But why would you want to be financially independent? There are many reasons for wanting to be financially independent. And as you will see, retiring may not be the most significant reason. In this post, I am going to list the main reasons people want to be Financially...

Read More »FX Daily, June 22: Dollar Begins Week on Back Foot

Swiss Franc The Euro has risen by 0.12% to 1.0664 EUR/CHF and USD/CHF, June 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Investors begin the new week, perhaps slowed a bit by the weekend developments and the growth of new infections. Equities are mixed. The MSCI Asia Pacific Index snapped a four-day advance, though India bucked the regional trend and gained 1%. Europe’s Dow Jones Stoxx 600 is recovering...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org