The virus news stream remains mixed; oil remains at center stage with still extreme volatility. The White House and House Democrats struck a deal on a new aid package worth 4 bln Canada reports March CPI; Mexico delivered a surprise 50 bp cut to 6.0% yesterday afternoon ECB will consider accepting sub-investment grade bonds as collateral in its operations; reports suggest Italy will boost its fiscal stimulus efforts UK reported March CPI data; Turkey is expected to cut rates 50 bp to 9.25%; South Africa March CPI rose 4.1% y/y Australia reported better-than-expected preliminary March retail sales The dollar is broadly weaker against the majors as market sentiment improves. The dollar bloc is outperforming, while Nokkie and euro are underperforming. EM

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, Daily News, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- The virus news stream remains mixed; oil remains at center stage with still extreme volatility.

- The White House and House Democrats struck a deal on a new aid package worth $484 bln

- Canada reports March CPI; Mexico delivered a surprise 50 bp cut to 6.0% yesterday afternoon

- ECB will consider accepting sub-investment grade bonds as collateral in its operations; reports suggest Italy will boost its fiscal stimulus efforts

- UK reported March CPI data; Turkey is expected to cut rates 50 bp to 9.25%; South Africa March CPI rose 4.1% y/y

- Australia reported better-than-expected preliminary March retail sales

![]() The dollar is broadly weaker against the majors as market sentiment improves. The dollar bloc is outperforming, while Nokkie and euro are underperforming. EM currencies are mostly firmer. ZAR and MYR are outperforming, while HUF and KRW are underperforming. MSCI Asia Pacific was up 0.3% on the day, with the Nikkei falling 0.7%. MSCI EM is up 0.9% so far today, with the Shanghai Composite rising 0.6%. Euro Stoxx 600 is up 1.1% near midday, while US futures are pointing to a higher open. 10-year UST yields are up 2 bp at 0.59%, while the 3-month to 10-year spread is up 2 bp to stand at +50 bp. Commodity prices are mostly higher, with Brent oil up 0.1%, WTI oil down 1%, copper up 1.1%%, and gold up 0.9%.

The dollar is broadly weaker against the majors as market sentiment improves. The dollar bloc is outperforming, while Nokkie and euro are underperforming. EM currencies are mostly firmer. ZAR and MYR are outperforming, while HUF and KRW are underperforming. MSCI Asia Pacific was up 0.3% on the day, with the Nikkei falling 0.7%. MSCI EM is up 0.9% so far today, with the Shanghai Composite rising 0.6%. Euro Stoxx 600 is up 1.1% near midday, while US futures are pointing to a higher open. 10-year UST yields are up 2 bp at 0.59%, while the 3-month to 10-year spread is up 2 bp to stand at +50 bp. Commodity prices are mostly higher, with Brent oil up 0.1%, WTI oil down 1%, copper up 1.1%%, and gold up 0.9%.

The virus news stream remains mixed. There was a considerable spike in new infection in the US yesterday, even as metropolitan areas are seeing some improvement. Infection rates in Germany and Singapore have accelerated a bit. In France, however, the number of patients admitted to ICU declined to the lowest in three weeks. The number in Italy and Spain have also continued to improve.

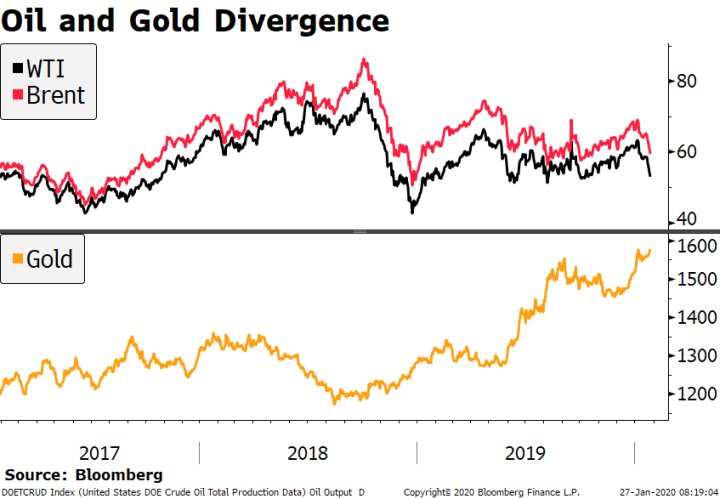

Oil remains at center stage with still extreme volatility. While the extreme price action this week has been in WTI, Brent is also getting dragged down as oversupply remains in place. OPEC+ representatives are saying they are open to further output cuts, but markets need to see concrete actions before any bounce can be seen. WTI has normalized somewhat but remains at extremely depressed levels. Trump mention fiscal aid to the sector but if it happens, we doubt this will be meaningful enough to make a difference. The oil sectors in the US and Canada are due for a major adjustment and we doubt there is any way to avoid it.

The dollar is trying to build on its recent gains. DXY could not sustain its break yesterday above the 100.30 area but for now has gained a toehold above 100. A clean break would target the April 6 high near 100.931. The euro remains heavy just below $1.09 while sterling is trading modestly higher after seeing support near the $1.2250 area yesterday. Lastly, USD/JPY remains stuck in narrow ranges just below the 108 area. We remain constructive on the dollar.

