This Great Graphic shows the results of the last three Wall Street Journal survey of business and academic economists on the outlook for Fed policy. The key take away is that despite all the talk and ink spilled on the shifting Fed stance and the split within the FOMC, economists views did not change much over the past month. In March, 76% of the economists expected the next hike in June. In the April survey that was completed earlier this week found 75% expect a June hike. Only one...

Read More »Time to Pick a Top in the Australian Dollar?

The yen's surge in recent days has captured the attention of investors and policymakers alike. It is indeed unsettling and seems to run counter to the economic logic negative interest rates, which the BOJ surprised the market with at the end of January. Yet, if one thinks the market has gotten ahead of itself, perhaps picking a top in the yen may not be prudent. Entry levels are important but so is the stop. It is not clear where one should put a stop if trying to pick a bottom to...

Read More »Why Janet Yellen Can Never Normalize Interest Rates

No Return to Normal BALTIMORE – On Tuesday, the Dow sold off – down 133 points. Oil traded in the $36 range. And Donald J. Trump lost the Wisconsin primary to Ted Cruz. Overall, world stocks have held up well, despite cascading evidence of impending doom. U.S. corporate profits have been in decline since the second quarter of 2015. Globally, 36 corporate bond issues have defaulted so far this year – up from 25 during the same period of 2015. Economists at JPMorgan Chase put the U.S....

Read More »Why Janet Yellen Can Never Normalize Interest Rates

BALTIMORE – On Tuesday, the Dow sold off – down 133 points. Oil traded in the $36 range. And Donald J. Trump lost the Wisconsin primary to Ted Cruz. Overall, world stocks have held up well, despite cascading evidence of impending doom. With higher rates, Yellen risks corporate profits and bond defaults U.S. corporate profits have been in decline since the second quarter of 2015. Globally, 36 corporate bond issues have defaulted so far this year – up from 25 during the same period of 2015....

Read More »Big Players (Read: Governments) Make Markets Unsafe

Authored by Steve H. Hanke of the Johns Hopkins University. Follow him on Twitter @Steve_Hanke. Reportage in The Wall Street Journal on April 4th states that “A fund owned by China’s foreign-exchange regulator has been taking stakes in some of the country’s biggest banks, raising speculation that it may be a new member of the so-called ‘national team’ of investors the Chinese government unleashes to support its stock market.” Statists and interventionists around the world (read: `those who...

Read More »Yen Continues to Climb

The main feature in the foreign exchange market continues to be the surge of the Japanese yen. A convincing explanation of the yen's strength seems elusive. Until last week, which means through the fiscal year-end last month, Japanese fund managers have been buying foreign bonds at a near-record pace. Foreign investors, for their part, have been dumping Japanese shares. The main buyers of the yen appeared to be speculators, wherein the futures markets, they have amassed a near-record...

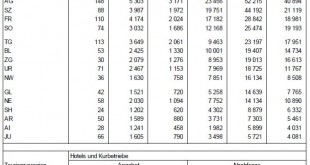

Read More »Statistics on tourist accommodation in February 2016: Overnight stays in February fall despite rise in domestic demand

07.04.2016 09:15 – FSO, Tourism (0353-1603-40) Statistics on tourist accommodation in February 2016 Overnight stays in February fall despite rise in domestic demand Neuchâtel, 07.04.2016 (FSO) – The Swiss hotel industry registered 3.1 million overnight stays in February 2016, which corresponds to a decrease of 1.3% (-41,000 overnight stays) compared with February 2015. Foreign visitors generated 1.5 million overnight stays, representing a decline of 5.3% (-84,000 overnight stays)....

Read More »Great Graphic: Head and Shoulders in Dollar-Yen

The old head and shoulders pattern in the dollar against the yen is back in vogue. We first pointed it out in the first week of January here. Recall the details. The neckline is drawn around JPY116.30 and measuring objective is near JPY107.00. That target also corresponds to a 38.2% retracement of the big Abe-inspired dollar rally (~JPY106.80). This Great Graphic from Bloomberg shows the pattern. We note the conflicting flows presently. Portfolio managers continue to be large...

Read More »Dutch Referendum: Devil is not in the Details

In what is possibly one of the under-appreciated political events of the year, the Netherlands holds a plebiscite today on an associational agreement with Ukraine that has already been approved by the Dutch parliament, the European Parliament and all other 27 EU members. When stated so baldly, it is difficult to see what is at stake. Yet the consequences of a no vote, which seems likely, will send reverberations throughout Dutch politics, the EU, and the geopolitical balance in...

Read More »Greenback Finds A Little Traction

The US dollar is better bid today but remains largely in the ranges seen in recent days. There a few developments to note, which together are lifting European equities after Asian equities softened. First, the API oil inventory estimate showed an unexpected fall of 4.3 mln barrels. An increase of half the magnitude was expected. The DOE estimate, which is considered more reliable, will be one of the North American highlights today. Second, and also supporting the oil complex today...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org