Unless the Federal Reserve intends to buy up every dead and dying mall in America, this is one crisis that the Fed can’t bail out with a few digital keystrokes. Just as generals prepare to fight the last war, central banks prepare to battle the last financial crisis–which in the present context means a big-bank liquidity meltdown like the one that nearly toppled thr global financial system in 2008-09. Planning to win...

Read More »Do Record Debt And Loan Balances Matter? Not Even Slightly

We live in a non-linear world that is almost always described in linear terms. Though Einstein supposedly said compound interest is the most powerful force in the universe, it rarely is appreciated for what the statement really means. And so the idea of record highs or even just positive numbers have been equated with positive outcomes, even though record highs and positive growth rates can be at times still associated...

Read More »Payrolls Still Slowing Into A Third Year

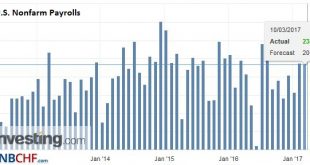

Today’s bland payroll report did little to suggest much of anything. All the various details were left pretty much where they were last month, and all the prior trends still standing. The headline Establishment Survey figure of 235k managed to bring the 6-month average up to 194k, almost exactly where it was in December but quite a bit less than November. In other words, despite what is mainly written as continued...

Read More »Time, The Biggest Risk

If there is still no current or present indication of rising economic fortunes, and there isn’t, then the “reflation” idea turns instead to what might be different this time as compared to the others. In 2013 and 2014, it was QE3 and particularly the intended effects (open ended and faster paced, a bigger commitment by the Fed to purportedly do whatever it took) upon expectations that supposedly set it apart from the...

Read More »Are Central Banks Losing Control?

Eight years after the crisis of 2008-09, central banks are still injecting $200 billion a month into the global financial system to keep it from imploding. If you want a central banker to choke on his croissant, read him this quote from socio-historian Immanuel Wallerstein: “Countries (have lost the ability) to control what happens to them in the ongoing life of the modern world-system.” Stated another way, Wallerstein...

Read More »Are Central Banks Losing Control?

Eight years after the crisis of 2008-09, central banks are still injecting $200 billion a month into the global financial system to keep it from imploding. If you want a central banker to choke on his croissant, read him this quote from socio-historian Immanuel Wallerstein: “Countries (have lost the ability) to control what happens to them in the ongoing life of the modern world-system.” Stated another way, Wallerstein...

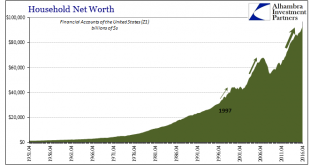

Read More »No Paradox, Economy to Debt to Assets

It is surely one of the primary reasons why many if not most people have so much trouble accepting the trouble the economy is in. With record high stock prices leading to record levels of household net worth, it seems utterly inconsistent to claim those facts against a US economic depression. Weakness might be more easily believed as some overseas problem, leading to only ideas of decoupling or the US as the “cleanest...

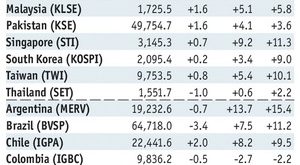

Read More »Emerging Markets: What has Changed

Summary North Korean banks subject to international sanctions have been banned from using Swift. Korea’s Constitutional Court upheld Parliament’s motion to impeach President Park. Singapore eased some property market curbs after a three-year decline in home prices. Egypt partially reversed a cut in bread subsidies. Nigeria’s President Buhari returned to the nation after spending nearly two months in the UK. Moody’s...

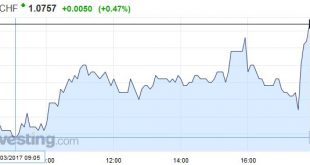

Read More »FX Daily, March 10: US Jobs Data: Deja Vu All Over Again?

Swiss Franc EUR/CHF - Euro Swiss Franc, March 10(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF Sterling vs the Swiss Franc has fallen to its lowest level in two months as the Pound is continuing to be dragged down by what is happening with the uncertainty caused by when Article 50 will be triggered. Article 50 has been debated in the House of Lords and a challenge concerning the rights of Europeans...

Read More »Solid US Jobs Report in line with Expectations

The US jobs report was largely in line with expectations. February was the second consecutive month that the US economy created more than 200k jobs. United States Nonfarm payrolls It is the first time since last June and July. The 235k is just below the revised January 238k gain (initially 227k). U.S. Nonfarm Payrolls, February 2017(see more posts on U.S. Nonfarm Payrolls, ) Source: Investing.com - Click to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org