AMERICAS

The White House and House Democrats struck a deal on a new aid package worth $484 bln. The Senate convened yesterday afternoon and approved it by unanimous consent. This opens the door for the House to vote on it as soon as Thursday. The Paycheck Protection Program will be topped off with another $320 bln, with a separate $60 bln earmarked for the Economic Injury Disaster Loan program. Another $100 bln will go to hospital funding and $25 bln for virus testing, which were the major demands made by the Democrats. Aid for state and local governments will reportedly be addressed in future measures.

There is no US data of note today, only weekly mortgage applications. New York Fed officials Singh and Stiroh will address covid-19 and climate change, respectively.

Canada reports March CPI data. Headline inflation is expected to plunge more than a full percentage point to 1.1% y/y, while common core is expected to remain steady at 1.8% y/y. Last week, the Bank of Canada kept rates at the 0.25% lower bound but expanded its asset purchases to include provincial and corporate debt. Next policy meeting is June 3, and further tweaks to its QE program may be seen then.

Banco de Mexico delivered a surprise 50 bp cut to 6.0% yesterday afternoon. This was the second emergency cut in this cycle and takes the policy rate to a three-year low. The bank also announced a series of moves to improve market liquidity, including new repo windows for government and corporate debt as well as allowing FX hedge sales after market close. Measures to boost funding for banks in order to support small businesses were also introduced. Next scheduled policy meeting is May 14 and another cut then is likely, if not sooner. Yet so far, Mexico has not complemented monetary policy with fiscal measures.

EUROPE/MIDDLE EAST/AFRICA

Reports suggest the ECB will consider accepting sub-investment grade bonds as collateral in its operations. This seems to be a pre-emptive move ahead of likely downgrades of EU sovereigns (Italy, for example) as they expand fiscal efforts to fight the fallout from the pandemic. Indeed, our own ratings model has Italy at BB+, compared to a BBB by S&P and Fitch. Recall that the ECB allows Greek bonds as part of its emergency QE program and it has extended the concession to accepting it as collateral. In other words, the precedent is there. Officials will reportedly hold a call today to discuss the matter.

Reports suggest Italy will boost its fiscal stimulus efforts. Prime Minister Conte will reportedly seek parliamentary approval to boost the budget deficit by around EUR55 bln ($60 bln). Conte’s initial plan last month was worth around EUR25 bln, but the latest moves will push the deficit higher than the IMF’s estimate for -8.3% of GDP this year. This supports our view that the nation will be downgraded as a result of the deteriorating fiscal outlook.

Italy BTP spreads to German bunds have come under increasing pressure since mid-March. Besides the fiscal deterioration, the widening is also due to the dashed hopes for joint debt issuance by the EU, along with worsening economic prospects for the county. Note, however, that the 10-year spread (260 bp) is still not at the high for the cycle, which was still below the 2019 highs. Spreads in Spain and Portugal have widened in sync with that of Italy, albeit by a smaller magnitude.

UK reported March CPI data. Headline inflation fell a couple ticks to 1.5%, as expected, while CPIH fell a tick more than expected to 1.5% y/y. BOE MPC member Tenreyro warned last week that it will get more difficult to interpret inflation readings as data collection becomes harder and spending patterns shift. Even then, she predicted that inflation will probably fall below 1% in the coming months. Like other central banks, we suspect the BOE will eventually expand its QE program as the impact of the virus worsens. Next BOE policy meeting is May 7.

Turkey central bank is expected to cut rates 50 bp to 9.25%. As usual, expectations are all over the place and range from no cut to cuts of 25, 50, 75, and 100 bp. CPI rose 11.9% y/y in March. While still well above the 3-7% target range, the direction is downward and so the bank is likely to continue pushing real rates further into negative territory. At this point, it seems the lira is less of a priority than boosting the economy. USD/TRY is edging towards the psychological 7 level and after that is the all-time high near 7.2360 from August 2018.

South Africa March CPI rose 4.1% y/y vs. 4.2% expected and 4.6% in February. Inflation is now in the bottom half of the 3-6% target range. Given the dire outlook for the economy, the SARB just delivered an emergency 100 bp cut to 4.25% last week. Next policy meeting is May 21 and if inflation remains well-behaved, another cut then seems likely. Fiscal stimulus will be seen too, as the government just unveiled a ZAR500 bln ($26 bln) package to boost the economy. ZAR130 bln will come from the existing budget, with the rest of it will be funded by both domestic and international borrowing.

ASIA

Australia reported better-than-expected preliminary March retail sales. Retail sales rose 8.2% m/m, the most on record but largely related to hoarding of food and essential products. In other words, this doesn’t seem especially meaningful for assessing the health of the Australian economy. April PMI data out tomorrow should give markets a better look at the economy. Still, AUD is benefitting from improved market sentiment today and is up 0.8%, the best performing major on the day.

Tags: Articles,Daily News,Featured,newsletter