Swiss Franc The Euro has fallen by 0.06% to 1.0776 EUR/CHF and USD/CHF, October 06(see more posts on EUR/CHF, USD/CHF, ) Source: investing.com - Click to enlarge FX Rates Overview: Market moves have stalled. The MSCI Asia Pacific Index did manage to extend Monday’s gains, but other markets are heavier. Europe’s Dow Jones Stoxx 600 is snapping a three-day advance. The communications sector is the sole standout, though financials and energy are little changed....

Read More »Kantonaler Wahlnotstand

In wenigen Tagen wird im Kanton Aargau, aber auch in anderen Kantonen, das Kantonsparlament und die Kantonsregierung gewählt. Der Wahlkampf ist eher flau. Vielleicht weil es daran liegt, dass das grösste Thema einfach totgeschwiegen wird: Corona wird bei keiner Partei auch nur schon erwähnt (und wenn doch, bitte zeigen Sie’s mir!). Wieso? Haben alle Parteien Angst vor einer eigenen Meinung? Angst vor einer Verteufelung, wie es die Medien schon an anderen Orten...

Read More »Pandemic increases demand for second homes in Switzerland

© Roland Van Der Meeren | Dreamstime.com Demand for second homes has risen since restrictions related to coronavirus were loosened, according to real estate company Wüest Partner. The option of remote working appears to be encouraging some to trade time in central city locations for more time in Alpine resorts, the countryside, commuter regions and smaller cities. The prices of second homes have risen 3.6% over the last 12 months, according to firm. Demand for...

Read More »Who’s Negative? The Marginal American Worker

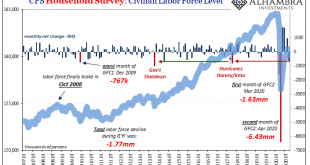

The BLS’s payroll report draws most of the mainstream attention, with the exception of the unemployment rate (especially these days). The government designates the former as the Current Employment Statistics (CES) series, and it intends to measure factors like payrolls (obviously), wages, and earnings from the perspective of the employers, or establishments. The Establishment Survey. Its cousin is called the Household Survey, or CPS, the Current Population Survey,...

Read More »Explaining the Plan to Dismantle Schools and the Fed’s Alchemy

Bob reads from an article recently tweeted out by the NEA, which calls for an end to schooling as we know it in order to promote anti-racism. He then discusses what the Fed has been up to since the coronavirus panic began. Mentioned in the Episode and Other Links of Interest: The YouTube version of this episode (with lots of visuals). Karlyn Borysenko’s YouTube episode on the NEA tweet. Jamilah Pitts’ article on school transformation. Fed article talking about...

Read More »FX Daily, October 05: Monday’s Dollar Blues

Swiss Franc The Euro has fallen by 0.05% to 1.0782 EUR/CHF and USD/CHF, October 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: New actions to contain the virus are being taken in the US and Europe, but investors are looking past it and taking equities and risk assets, in general, higher to start the new week. MSCI Asia Pacific recouped most of last week’s 0.7% loss with gains of move than 1% in Japan, Hong...

Read More »House View, October 2020

Asset Allocation Rising coronavirus cases accompanied by flagging recovery momentum and a fractious run-up to the US elections make prospects for equities highly reliant on 3Q results and further policy stimulus. Against this background we have downgraded our stance on euro area equities from neutral to underweight, following a similar downgrade for US equities in August. We continue to like structural growth drivers and select, high-quality cyclical stocks. We...

Read More »Hackers steal wages from Swiss universities

The University of Basel is one of the hacked institutions Keystone Unidentified cybercriminals have managed to siphon off employee salary transfers from at least three Swiss universities, including the University of Basel. “According to our information, several universities in Switzerland have been affected,” said Martina Weiss, Secretary General of the Rectors’ Conference of the Swiss Universities, confirming to the AFP news agency a report in the SonntagsZeitung....

Read More »Rising numbers struggling to pay rent in Switzerland

© Ocskay Mark | Dreamstime.com Nearly 44% of renters surveyed said that coming up with the money pay rent is now harder than it was before Covid-19, according to ASLOCA, a renters’ association. Following the survey the organisation is calling for more protection against the cancellation of rental contracts and moratoriums on evictions. The main reason cited for the current financial difficulties faced when paying rent was falling revenue from fewer hours of work,...

Read More »Things Change

Things Change October 2, 2020 “Doing more of what’s hollowed out our economy and society” is a slippery path to ruin. Things change, supposedly immutable systems crumble and delusions die. That’s the lay of the land in the The Empire of Uncertainty I described yesterday. It’s difficult not to be reminded of the Antonine Plague of 165 AD that crippled the Western Roman Empire. The exact nature of the virus that struck down as many as one-third of the Empire’s...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org