Summary: Populism-nationalism is not really a wave sweeping across the world. Where it succeeded was where a center-right party in a two-party system embraced part of the populist agenda. Center-right parties in Europe are not embracing key agenda for populist-naitonalist, but appear to be tacking to the right on domestic issues. The conventional narrative is that in the aftermath of the Great Financial...

Read More »Importance of Hiding Gold Creatively and Securely If Taking Delivery

Why gold retains value? Interesting unknown gold facts “Prepare your jaws for a sizeable drop!” History, finite, rare and peak gold “It is beautiful to look at…” ‘Heavy metal’ – Thud sound of a gold bar (kilo) ‘Going for gold’ – Olympic gold medals to Chelthenham ‘Gold Cup’ Peak gold … “Hard work to get gold out of the ground…” How much an Oscar is actually worth? Importance of hiding gold creatively and securely if...

Read More »Economic Dissonance, Too

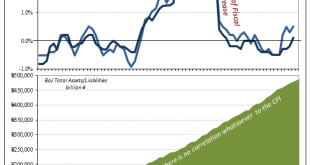

Germany is notoriously fickle when it comes to money, speaking as much of discipline in economy or industry as central banking. If ever there is disagreement about monetary arrangements, surely the Germans are behind it. Since ECB policy only ever attains the one direction, so-called accommodation, there never seems to be harmony. But that may only be true because “accommodation” doesn’t ever achieve what it aims to....

Read More »Emerging Markets: What has Changed?

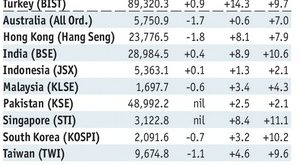

Summary A Korean special prosecutor indicted Samsung chief Jay Y. Lee on bribery charges. Korean press is reporting that China has told its travel agents to halt sales of holiday packages to South Korea. Bulgaria’s interim government said it may apply to join the eurozone within a month. South Africa’s main labor union Cosatu accepted a government-proposed minimum wage. New Commerce Secretary Ross appears to be taking...

Read More »True Cognitive Dissonance

There is gold in Asia, at least gold of the intellectual variety for anyone who wishes to see it. The Chinese offer us perhaps the purest view of monetary conditions globally, where RMB money markets are by design tied directly to “dollar” behavior. It is, in my view, enormously helpful to obsess over China’s monetary system so as to be able to infer a great deal about the global monetary system deep down beyond the...

Read More »FX Daily, February 28: Markets Little Changed as Breakout is Awaited

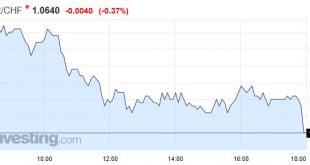

Swiss Franc EUR/CHF - Euro Swiss Franc, February 28(see more posts on EUR/CHF, ) Source: Investing.com - Click to enlarge GBP/CHF GBH CHF continues to see a volatile period with the general global uncertainty which has seen investors favour the safe haven currency. GBP CHF currently sits at 1.25 for this pair and there is resistance at these levels which is preventing the pound from driving higher. Brexit is now...

Read More »The Gold-Silver Ratio Curiously Failed to Fall – Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Gold Scarcity Intensifies Further Last week (a holiday-shortened week, as Monday was President’s Day in the US), the price of the dollar fell. In gold, it fell almost half a milligram to 24.75mg, and prices in silver it dropped 30mg, to 1.7 grams of the white monetary metal. Looks good… and since last week, costs...

Read More »It Was ‘Dollars’ All Along

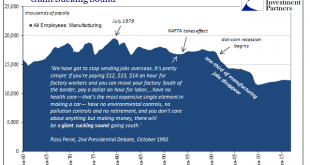

Ross Perot famously declared the “giant sucking sound” in the 1992 Presidential campaign. The debate over NAFTA did not end with George H. W. Bush’s defeat, as it simmered in one form or another for much of the 1990’s. Curiously, however, it seemed almost perfectly absent during the 2000’s, the very decade in which Perot’s prophecy came true. Americans didn’t notice because there was a bubble afoot. That bubble,...

Read More »Each Week the Same: Another SNB Intervention Record

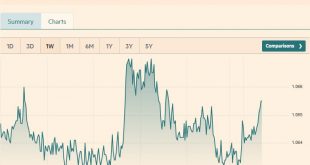

Headlines Week February 27, 2017 We were arguing in the last weeks, that the EUR/CHF is trending towards parity. There are three reasons: Continuing SNB interventions Strengthening Swiss local demand Speculators increase their dollar shorts against Euro and reduce them against CHF. FX week until February 27 The EUR/CHF fell to new lows. The average rate in the week was 1.0648. The SNB is apparently ready to let the...

Read More »Weekly Speculative Position: More EUR Shorts, Less CHF Shorts .. Again

Swiss Franc Speculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts. The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The carry trade against CHF collapsed. The...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org